XRP ETFs have seen nearly $900 million in net inflows since launch, signaling strong institutional interest. Despite ETF success, XRP’s price has not mirrored the inflows, remaining below its year-to-date opening price.

What to Know:

- XRP ETFs have seen nearly $900 million in net inflows since launch, signaling strong institutional interest.

- Despite ETF success, XRP’s price has not mirrored the inflows, remaining below its year-to-date opening price.

- Analysts remain cautiously optimistic, suggesting potential price breakouts if key resistance levels are breached.

The recent introduction of spot XRP ETFs in the US market has captured significant attention, especially amid ongoing regulatory discussions surrounding digital assets. The substantial inflows into these ETFs are noteworthy for institutional investors and active traders, potentially reshaping XRP’s market dynamics.

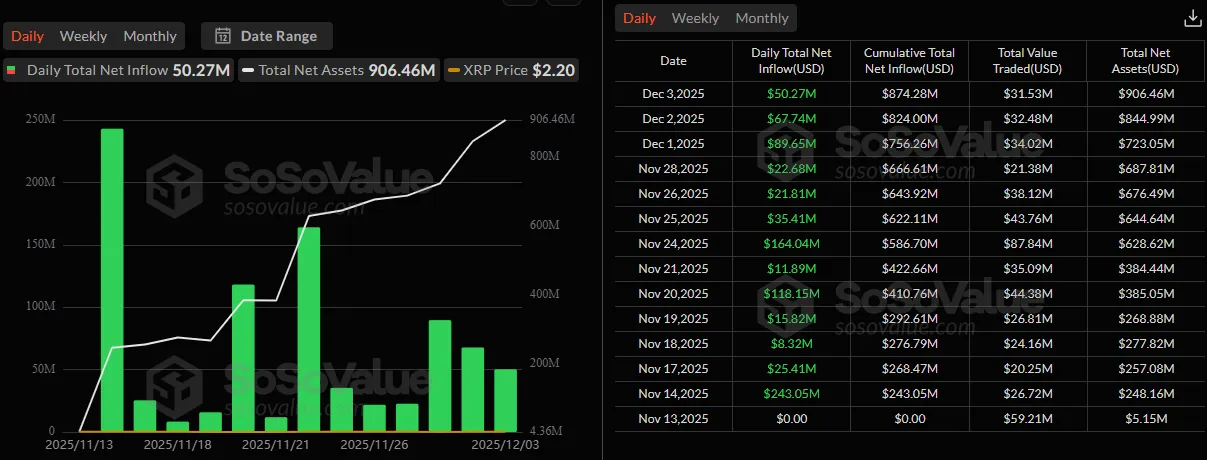

Since the debut of Canary Capital’s XRPC ETF in mid-November, followed by similar offerings from Bitwise, Grayscale, and Franklin Templeton, the aggregate net inflows have surged to almost $900 million. This figure, accumulated over just a few weeks, underscores robust demand for XRP exposure through regulated investment vehicles. The consistent daily inflows since November 13 is a particularly bullish signal, reminiscent of the early days of gold ETFs, which saw sustained accumulation as institutions gained comfort with the product structure.

The first day of trading for XRPC saw inflows of $243.05 million, and even the lowest daily inflow on November 18 was still a respectable $8.32 million. In the first three days of December alone, the funds attracted $89.65 million on Monday, $67.74 million on Tuesday, and $50.27 million on Wednesday, bringing the total for the month to $207.66 million. This contrasts with the performance of Bitcoin and Ethereum funds over the same period, which have experienced net outflows, suggesting a specific appetite for XRP-related assets.

Despite the impressive ETF inflows, XRP’s price has not reflected this positive momentum. Opening the year at $2.32, XRP currently trades around $2.15, having faced rejection at the $2.20 level recently. This divergence between ETF demand and price action raises questions about market efficiency and potential arbitrage opportunities. It also highlights the complex interplay between investment product structures and the underlying asset’s intrinsic value, a dynamic often observed in traditional commodity markets.

XRP’s struggle to maintain its YTD opening price, despite positive developments such as its best year on record, can be attributed to several factors. Macroeconomic pressures, regulatory uncertainties, and broader market sentiment all play a role. Additionally, the ongoing legal battle between Ripple and the SEC continues to cast a shadow over XRP’s price discovery, creating a risk premium that deters some investors. This situation mirrors past instances in traditional finance where legal or regulatory overhangs have suppressed asset valuations despite strong fundamentals.

Analysts remain cautiously optimistic about XRP’s future price performance. The consensus is that a breakout above the $2.28 resistance level could pave the way for a move towards $2.75. However, XRP remains significantly below its all-time high of $3.65, underscoring the challenges it faces in regaining investor confidence. The ability of XRP to overcome these hurdles will depend on a combination of factors, including regulatory clarity, technological advancements, and continued institutional adoption.

The launch and performance of XRP ETFs provide valuable insights into the evolving landscape of digital asset investments. While the inflows demonstrate significant institutional interest, the divergence between ETF demand and XRP’s price highlights the complexities of market dynamics and the influence of external factors. As the market matures and regulatory frameworks become clearer, we can expect to see greater alignment between investment product performance and the underlying asset’s value.

In conclusion, the strong inflows into XRP ETFs are a positive sign for the digital asset’s long-term prospects. However, investors should remain vigilant and consider the broader market context, regulatory environment, and potential risks before making investment decisions. The current situation underscores the importance of thorough due diligence and a balanced approach to digital asset investing, principles that have long guided successful strategies in traditional financial markets.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP ETFs have seen nearly $900 million in net inflows since launch, signaling strong institutional interest. Despite ETF success, XRP’s price has not mirrored the inflows, remaining below its year-to-date opening price. Analysts remain cautiously optimistic, suggesting potential price breakouts if key resistance levels are breached.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.