XRP’s recent price weakness is being driven by multiple factors, including a sharp drop in transaction fees and waning speculative interest. Technical analysis suggests further downside risk, with a potential target of $1.73 if key support levels fail to hold.

What to Know:

- XRP’s recent price weakness is being driven by multiple factors, including a sharp drop in transaction fees and waning speculative interest.

- Technical analysis suggests further downside risk, with a potential target of $1.73 if key support levels fail to hold.

- Despite the current bearish sentiment, contrarian investors may see opportunity if XRP can stabilize and regain momentum.

XRP is facing renewed scrutiny as its price has wobbled, threatening a deeper correction. The confluence of declining transaction fees, reduced speculative appetite, and a bearish technical pattern are raising concerns among investors. For institutions and active traders, these factors create both risks and potential opportunities that warrant careful analysis.

A primary driver of the recent price pressure is the significant decrease in transaction fees on the XRP Ledger (XRPL). Data shows a steep drop in total daily transaction fees, reaching levels not seen since December 2020.

This decline suggests reduced network activity and demand for XRP transactions, which can erode its fundamental value proposition. Lower fees might attract more users in the long run, but the immediate impact can signal a lack of short-term utility and reduce revenue for validators. This is similar to when Ethereum gas fees spiked during periods of high congestion, only to fall back during quieter periods, impacting miner revenues and short-term price sentiment.

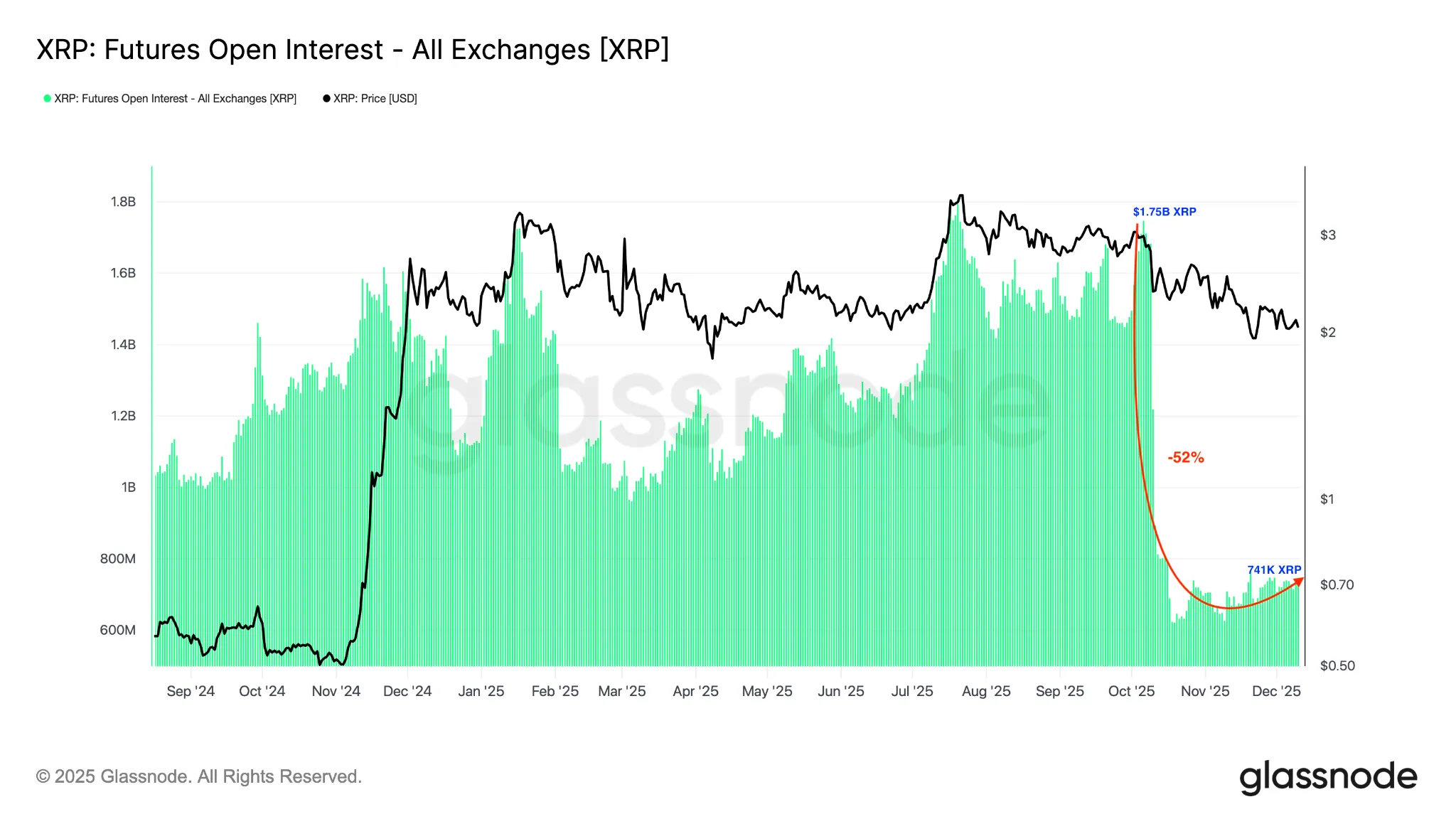

Adding to the bearish outlook is the substantial decrease in XRP futures open interest (OI). The drop signifies a reduction in speculative positions and overall market participation.

Coupled with falling funding rates, this suggests that derivatives traders are losing confidence in XRP’s near-term recovery potential. Such a sentiment shift can create a self-fulfilling prophecy, as reduced leverage and speculative inflows exacerbate price declines. We’ve seen similar dynamics play out in other assets, where a drop in open interest precedes a significant price move, often to the downside.

From a technical analysis perspective, XRP’s price chart reveals a potential descending triangle pattern, which typically signals further downside risk. A break below the triangle’s support line could trigger a sharp sell-off, potentially driving the price down to the $1.73 level.

This bearish pattern underscores the importance of key support levels in preventing further losses. If the $2-$1.98 range fails to hold, the next significant support lies considerably lower, increasing the risk of a substantial correction. This is not unlike traditional markets, where technical patterns combined with fundamental weakness can amplify price movements.

However, it’s worth noting that extreme fear in the market can sometimes present contrarian buying opportunities. Social sentiment toward XRP has dipped into the “fear zone,” reminiscent of levels seen before previous rallies.

While not a guarantee of future performance, such sentiment extremes can indicate that the market has become oversold and that a reversal could be in the cards. Savvy investors often look for these disconnects between price action and underlying fundamentals to identify potential entry points.

Ultimately, the outlook for XRP remains uncertain, with both bearish and bullish factors at play. The decline in transaction fees and open interest, coupled with the bearish technical pattern, suggests caution. However, contrarian investors may find opportunity in the current fear, provided that XRP can stabilize and regain positive momentum.

Related: XRP Holders Brace for Clarity Act Impact

Source: Original article

Quick Summary

XRP’s recent price weakness is being driven by multiple factors, including a sharp drop in transaction fees and waning speculative interest. Technical analysis suggests further downside risk, with a potential target of $1.73 if key support levels fail to hold.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.