XRP is once again in the spotlight as the crypto world anticipates a pivotal vote from the SEC that could reshape Ripple’s legal landscape and impact XRP’s future trajectory.

XRP is once again in the spotlight as the crypto world anticipates a pivotal vote from the SEC that could reshape Ripple’s legal landscape and impact XRP’s future trajectory. As of Thursday, all eyes are on potential outcomes that could include withdrawing the SEC’s appeal and lifting long-standing restrictions on XRP’s institutional sales—events that may spark significant price momentum.

The spotlight returns to the Ripple vs. SEC battle with a key closed-door meeting scheduled. This meeting will provide SEC Chair Atkins and commissioners a full quorum to vote on critical issues, including a penalty reduction, lifting a sales injunction, and possibly withdrawing the agency’s appeal concerning XRP’s programmatic sales. A joint request from Ripple and the SEC indicates both parties agreed to pause their ongoing appeal, further signaling a commitment toward settlement. However, these intentions will only carry legal weight if confirmed by the Commission’s official decision.

Among regulatory circles, optimism is growing that the SEC may finally be preparing to move away from its aggressive crypto enforcement stance. With Republican commissioners like Mark Uyeda and Hester Peirce favoring crypto-friendly policies, and recent dismissals of key cases like the one involving Coinbase, there’s speculation the Commission may align on easing regulatory pressure on Ripple. Despite the unfolding developments, XRP remains notably below older price highs, including its January peak and historic all-time close.

Former SEC lawyer John Reed Stark shared a sharp critique of the agency’s recent approach to crypto in light of the public statements by the new chief of its Cyber and Emerging Technologies Unit. He commented, “Stick a fork in SEC crypto-enforcement, it’s done.” Stark has long been critical of the SEC’s crypto oversight structure, citing a lack of audits, inspections, and basic financial safeguards. These remarks underscore narrative shifts that could influence how cryptocurrencies like XRP are policed moving forward.

On May 7, XRP posted a 1.31% drop after a modest gain the day before, ending the session at $2.1267. This decline contrasted with a marginal uptick in the broader crypto market, which edged up 0.08%, pushing the total market cap close to $3 trillion. Unresolved legal debates and the lack of clear direction regarding an XRP-spot ETF have kept investor confidence subdued. However, if the SEC does proceed with withdrawing its appeal, the agency could pave the way to approve pending ETF applications linked to XRP, potentially renewing investor interest in the process.

Related: Expert Advice: Sell XRP If You’re Confused

XRP’s near-term direction will hinge on:

- Outcomes from the SEC vote

- Legal developments regarding appeal status

- Updates on XRP-spot ETF approvals

- Macroeconomic shifts, particularly from US-China trade dynamics

Technically, XRP has key support near $2.10, while a break beyond $2.50 could catalyze a rally toward the $3 mark. A sustained push could see the token challenge its all-time high of $3.5505. However, the current chart setup leans bearish, signaling that traders remain cautious as they await clarity from regulators.

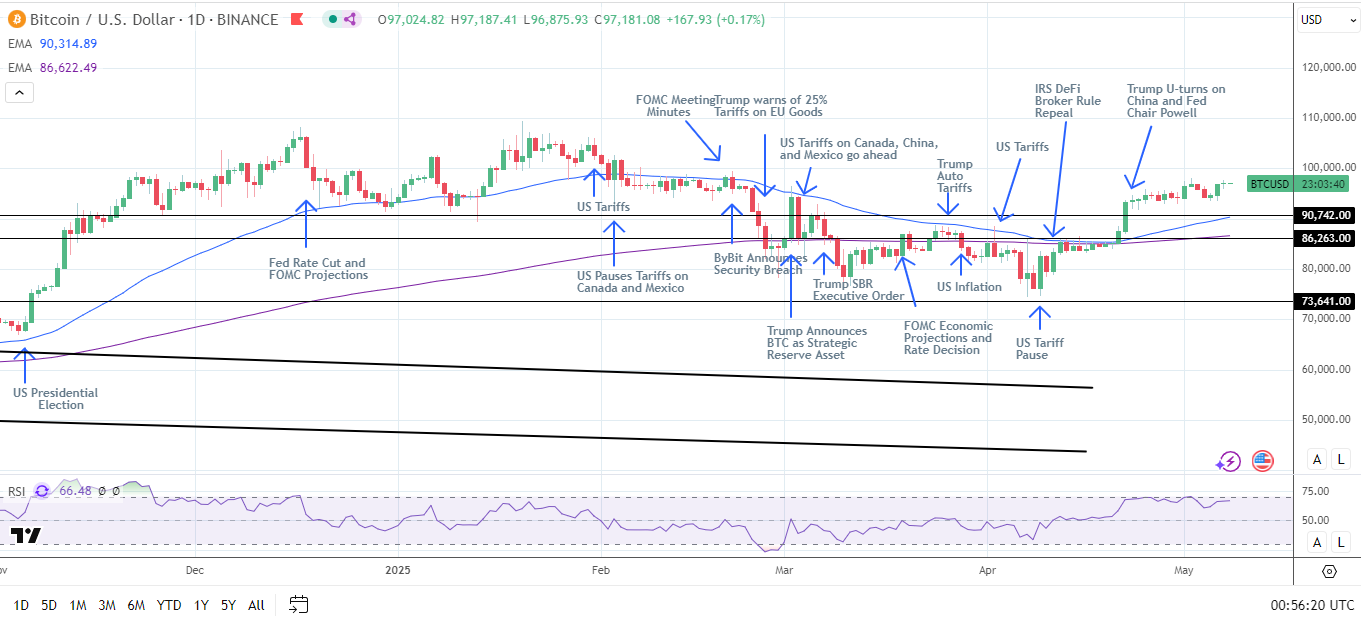

Meanwhile, across the crypto landscape, Bitcoin reacted more favorably following commentary from Federal Reserve Chair Jerome Powell. Bitcoin’s price climbed above $97,000 after Powell maintained current interest rates at 4.5% and characterized the U.S. economy as resilient despite global trade concerns. These comments were interpreted as moderately dovish, providing a confidence boost to crypto markets.

Notably, institutional interest appears to be ramping up. On May 7, several ETFs recorded significant inflows, including:

- ARK 21Shares Bitcoin ETF (ARKB) – $54.7 million

- Fidelity Wise Origin Bitcoin Fund (FBTC) – $39.9 million

- Bitwise Bitcoin ETF (BITB) – $10.5 million

Total U.S. spot Bitcoin ETF net inflows for the day reached $105.1 million, reversing earlier losses. Absent final figures from BlackRock’s IBIT fund, the streak of positive flows signals improving sentiment among long-term investors.

Looking ahead, XRP’s fortunes will largely rest on regulatory decisions and whether an appeal withdrawal comes to fruition. Broader crypto momentum hinges on macroeconomic signals and the legislative environment in the U.S., including developments like the proposed Bitcoin Act—a bill that aims to institutionalize government ownership of Bitcoin. The weeks ahead may be crucial for Ripple and investors attempting to navigate its evolving regulatory landscape.

Quick Summary

XRP is once again in the spotlight as the crypto world anticipates a pivotal vote from the SEC that could reshape Ripple’s legal landscape and impact XRP’s future trajectory.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.