The much-anticipated launch of an XRP ETF has arrived, making it a milestone in the cryptocurrency industry. Yet, despite this significant win for regulators and Ripple supporters alike, the market responded with indifference.

The much-anticipated launch of an XRP ETF has arrived, marking a milestone in the cryptocurrency industry. Yet, despite this significant win for regulators and Ripple supporters alike, the market responded with indifference. Alongside XRP, a new dogecoin (DOGE) ETF also made its debut in the U.S., reflecting what many see as the peak of pro-crypto sentiment from the Securities and Exchange Commission (SEC).

Institutional Adoption Expands—Even to Memecoins

The approval of spot ETFs for XRP and DOGE is unprecedented, considering neither has traditionally been associated with institutional-grade assets. While bitcoin (BTC) and ether (ETH) have long been viewed as pillars of decentralized finance, DOGE often draws comparisons to collectibles like baseball cards, driven more by online culture than economic fundamentals.

With DOGE’s ETF now listed, some critics argue that this move by the SEC creates a misleading sense of credibility around a memecoin prone to volatility. XRP, meanwhile, benefits from a more practical use case in payments infrastructure, but its market reaction was no less muted.

Markets Shrug Off ETF Launches

Despite these landmark approvals, traders remained unimpressed. DOGE saw a 2% drop within 24 hours of trading, and the broader meme token sector also dipped—tokens such as M, PUMP, and TOSHI fell nearly 10% each. XRP, the supposed stable counterpart in this scenario, mirrored DOGE with a 2% decline.

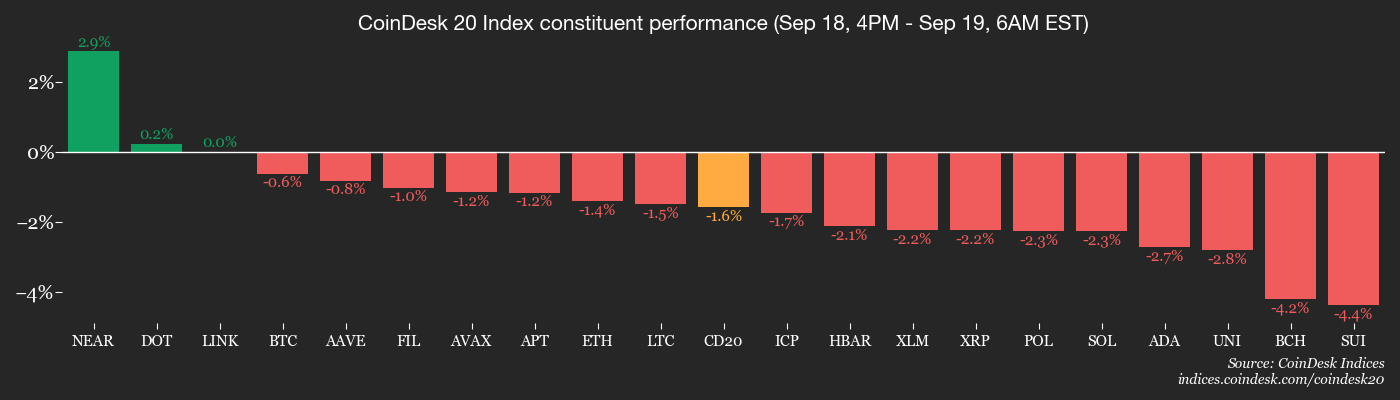

Bitcoin and ether also faced downward pressure as institutional players increasingly sought downside protection via derivatives. The CoinDesk 20 Index was down 1.3% at publication time, signaling widespread caution across the market.

Crypto heavyweights in the CoinDesk 20 Index tumbled even amid new ETF listings.

Broader Economic Forces Weigh On Crypto

Outside of crypto-specific developments, macroeconomic indicators also cast a shadow. The U.S. Dollar Index (DXY) and Treasury yields ticked upward, adding stress to risk assets. The Bank of Japan kept interest rates steady, but internal dissent hinted at future hikes. A planned reduction of ETF holdings by Japan’s central bank added to the caution.

Meanwhile, the anticipated Fusaka upgrade for Ethereum, scheduled for December 3, aims to increase data efficiency and reduce second-layer rollout costs—developments that may eventually help tokens like XRP regain relevance in payment systems.

XRP ETF Hits Record First-Day Volume

Despite the lukewarm price action, the XRP ETF’s debut wasn’t without an upside. According to CoinDesk reports, XRP’s ETF drew $37.7 million in trading volume in its first day—crowning it the year’s biggest ETF launch. DOGE followed with $17 million, placing it among the top five.

Though traders seemed apathetic, this level of institutional volume underscores a growing mainstream acceptance of digital assets—even those previously viewed as fringe or speculative.

ETF Era Highlights Changing Sentiment

These developments point to a broader shift in how cryptocurrencies are being integrated into traditional finance. The listings reflect both the SEC’s evolving stance and the deepening liquidity driving opportunistic sentiment in the markets. But as investor appetite wanes, ETF hype alone may not be enough to kickstart price rallies.

XRP’s entrance into the ETF space may be a landmark win for its long-term adoption case. However, as current trends suggest, price performance lags behind structural advancements—highlighting the gap between institutional validation and immediate market enthusiasm.

Looking Ahead

With XRP now formally listed through a spot ETF, all eyes turn toward how liquidity, macro trends, and further crypto regulation will interact. The future of Ripple’s utility token will largely depend on broader investor sentiment, especially as macroeconomic constraints continue to weigh heavily.

Related: XRP Price: $12M Max Pain for Bears

Despite a sluggish reception, the launch signifies an important institutional acceptance that could gradually shift the perception and integration of XRP across financial markets.

Quick Summary

The much-anticipated launch of an XRP ETF has arrived, marking a milestone in the cryptocurrency industry. Yet, despite this significant win for regulators and Ripple supporters alike, the market responded with indifference.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.