XRP is currently trading near the lower end of its three-week range, showing a 6% drop in the last 24 hours. A bearish “death cross” pattern may emerge, signaling potential further price declines.

What to Know:

- XRP is currently trading near the lower end of its three-week range, showing a 6% drop in the last 24 hours.

- A bearish “death cross” pattern may emerge, signaling potential further price declines.

- Broader market conditions, including Bitcoin’s recent performance, are contributing to the cautious outlook for XRP.

XRP, the cryptocurrency used by Ripple for cross-border transactions, has seen a recent dip, raising concerns among investors. The token is currently trading around $2.25, approaching the lower boundary of its established trading range. Technical indicators suggest potential further downside, warranting a closer look at market dynamics.

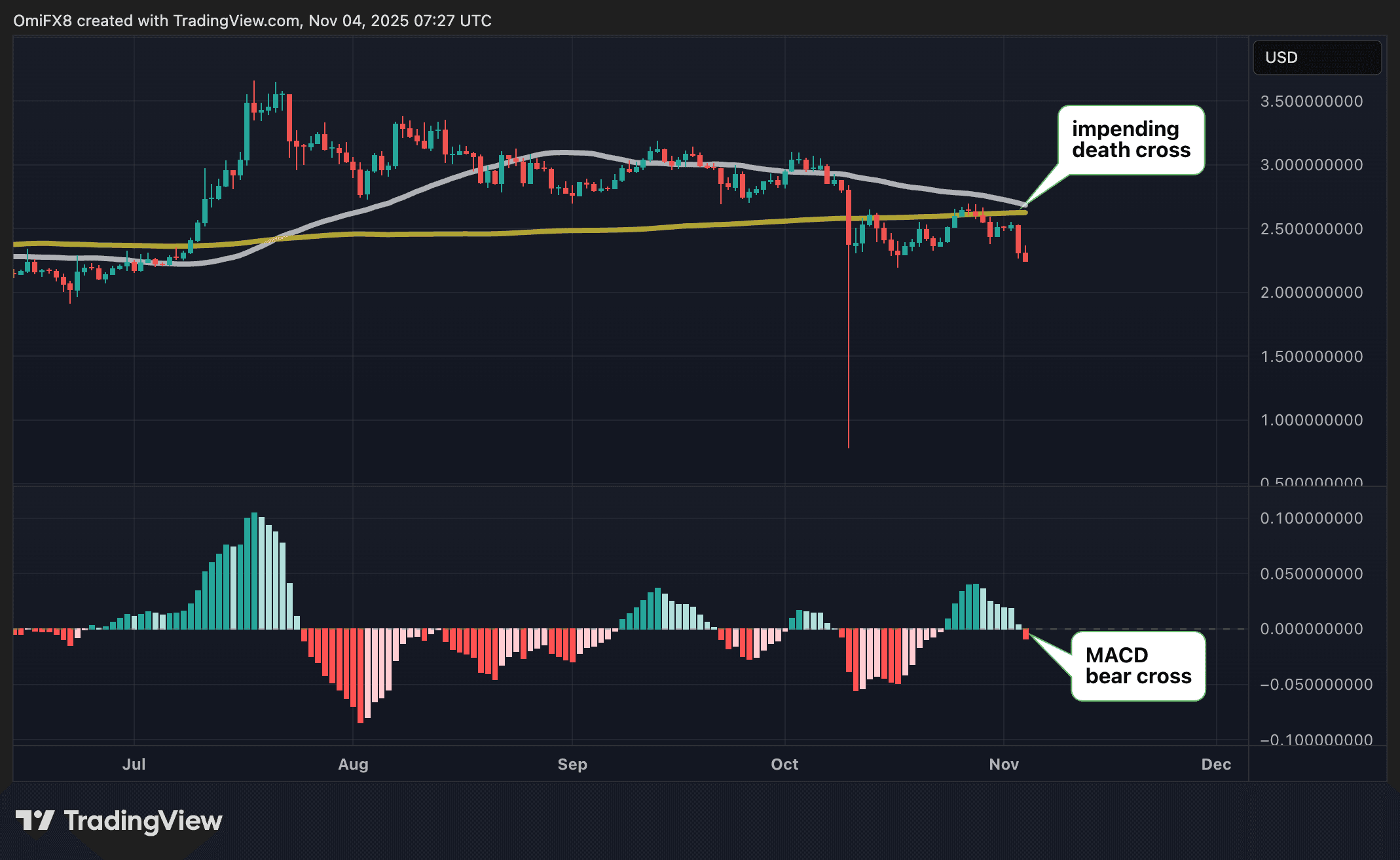

The looming “death cross” on XRP’s daily chart, where the 50-day SMA could cross below the 200-day SMA, is a key technical signal. This pattern can indicate weakening short-term momentum relative to the longer trend. Traders often interpret this as a sign of possible extended declines.

Adding to the cautious sentiment is the broader market’s performance, particularly Bitcoin’s recent struggles. The MACD histogram on XRP’s daily chart is also hinting at a bearish crossover. These factors are contributing to a more negative outlook for XRP in the short term.

Despite the current bearish signals, XRP’s utility in facilitating cross-border payments for Ripple remains a fundamental strength. Investors will be closely watching how XRP navigates these technical challenges. Monitoring regulatory developments and the broader adoption of digital assets is also crucial for assessing XRP’s long-term potential.

In conclusion, while technical indicators suggest potential short-term challenges for XRP, its underlying use case and Ripple’s ongoing efforts in the payment space provide a foundation for future growth. Investors should stay informed and consider both technical and fundamental factors when evaluating XRP’s prospects.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP is currently trading near the lower end of its three-week range, showing a 6% drop in the last 24 hours. A bearish “death cross” pattern may emerge, signaling potential further price declines. Broader market conditions, including Bitcoin’s recent performance, are contributing to the cautious outlook for XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.