XRP is showing potential for integration with traditional banking systems like SWIFT—even without a formal Ripple-SWIFT partnership. A recent analysis by XRP community researcher SMQKE explores this indirect connectivity through API bridges, sparking discussions across the crypto industry.

XRP is showing potential for integration with traditional banking systems like SWIFT—even without a formal Ripple-SWIFT partnership. A recent analysis by XRP community researcher SMQKE explores this indirect connectivity through API bridges, sparking discussions across the crypto industry.

How XRP Integrates with SWIFT via Third Parties

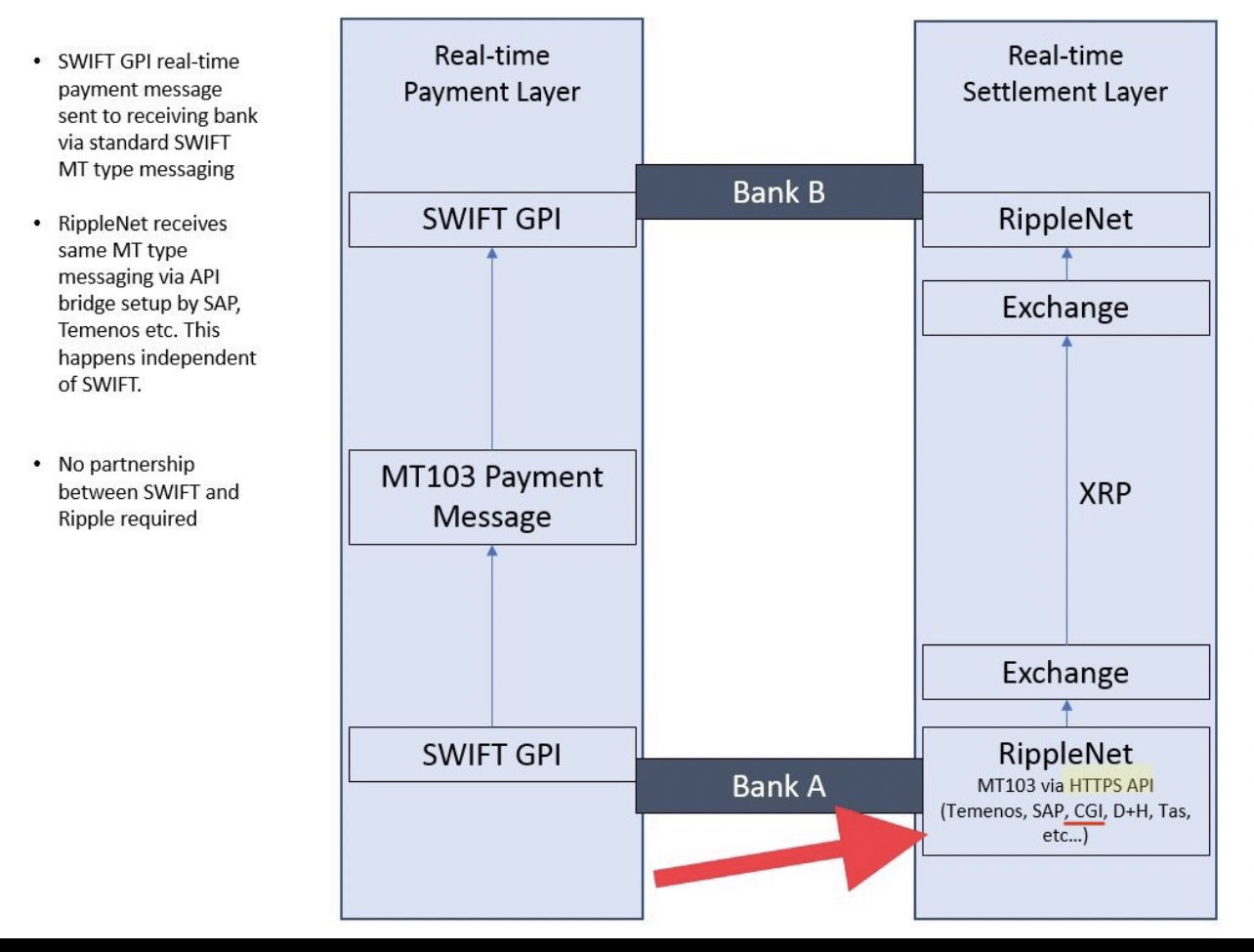

Despite the absence of a direct relationship between Ripple and SWIFT, third-party technology platforms are paving the way for interoperability. Vendors such as SAP, Temenos, and CGI allow RippleNet to receive SWIFT’s MT103 payment messages through HTTPS APIs.

Here’s how the flow works: when a SWIFT GPI payment is initiated, the MT103 message moves through the conventional banking network. The same message can then be forwarded to RippleNet via these vendor-managed API connections. This enables RippleNet to use the XRP token to provide liquidity and settle the payment—even if the original transfer began on the SWIFT network.

In essence, banks connected to RippleNet can facilitate payments that originate from SWIFT without requiring the two systems to partner directly. The result is a hybrid solution that maintains speed, liquidity, and compliance.

Illustration of how XRP bridges SWIFT transactions via third-party APIs.

Ripple Insider Validates Indirect Integration Method

After SMQKE’s proposal went viral, reactions within the XRP community varied. Influential content creators like Crypto Eri questioned the legitimacy of the document, prompting her to publicly ask Ripple engineer Neil Hartner for clarification.

Hartner responded via social media, confirming the proposal’s technical feasibility. While he couldn’t verify the vendor-specific details, he did observe that a bank could, in theory, send an MT103 message directly to Ripple Payments (formerly known as RippleNet) using its API’s additional_info field.

However, Hartner advised caution in interpreting his statements, noting, “Don’t read too much into my answer,” which underlines both the technical readiness and regulatory sensitivity of such a setup.

The Role of ISO 20022 in Interoperability

A major enabler of this indirect connectivity is the widespread adoption of the ISO 20022 messaging standard. Ripple has long positioned itself at the forefront of ISO 20022 compliance, which allows for smoother interaction between traditional institutions and decentralized networks.

Through ISO 20022 alignment, Ripple can generate interoperable messages across different platforms, including SWIFT. This compatibility supports faster settlements, reduced reconciliation errors, and better regulatory oversight, all of which are crucial for modern cross-border payments.

More on ISO 20022’s impact is available here.

Can XRP Eventually Overtake SWIFT?

Although Ripple and SWIFT have no direct partnership, speculation continues to swirl that XRP could not just coexist, but eventually overtake SWIFT in some areas. According to a statement made by Ripple CEO Brad Garlinghouse at the 2025 XRPL Apex event, the XRP Ledger (XRPL) could process up to 14% of SWIFT’s total volume by the year 2030.

Given that SWIFT handles about $150 trillion annually, a 14% share would equate to around $21 trillion in volume flowing through XRPL. If this vision materializes, XRP’s role as a liquidity instrument could become significantly more prominent.

One analysis estimated that such transactional throughput would require a liquidity pool of $700 billion, assuming XRP’s average turnover rate reached 30 times per year. Under these parameters and with the existing token supply, the projected price of XRP could fall between $11 and $24.

Nonetheless, it is important to recognize that these projections are speculative and should not be treated as financial advice or concrete forecasts.

Even without direct collaboration, XRP appears poised to serve as a technological bridge between blockchain innovation and traditional finance infrastructure like SWIFT—thanks to smart integration via APIs and industry standards such as ISO 20022.

Related: XRP Price: $12M Max Pain for Bears

For more context on Ripple’s stance on a possible SWIFT partnership, read this detailed analysis.

Quick Summary

XRP is showing potential for integration with traditional banking systems like SWIFT—even without a formal Ripple-SWIFT partnership. A recent analysis by XRP community researcher SMQKE explores this indirect connectivity through API bridges, sparking discussions across the crypto industry.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.