XRP has significantly outperformed other top cryptocurrencies, driven by substantial ETF inflows. On-chain data indicates a supply shock with declining exchange balances, increasing sensitivity to demand. Technical indicators and growing institutional infrastructure support a bullish outlook for XRP.

What to Know:

- XRP has significantly outperformed other top cryptocurrencies, driven by substantial ETF inflows.

- On-chain data indicates a supply shock with declining exchange balances, increasing sensitivity to demand.

- Technical indicators and growing institutional infrastructure support a bullish outlook for XRP.

XRP has emerged as a leading cryptocurrency in early 2026, demonstrating significant gains compared to Bitcoin and Ethereum. This surge is primarily fueled by strong demand from regulated investment vehicles, particularly spot XRP ETFs, which have seen accelerating capital inflows. These developments suggest a shift in market perception of XRP, moving beyond mere speculation.

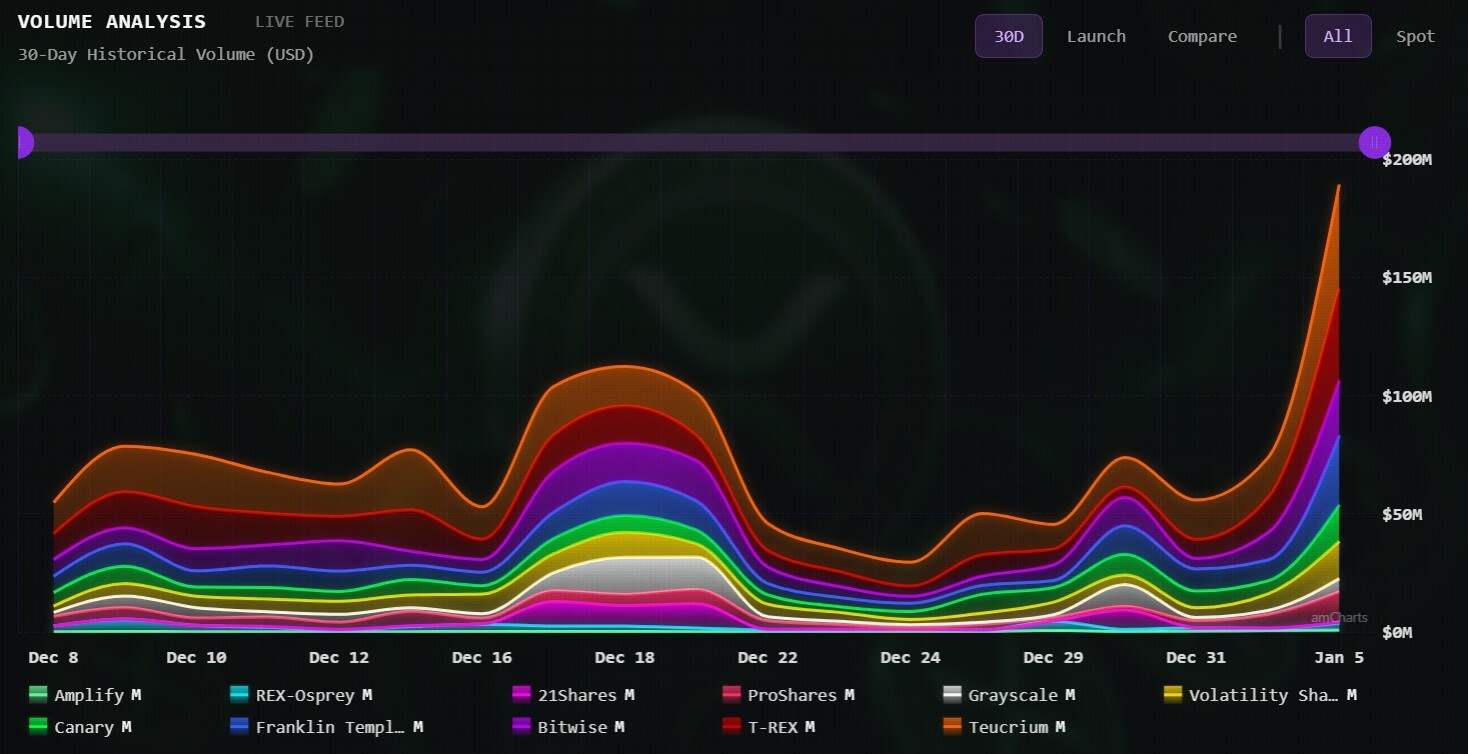

The primary driver behind XRP’s rally is the consistent demand from U.S. spot XRP ETFs, which have absorbed capital at an increasing rate since their launch. These ETFs have registered substantial inflows in the first few trading days of the year, pushing cumulative inflows past $1 billion. This sustained buying pressure indicates strong institutional interest in XRP.

The ongoing price action is further amplified by a supply squeeze, with on-chain data revealing that XRP holdings on centralized exchanges have dropped to multi-year lows. This scarcity of available tokens makes the market more reactive to demand spikes, especially from institutional buyers. This dynamic highlights a shift from retail-driven rallies to those influenced by large-scale institutional volume.

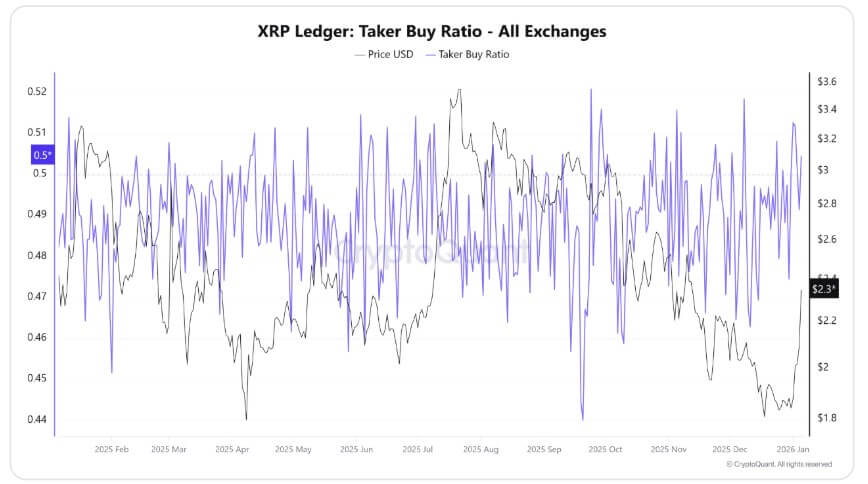

Technical indicators reinforce the bullish sentiment, with XRP’s rally to $2.37 marked by a breakout from a falling wedge pattern. This breakout was further supported by short liquidations, which added momentum to the price increase above the $2.30 level. The Taker Buy Ratio also indicates that buyers are aggressively driving the price, reflecting strong bullish sentiment.

Ripple’s strategic acquisitions and infrastructure enhancements are also contributing to a more positive outlook for XRP. By assembling a toolkit that resembles a traditional market-structure stack, Ripple has created a more credible platform for enterprises to test on-chain settlement. These developments help reduce operational friction for potential institutional adopters.

In conclusion, XRP’s recent performance is driven by a combination of strong ETF inflows, a supply-side squeeze, positive technical indicators, and Ripple’s strategic infrastructure developments. These factors suggest a structural maturation of the XRP market, positioning it as a potential utility component within a broader, regulated payments architecture.

Related: XRP Targets Breakout: Buy Signals Emerge

Source: Original article

Quick Summary

XRP has significantly outperformed other top cryptocurrencies, driven by substantial ETF inflows. On-chain data indicates a supply shock with declining exchange balances, increasing sensitivity to demand. Technical indicators and growing institutional infrastructure support a bullish outlook for XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.