XRP ETFs continue to attract significant inflows, recently surpassing $1 billion in total investments. These inflows occur amidst a broader crypto market downturn, impacting the pace of investment but not the overall positive trend.

What to Know:

- XRP ETFs continue to attract significant inflows, recently surpassing $1 billion in total investments.

- These inflows occur amidst a broader crypto market downturn, impacting the pace of investment but not the overall positive trend.

- The sustained inflows into XRP ETFs highlight strong community engagement and the potential for further growth with clearer regulatory frameworks, benefiting Ripple and the broader institutional interest in XRP.

XRP ETFs have demonstrated resilience and strong investor interest, even amid a volatile crypto market. Recent data confirms ongoing inflows, pushing the total assets under management well beyond the $1 billion mark. This performance underscores the growing acceptance of XRP as a viable asset for institutional portfolios, setting new benchmarks in the ETF space.

Steady Inflows Despite Market Conditions

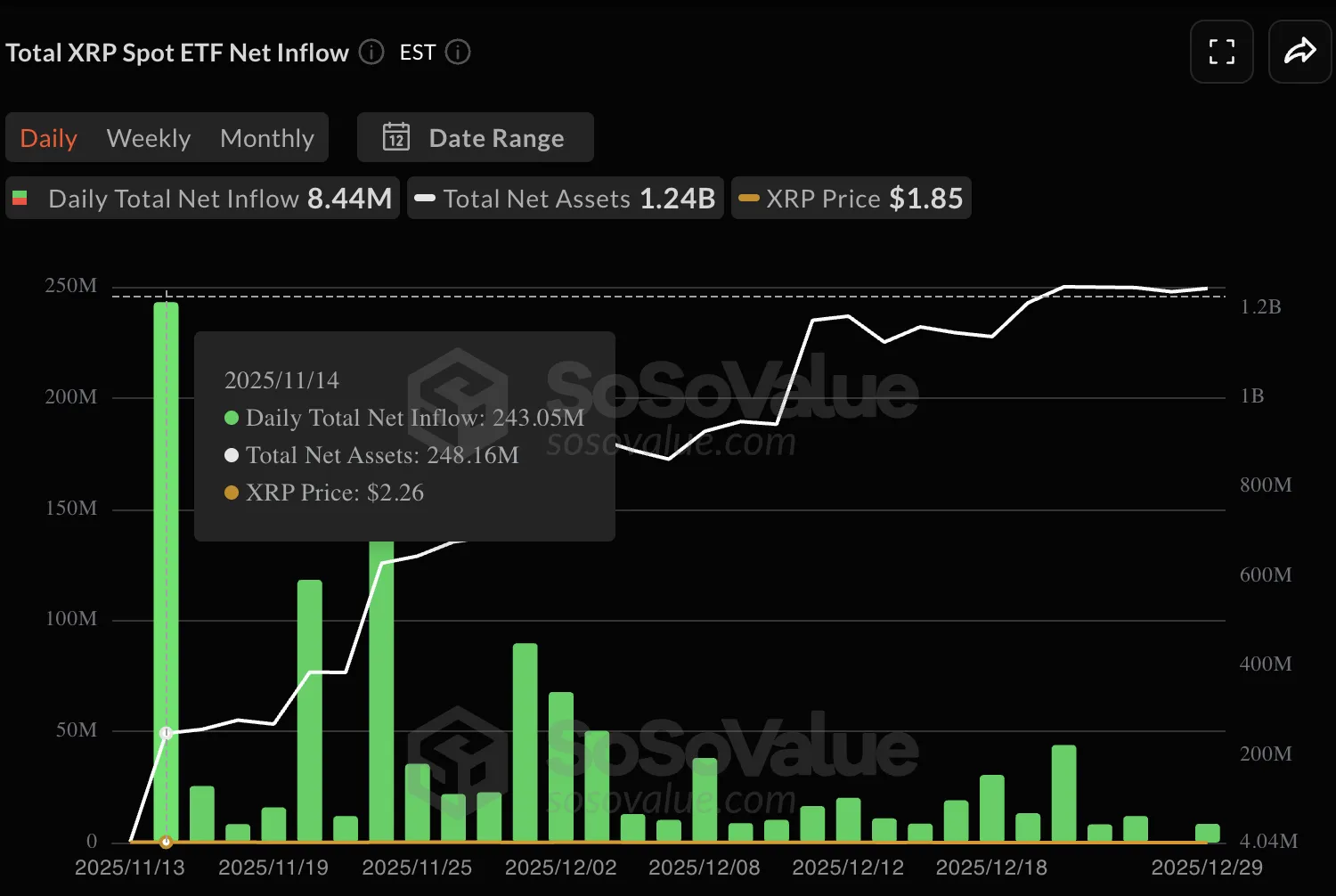

Despite a bearish crypto market in recent months, XRP ETFs have consistently attracted new investments. On a recent Monday, these ETFs saw an inflow of $8 million, distributed among key asset managers like Bitwise, Grayscale, and Franklin Templeton. Bitwise led with $5.18 million, followed by Franklin Templeton with $3.01 million, and Grayscale with $1.43 million. While some ETFs, like Canary Capital, experienced minor outflows, the overall trend remains positive.

Cumulative Performance and Key Contributors

The cumulative net inflow into XRP ETFs now stands at $1.15 billion, with total assets under management reaching $1.24 billion. Canary Capital has been the largest contributor, with $324.67 million, followed by 21Shares with $250 million, Bitwise with $232 million, and Franklin Templeton with $209.86 million. Since their launch in mid-November, these ETFs have recorded continuous net inflows, highlighting strong investor confidence.

Market Context and Initial Expectations

The launch of XRP ETFs occurred during a period when XRP’s price dipped below $2, impacting the initial inflow predictions. Prior to the launch, industry experts anticipated much higher inflows, with some projecting up to $10 billion in the first month. While these ambitious targets were not met, the current inflows are still considered a significant achievement, especially given the prevailing market conditions.

Comparative Performance and Milestones

XRP ETFs have set several records, including the best-performing ETF launches of 2025 and the fastest to reach $1 billion in inflows after Bitcoin and Ethereum ETFs. This performance surpasses that of Solana ETFs, which launched earlier but have yet to reach the same milestone, with total inflows significantly lower at $758.7 million. The rapid growth of XRP ETFs underscores the strong community engagement and the potential for continued expansion.

Regulatory Impact and Future Outlook

The CEO of Teucrium highlighted the success of their XRP futures ETF, XXRP, which attracted over $500 million in just 12 weeks, far exceeding the typical benchmark for new ETFs. He suggested that clearer regulations by 2026 could further boost investment in XRP-related products. Improved regulatory clarity would likely reduce uncertainty and encourage greater participation from institutional investors, driving further inflows and market stability.

The sustained inflows into XRP ETFs reflect a growing institutional interest and confidence in XRP. Despite initial projections not being fully realized due to market headwinds, the current performance is a testament to the strong community backing and the potential for future growth. As regulatory landscapes become clearer, XRP ETFs are poised to attract even greater investment, solidifying XRP’s position in the digital asset market.

Related: XRP Targets Massive $182B Valuation

Source: Original article

Quick Summary

XRP ETFs continue to attract significant inflows, recently surpassing $1 billion in total investments. These inflows occur amidst a broader crypto market downturn, impacting the pace of investment but not the overall positive trend.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.