Ethereum whales are accumulating, signaling strength, while older holders rotate positions. XRP is experiencing distribution from veteran holders, potentially weakening its market structure. Realized cap and dormancy metrics are key indicators of market health and potential price floors.

What to Know:

- Ethereum whales are accumulating, signaling strength, while older holders rotate positions.

- XRP is experiencing distribution from veteran holders, potentially weakening its market structure.

- Realized cap and dormancy metrics are key indicators of market health and potential price floors.

The crypto market is currently undergoing a fascinating test as veteran holders’ behavior diverges across different assets. Ethereum shows signs of healthy rotation, while XRP is experiencing distribution from longer-term holders. These contrasting patterns reveal critical insights into the structural integrity of each asset.

Ethereum’s whales are accumulating ETH as the price consolidates, indicating strong support. Santiment’s Age Consumed metric shows that the pressure comes from holders in the three-to-ten-year band trimming positions rather than ICO-era wallets dumping. This measured pace contrasts with panic-driven spikes seen earlier in the year.

Glassnode data shows those mid-duration cohorts selling roughly 45,000 ETH per day, a measured pace that contrasts with the panic-driven spikes seen earlier in the year when both short- and long-term holders exited simultaneously.

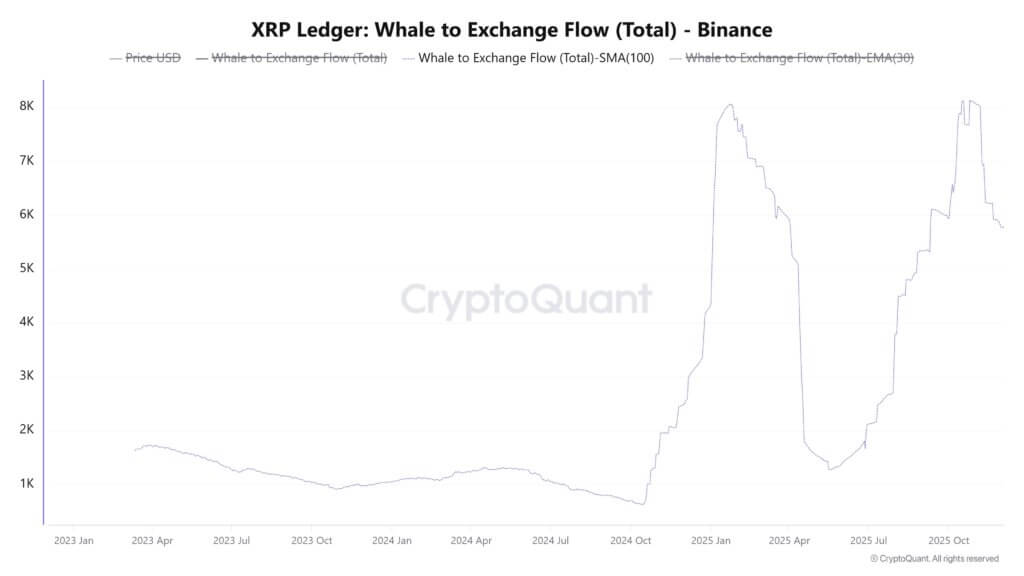

XRP presents a different picture, with dormant supply reactivating as whales transfer holdings to exchanges. CryptoQuant’s Whale-to-Exchange Flow metric peaked recently, signaling a multi-month uptrend and suggesting the distribution is structural rather than episodic. This pattern indicates that XRP’s 2025 moves systematically drew out older holders who had waited through consolidation.

Realized cap, which measures the aggregate cost basis of all coins, acts as long-term support for assets with genuine cost-basis ladders. Ethereum’s realized cap continues to rise, absorbing distribution from older holders via fresh inflows. This continued accumulation at varied entry points means the network retains cost-basis diversity.

XRP’s realized cap nearly doubled during the late-2024 rally, with a significant portion coming from buyers who entered in the last six months. This concentration of cost basis at cycle highs leaves XRP vulnerable if spot demand fades. Glassnode’s realized profit-to-loss ratio has trended downward since January, indicating that recent entrants are now realizing losses rather than gains.

Dormancy metrics, which track when previously idle supply reenters active circulation, signal regime changes. Ethereum’s Age Consumed metric quieted as whales accumulated, suggesting that heavy flows were driven by large holders rotating rather than ancient wallets capitulating. XRP’s dormancy pattern broke the other way, with the 365-day Dormant Circulation hitting levels unseen since July.

The divergence in whale behavior between Ethereum and XRP highlights the importance of understanding market structure and holder dynamics. Ethereum’s strength lies in its diversified cost basis and continued accumulation, while XRP faces challenges due to concentrated realized cap and veteran distribution. Monitoring these metrics can provide valuable insights for navigating the crypto landscape.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Ethereum whales are accumulating, signaling strength, while older holders rotate positions. XRP is experiencing distribution from veteran holders, potentially weakening its market structure. Realized cap and dormancy metrics are key indicators of market health and potential price floors.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.