XRP is facing renewed market pressure this week as it tracks a broader downtrend in digital assets while investors brace for critical comments from Federal Reserve Chair Jerome Powell. The mood across the crypto landscape has shifted into caution, with XRP sliding over 6% as Bitcoin struggles to inch above $113,000.

XRP is facing renewed market pressure this week as it tracks a broader downtrend in digital assets while investors brace for critical comments from Federal Reserve Chair Jerome Powell. The mood across the crypto landscape has shifted into caution, with XRP sliding over 6% as Bitcoin struggles to inch above $113,000.

How XRP Is Reacting to Market Sentiment

The focus keyword, XRP, continues to reflect the market’s risk-off sentiment. XRP, along with Ethereum (ETH) and Solana (SOL), has been dragged down by investor hesitancy ahead of the U.S. Federal Reserve’s much-anticipated speech at Jackson Hole. While earlier market momentum had some hoping for a BTC rally toward $135,000, that optimism has now given way to sideways action and pullbacks.

According to data from SoSoValue, over $1 billion has already been withdrawn from Bitcoin funds in recent days. Ether exchange-traded funds (ETFs) haven’t escaped the exodus either, with another $500 million flowing out this week alone. XRP is caught in this broader wave of institutional pullback, with many preferring to reduce exposure before Powell clarifies monetary policy direction.

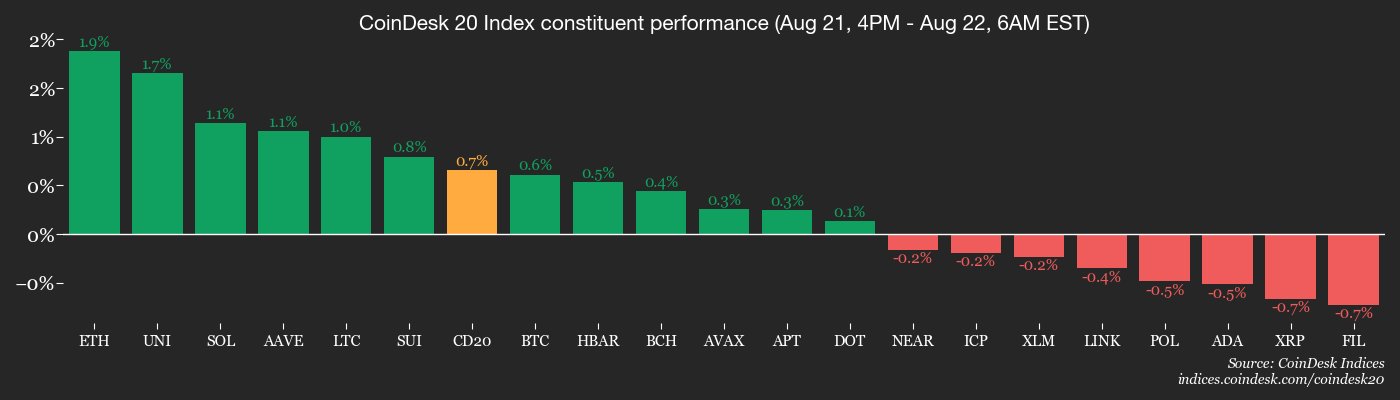

The CD20 index reflects declining investor sentiment across major cryptocurrencies including XRP.

Derivative Markets Indicate Cautious Positioning

Options on XRP and other altcoins are pricing in relatively modest moves ahead of Powell’s remarks—roughly ±2% for Bitcoin, according to Pulkit Goyal of Orbit Markets. However, the derivatives positioning paints a mixed picture. Open interest has increased in smaller altcoins but declined in XRP, SOL, and DOGE, signaling an ongoing de-risking trend among traders.

Volume across major tokens—aside from BTC—has fallen more than 20%, suggesting that market participants are refraining from significant positioning until Powell delivers his keynote at the Jackson Hole Economic Policy Symposium. XRP calls are being traded cautiously, with a visible lean toward protective strategies like puts, underlying current market anxiety.

Ripple’s Emerging Focus: RLUSD Stablecoin Launch in Japan

While the short-term charts look weak, there is a longer-term story in the making for Ripple, XRP’s parent company. Ripple is teaming up with Japan’s SBI Holdings to launch the RLUSD stablecoin in Japan by Q1 2026. The stablecoin will be fully backed by U.S. dollars, short-term Treasuries, and cash equivalents. Monthly reports from an independent auditor aim to maintain transparency and ensure compliance.

The stablecoin will be distributed by SBI VC Trade, a registered payment platform, under Japan’s evolving stablecoin framework. SBI Holdings CEO Tomohiko Kondo positioned RLUSD as a catalyst for digital asset growth in Japan, emphasizing its role in increasing trust and broadening stablecoin options in the country.

This announcement shows Ripple’s continued strategy to gain ground in regions with clearer regulatory frameworks, especially Asia. The move also aligns with Japan’s simultaneous approval of its first yen-backed stablecoin, which could encourage cross-stablecoin integrations and increased attention to Ripple’s ecosystem.

The Broader Macro Picture

Beyond digital assets alone, macroeconomic events are weighing on investor decisions. Today’s main event is Powell’s address at Jackson Hole scheduled for 10 a.m. ET. Traders are waiting to learn whether the Fed Chair will signal support for interest rate cuts in early 2026—or adopt a more cautious stance that could stifle risk assets like XRP and partners in the crypto sector.

In equities, crypto-related firms such as Coinbase, Galaxy Digital, and Marathon Digital also saw share price weakness, reflecting apprehension in risk markets. Market futures suggest a slight bullish tilt, but sentiment could quickly reverse if Powell’s tone doesn’t favor dovish outcomes.

XRP in Context: Secondary to Bitcoin, But Watching Closely

While all eyes are on Bitcoin’s behavior around the $113K line, XRP and similar altcoins are effectively in holding patterns awaiting its lead. If Bitcoin rallies on Powell’s speech, XRP could follow. Conversely, a bearish read could deepen declines.

In short, XRP isn’t crashing—but it isn’t rallying either. Like much of the altcoin market, it’s watching Bitcoin closely, hoping for a positive cue. At the moment, institutional investors are playing it safe as uncertainty looms.

When to Expect More Movement

Metrics from token options platforms suggest movement could pick up immediately after Powell’s speech. With expectations hovering around a 2% price swing in Bitcoin, XRP may experience correlated volatility. For investors, the prudent approach is to monitor macro statements and prepare for renewed activity once the Fed’s path becomes clearer.

Ripple’s next big catalyst will likely stem from developments in Asia—whether through RLUSD’s rollout or further integration with traditional finance via partners like SBI Holdings. Until then, XRP remains both a policy-sensitive asset and a long-term play in a region opening up to compliant digital currencies.

Related: XRP Price: $12M Max Pain for Bears

Stay updated on the Ripple and SBI stablecoin initiative and other crypto news to make informed decisions.

Quick Summary

XRP is facing renewed market pressure this week as it tracks a broader downtrend in digital assets while investors brace for critical comments from Federal Reserve Chair Jerome Powell. The mood across the crypto landscape has shifted into caution, with XRP sliding over 6% as Bitcoin struggles to inch above $113,000.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.