XRP is showing signs of a potential recovery, with traders eyeing a move toward the $2.30–$2.50 range. Breaking above the $2.30 resistance could signal a bullish trend shift, attracting increased buying pressure.

What to Know:

- XRP is showing signs of a potential recovery, with traders eyeing a move toward the $2.30–$2.50 range.

- Breaking above the $2.30 resistance could signal a bullish trend shift, attracting increased buying pressure.

- Conflicting signals from funding rates and chart patterns suggest a volatile period ahead, with a possible liquidity squeeze.

XRP is back on the radar for many institutional desks as it attempts to shake off a multi-month downtrend. The digital asset recently defended its $2 psychological support level, sparking renewed interest in its short-term trajectory. The critical question now is whether XRP can muster enough momentum to overcome the $2.30 resistance and target higher levels, a move that could signal a broader trend reversal and bring sidelined capital back into play.

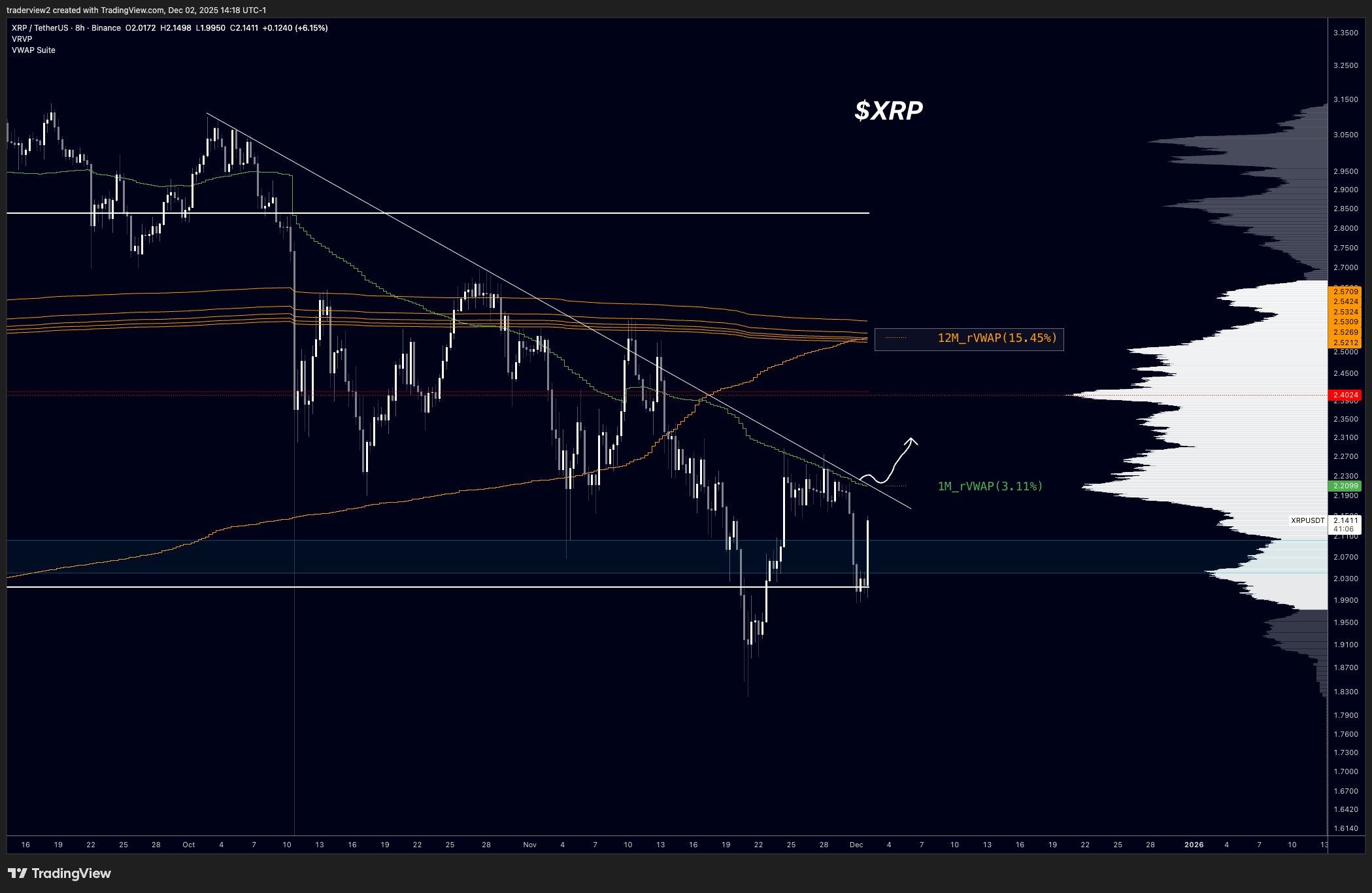

XRP’s recent bounce from just under $2 coincided with a retest of a fair value gap (FVG) established during a prior rally. This suggests underlying demand remains intact even as the broader trend has been bearish since July. The price action is compressing below the $2.30 level, forming a technical pattern akin to a coiled spring. If XRP manages to break above $2.30 convincingly, it would represent the first significant trend shift in months, potentially opening the door for a run toward the $2.58 target.

However, the path won’t be without obstacles. The $2.34–$2.42 range contains a sell-side FVG, where profit-taking is likely to emerge. It’s worth noting that XRP’s price action in 2025 has been characterized by rapid moves between liquidity pockets. Should momentum shift, XRP could overshoot intermediate resistance levels as it seeks out liquidity, making $2.58 a viable, albeit extended, target. The relative strength index (RSI) is currently leaning slightly bullish, and reclaiming the 200-period simple moving average (SMA) would further support this outlook.

Open interest in XRP futures has plummeted in recent months, falling from $8.6 billion to $3.8 billion. This thinning of positioning suggests that any directional move could be amplified by a potential squeeze, similar to what we’ve seen in other digital assets with depleted order books.

Orderbooks are clear, if there was a time, it’s now for this trend to shift. If this setup fails, acceptance under $2 is next and the end of year is ugly.

Funding rates for XRP remain predominantly negative, indicating that short positions are still dominant in the futures market. This negative sentiment, combined with declining prices, reinforces the current downtrend. Some analysts believe that if funding rates fall further, a retest of the $2.00–$1.90 zone becomes increasingly probable. However, deeply negative funding can also be a contrarian indicator, often preceding a liquidity squeeze as shorts are forced to cover. In such a scenario, XRP could consolidate briefly before breaking above the $2.30 resistance.

Conversely, some traders are spotting potential reversal patterns. One analyst noted a three-drive exhaustion pattern on the inverted XRP chart, suggesting the downtrend may be losing steam. A higher low has recently formed, and reclaiming the monthly relative volume-weighted average price (rVWAP) at $2.22 would signal that a bullish rotation is underway, potentially paving the way toward the $2.50 region.

The conflicting signals from funding rates, chart patterns, and open interest highlight the uncertainty surrounding XRP’s near-term trajectory. A decisive break above $2.30 would likely attract significant buying pressure, while failure to overcome this resistance could lead to further downside. Active traders should closely monitor these key levels and be prepared for potential volatility as the market attempts to establish a clear direction. XRP’s moves should be viewed within the context of Bitcoin’s performance and broader market sentiment.

Ultimately, XRP’s ability to break free from its downtrend hinges on its ability to attract sustained buying interest and overcome key resistance levels. The coming days will be crucial in determining whether XRP can capitalize on its recent bounce and embark on a more sustained recovery.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP is showing signs of a potential recovery, with traders eyeing a move toward the $2.30–$2.50 range. Breaking above the $2.30 resistance could signal a bullish trend shift, attracting increased buying pressure. Conflicting signals from funding rates and chart patterns suggest a volatile period ahead, with a possible liquidity squeeze.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.