Ark Invest has filed an S-1 for the ARK CoinDesk 20 Crypto ETF, with XRP as a significant holding. This move reflects growing institutional interest in diversified crypto exposure beyond Bitcoin. A substantial allocation to XRP could boost its liquidity and adoption among institutional investors.

What to Know:

- Ark Invest has filed an S-1 for the ARK CoinDesk 20 Crypto ETF, with XRP as a significant holding.

- This move reflects growing institutional interest in diversified crypto exposure beyond Bitcoin.

- A substantial allocation to XRP could boost its liquidity and adoption among institutional investors.

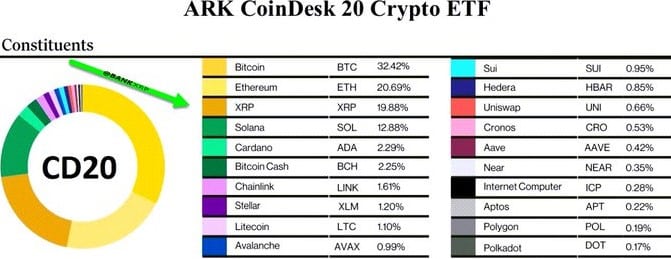

Cathie Wood’s Ark Invest is seeking SEC approval for its ARK CoinDesk 20 Crypto ETF, signaling further institutional inroads into the digital asset space. The proposed ETF intends to track the CoinDesk 20 (CD20) Index, offering exposure to a basket of leading cryptocurrencies. Notably, XRP is positioned as one of the fund’s primary holdings, underscoring its increasing recognition as a viable institutional asset.

XRP’s Significant ETF Allocation

In the filing submitted this week, XRP receives a substantial 19.88% weighting within the ARK CoinDesk 20 ETF. This allocation places XRP behind only Bitcoin and Ethereum, which hold weights of 32.4% and 20.69%, respectively. The inclusion of XRP at this level suggests a growing acceptance of the token as a liquid and investable asset class suitable for regulated investment products.

Other cryptocurrencies included in the fund are Solana, Cardano, Bitcoin Cash, Chainlink, Stellar, Litecoin, and Avalanche. Ark Invest will act as the fund’s sponsor, with shares expected to list on NYSE Arca, Inc. The ETF’s initial launch capital is projected to be around $437,000.

Potential Impact on XRP Markets

The substantial allocation to XRP within a high-profile ETF like the ARK CoinDesk 20 could have positive implications for its market dynamics. Increased institutional exposure may translate to deeper liquidity, tighter spreads, and reduced volatility. Moreover, it could pave the way for broader adoption among institutional investors who have been hesitant to allocate to XRP due to regulatory uncertainties. This move may also prompt other fund managers to consider including XRP in their crypto offerings, further legitimizing its role in the digital asset ecosystem.

XRP’s Expanding ETF Footprint

The ARK CoinDesk 20 ETF is just one example of XRP’s growing presence in U.S.-listed crypto funds. Over the past year, the token has been incorporated into several major basket ETFs, including the Bitwise 10 Crypto Index Fund (BITW), the Grayscale CoinDesk Crypto 5 ETF (GDLC), and Hashdex’s Nasdaq Crypto Index US ETF (NCIQ). This trend indicates a broader recognition of XRP’s potential as a diversifier within crypto portfolios.

Single-Asset XRP ETFs Gain Traction

In addition to diversified products, XRP has also seen increased interest through single-asset spot ETFs. Currently, five XRP spot ETFs are trading on U.S. exchanges, offered by Grayscale, Franklin, Bitwise, Canary, and 21Shares. Since Canary launched the first of these products in November, the group has attracted $1.23 billion in net inflows, lifting total assets under management to approximately $1.36 billion. This surge in inflows reflects a growing appetite among retail and institutional investors for direct exposure to XRP through regulated investment vehicles.

Looking Ahead

While the approval of the ARK CoinDesk 20 ETF is not guaranteed, the filing underscores the increasing maturity of the crypto market and the growing demand for diversified investment products. XRP’s prominent role in this ETF, along with its expanding presence in other crypto funds, suggests a positive outlook for its long-term adoption and integration into the broader financial system. Investors should closely monitor the SEC’s decision on the ARK filing and the performance of existing XRP ETFs to gauge the evolving institutional sentiment towards this digital asset.

Related: XRP Golden Cross Signals Price Momentum

Source: Original article

Quick Summary

Ark Invest has filed an S-1 for the ARK CoinDesk 20 Crypto ETF, with XRP as a significant holding. This move reflects growing institutional interest in diversified crypto exposure beyond Bitcoin. A substantial allocation to XRP could boost its liquidity and adoption among institutional investors.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.