XRP ETFs experienced a daily net inflow of $10.63 million, making it a five-day high in traded value. This increase in volume and inflows reflects growing institutional and retail interest in XRP as an asset class.

What to Know:

- XRP ETFs experienced a daily net inflow of $10.63 million, marking a five-day high in traded value.

- This increase in volume and inflows reflects growing institutional and retail interest in XRP as an asset class.

- Sustained ETF inflows could tighten XRP’s supply, potentially influencing its market dynamics and long-term price action.

XRP has seen a notable uptick in ETF activity, signaling a potential shift in investor sentiment. Recent data highlights a surge in daily net inflows and trading volumes for XRP ETFs, suggesting increasing interest from both institutional and retail participants. While the market remains speculative, these trends could have significant implications for XRP’s supply dynamics and future price action.

ETF Inflows Reach Five-Day Streak

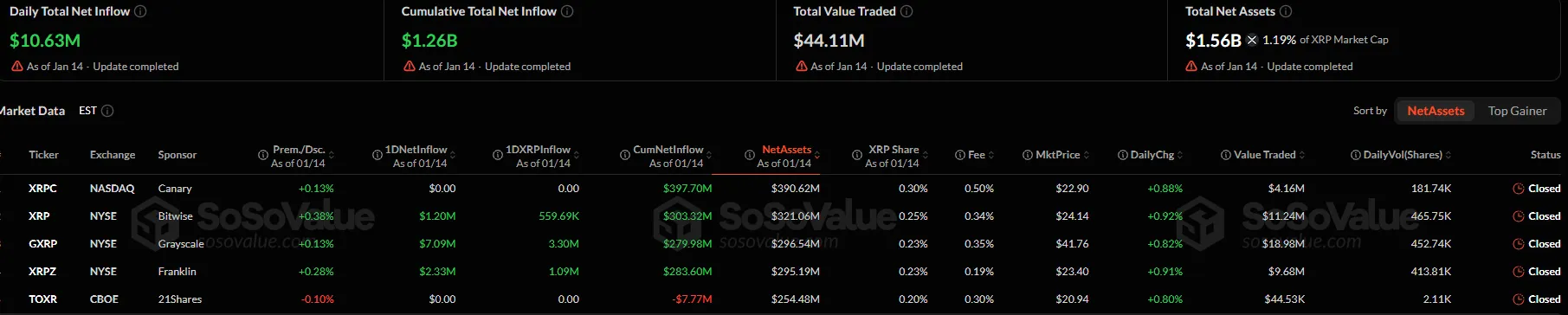

XRP ETFs have extended their inflow streak to five days, with a notable $10.63 million net inflow recorded recently. This positive momentum indicates a growing appetite among investors to gain exposure to XRP through regulated investment vehicles. The Grayscale XRP Trust ETF (GXRP) led the charge, pulling in $7.09 million, followed by the Franklin XRP ETF (XRPZ) and the Bitwise XRP ETF (XRP), which saw inflows of $7.09 million and $1.20 million, respectively. These inflows reflect a preference for accumulation over distribution, suggesting a bullish outlook among ETF investors.

Trading Volume Surges

The five US XRP spot ETFs recorded a daily trading volume of $44.11 million, marking the highest level of market participation in the last five trading days. Increased trading volume typically indicates stronger liquidity and heightened investor interest, making it easier for institutions to enter and exit positions without significantly impacting the price. This surge in volume could be a precursor to further institutional adoption of XRP as an asset class.

Impact on XRP Supply

As XRP ETFs continue to attract inflows, they actively accumulate XRP tokens, potentially impacting the asset’s supply dynamics. Currently, these ETFs hold 1.19% of XRP’s market cap, adding pressure to the asset’s circulating supply. If this trend persists, XRP may eventually experience a supply squeeze, where demand outstrips available supply, potentially leading to price appreciation. However, it’s crucial to note that the relationship between ETF inflows and price movement is not always direct or immediate.

Caveats and Considerations

While the recent ETF inflows and trading volume are encouraging signs for XRP, it’s essential to exercise caution and avoid overhyping the potential impact. There is no guarantee that the current trend of inflows will continue indefinitely. Market conditions, regulatory developments, and macroeconomic factors can all influence investor sentiment and capital flows. Additionally, ETF inflows alone do not guarantee a price increase for XRP. A sustained price rally requires demand to consistently outpace supply, which is not solely determined by ETF activity.

XRP’s Price Performance

Despite the positive ETF developments, XRP’s price has not yet experienced a significant surge. This highlights the importance of managing expectations and recognizing that ETF inflows are just one factor among many that influence an asset’s price. Market participants should carefully consider the broader market context, technical indicators, and fundamental analysis before making investment decisions. The historical performance of other cryptocurrencies following ETF launches suggests that price appreciation can take time and is not always guaranteed.

In conclusion, the recent surge in XRP ETF inflows and trading volume suggests growing institutional and retail interest in the asset. While these developments could potentially lead to a supply squeeze and price appreciation, it’s crucial to exercise caution and avoid overhyping the potential impact. Market participants should carefully consider the broader market context and manage their expectations accordingly. The long-term impact of XRP ETFs on the asset’s price and market dynamics remains to be seen.

Related: XRP Interest Surges: What Signals Reveal

Source: Original article

Quick Summary

XRP ETFs experienced a daily net inflow of $10.63 million, marking a five-day high in traded value. This increase in volume and inflows reflects growing institutional and retail interest in XRP as an asset class. Sustained ETF inflows could tighten XRP’s supply, potentially influencing its market dynamics and long-term price action.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.