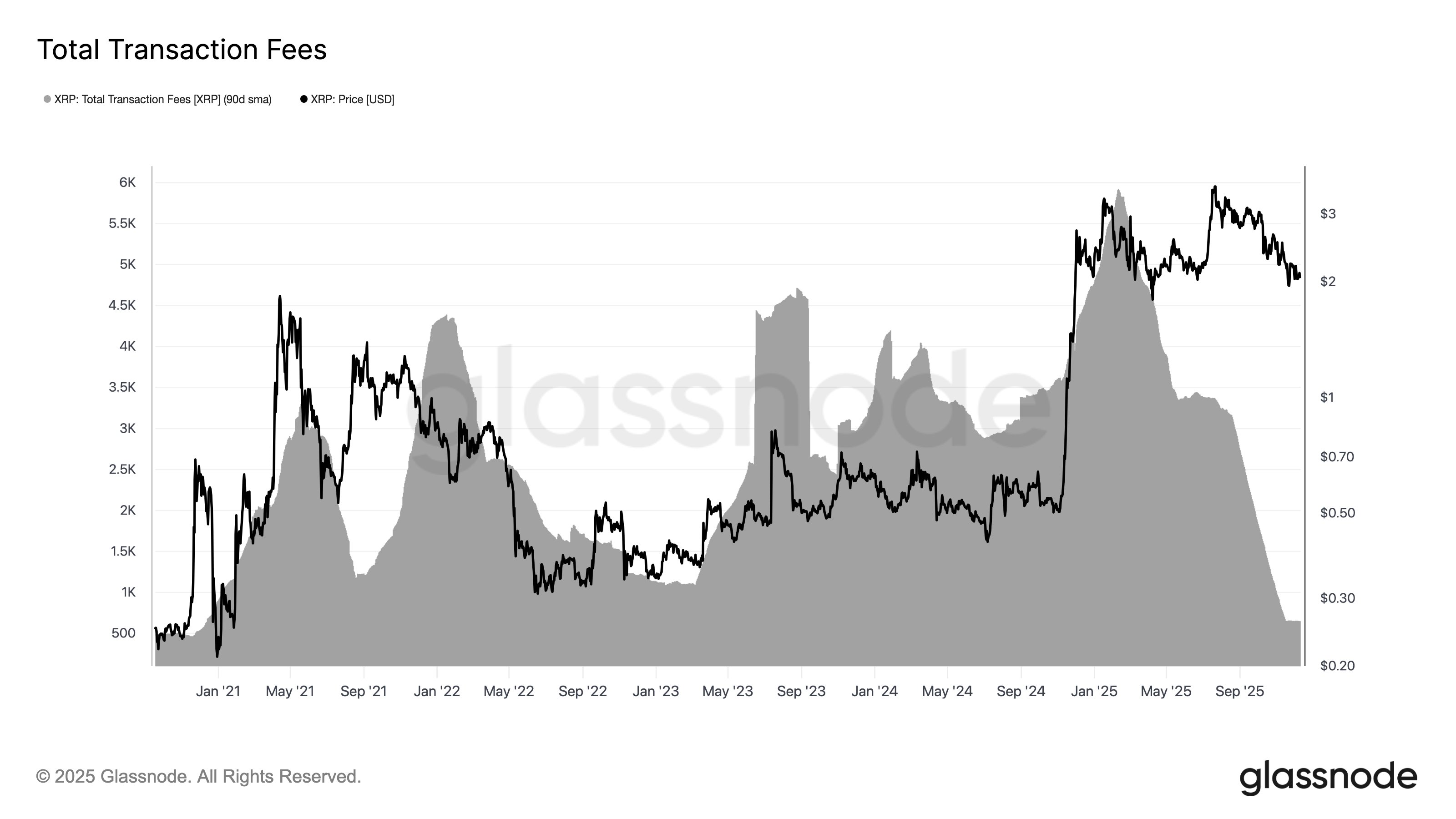

XRP transaction fees have plummeted, signaling potentially waning network activity and raising questions about its long-term utility.

What to Know:

- XRP transaction fees have plummeted, signaling potentially waning network activity and raising questions about its long-term utility.

- The NYSE’s installation of a Satoshi Nakamoto statue highlights the growing convergence of traditional finance and the digital asset space, despite some volatility in related stock debuts.

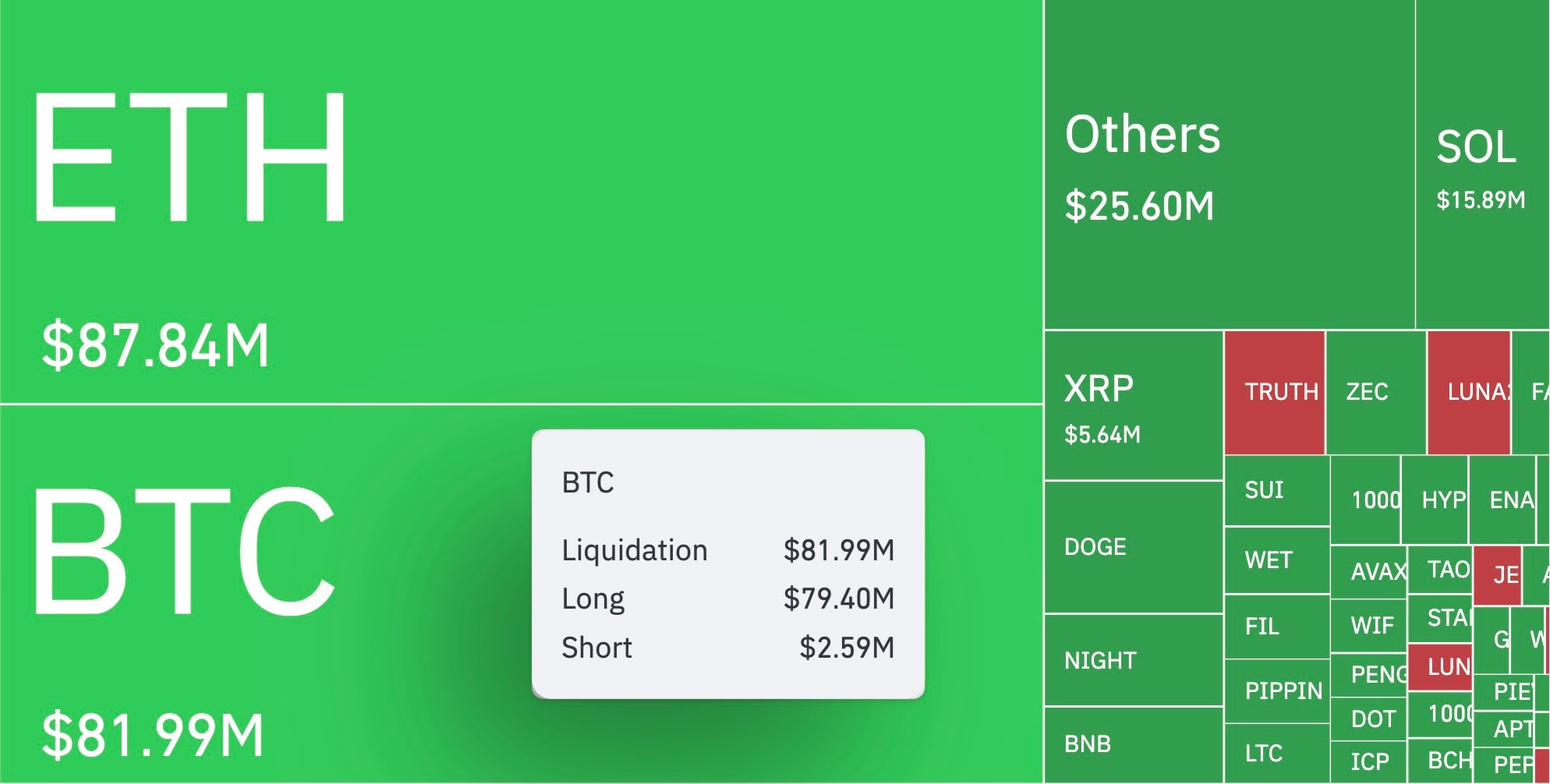

- A significant liquidation imbalance in Bitcoin derivatives markets suggests that leveraged long positions were prematurely established following the recent Federal Reserve announcements.

The digital asset market is currently navigating a complex environment, influenced by macroeconomic signals and idiosyncratic developments within specific crypto ecosystems. XRP’s fee revenue decline, the NYSE’s symbolic embrace of Bitcoin’s founder, and the leveraged trading activity in Bitcoin all provide distinct insights into the current state of the market and its evolving relationship with traditional finance. Institutional investors are keenly observing these dynamics to gauge the maturity and sustainability of the asset class.

XRP Fee Revenue Plunge

The dramatic 89% drop in XRP transaction fees, as highlighted by Glassnode data, is a concerning indicator for the Ripple network. A sustained decline in fees can reflect reduced network activity, potentially stemming from decreased usage of XRP for payment settlements or a shift in user preferences toward alternative platforms. For institutional investors, this raises questions about the long-term viability and utility of XRP, particularly in comparison to other blockchain networks with more robust fee generation.

The decline in XRP fees mirrors periods of reduced activity observed in other crypto assets, often preceding price corrections. It remains to be seen whether this is a temporary lull or a more structural issue for XRP. Investors should monitor on-chain metrics closely for signs of stabilization or further deterioration.

NYSE’s Nod to Satoshi

The installation of a Satoshi Nakamoto statue at the NYSE is a symbolic, yet powerful, gesture, reflecting the increasing acceptance of Bitcoin and the broader crypto ecosystem within traditional financial circles. This move by the NYSE underscores the growing institutional interest in digital assets and their potential to reshape the financial landscape. However, the rocky debut of XXI, a company holding a significant Bitcoin treasury, serves as a reminder that market sentiment toward crypto-related ventures can be volatile.

“Satoshi Nakamoto”

Valentina Picozzi – @satoshigalleryTwenty One Capital places a statue of Satoshi Nakamoto, the inventor of Bitcoin, in NYSE. Its new home marks a shared ground between emerging systems and established institutions. From code to culture, the placement… pic.twitter.com/sTiNq3h5HY

— NYSE ð (@NYSE) December 10, 2025

The juxtaposition of the NYSE’s embrace of Bitcoin’s ethos with the challenges faced by XXI highlights the complexities of integrating digital assets into traditional market structures. The market will likely watch closely to see how XXI evolves its business model around its Bitcoin holdings, and whether it can successfully bridge the gap between traditional finance and the crypto world.

Bitcoin’s Leveraged Longs Get Squeezed

The significant liquidation imbalance in Bitcoin derivatives, with long positions bearing the brunt, underscores the risks associated with excessive leverage in the crypto market. This event serves as a cautionary tale for institutional investors, highlighting the importance of prudent risk management and avoiding over-leveraged positions, particularly in response to macroeconomic announcements. The wipeout of leveraged longs suggests that some traders may have prematurely anticipated a sustained rally following the Federal Reserve’s recent statements.

Such liquidation events are not uncommon in the crypto market, often triggered by unexpected price swings or shifts in sentiment. They serve as a reminder that even in a bullish environment, excessive leverage can amplify losses and destabilize market conditions. Seasoned investors understand that disciplined risk management is paramount, particularly when navigating the volatile waters of the digital asset space.

Navigating Market Uncertainty

The current market landscape is characterized by a degree of uncertainty, with Bitcoin trading within a relatively narrow range and XRP struggling to regain momentum. The contrasting signals from these assets, coupled with the broader macroeconomic backdrop, require a nuanced approach to investment strategy. Institutional investors should remain vigilant, closely monitoring market dynamics and adjusting their positions accordingly.

The market’s reaction to the Federal Reserve’s announcements underscores the sensitivity of digital assets to macroeconomic factors. While rate cuts are generally seen as positive for risk assets, the immediate impact on Bitcoin and other cryptocurrencies can be complex and influenced by a variety of factors, including derivatives positioning and overall market sentiment.

Cautious Optimism

Despite the recent volatility and mixed signals, the long-term outlook for digital assets remains constructive. The increasing institutional adoption, as evidenced by the NYSE’s symbolic gesture and the growing corporate holdings of Bitcoin, suggests that the asset class is gradually maturing and gaining wider acceptance. However, investors should remain mindful of the inherent risks and uncertainties, and exercise caution when deploying capital in this evolving market.

The key takeaway is that the digital asset market is becoming increasingly intertwined with traditional finance, but it still retains its unique characteristics and challenges. A balanced approach, combining fundamental analysis, technical insights, and prudent risk management, is essential for navigating this dynamic landscape and achieving sustainable investment success.

Related: XRP Price Prediction: Modeled on Ethereum’s Rise

Source: Original article

Quick Summary

XRP transaction fees have plummeted, signaling potentially waning network activity and raising questions about its long-term utility. The NYSE’s installation of a Satoshi Nakamoto statue highlights the growing convergence of traditional finance and the digital asset space, despite some volatility in related stock debuts.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.