An analyst projects significant growth for XRP in 2027 due to large-scale tokenization of U.S. financial markets. This forecast aligns with broader discussions about the tokenization of real-world assets and its potential impact on the crypto space.

What to Know:

- An analyst projects significant growth for XRP in 2027 due to large-scale tokenization of U.S. financial markets.

- This forecast aligns with broader discussions about the tokenization of real-world assets and its potential impact on the crypto space.

- The projected growth matters for XRP and Ripple, as it suggests a pathway for institutional adoption and increased flows into the XRP Ledger.

An XRP community figure, Chad Steingraber, has set forth a timeline anticipating XRP’s most aggressive growth phase to occur in 2027. This projection hinges on the large-scale tokenization of U.S. financial markets. The analyst’s outlook was spurred by recent comments from the SEC suggesting that the entire U.S. market could be tokenized within the next two years. If accurate, the forecast has major implications for Ripple and the broader adoption of digital assets in traditional finance.

Data Shows Tokenization Is Still in Its Early Stages

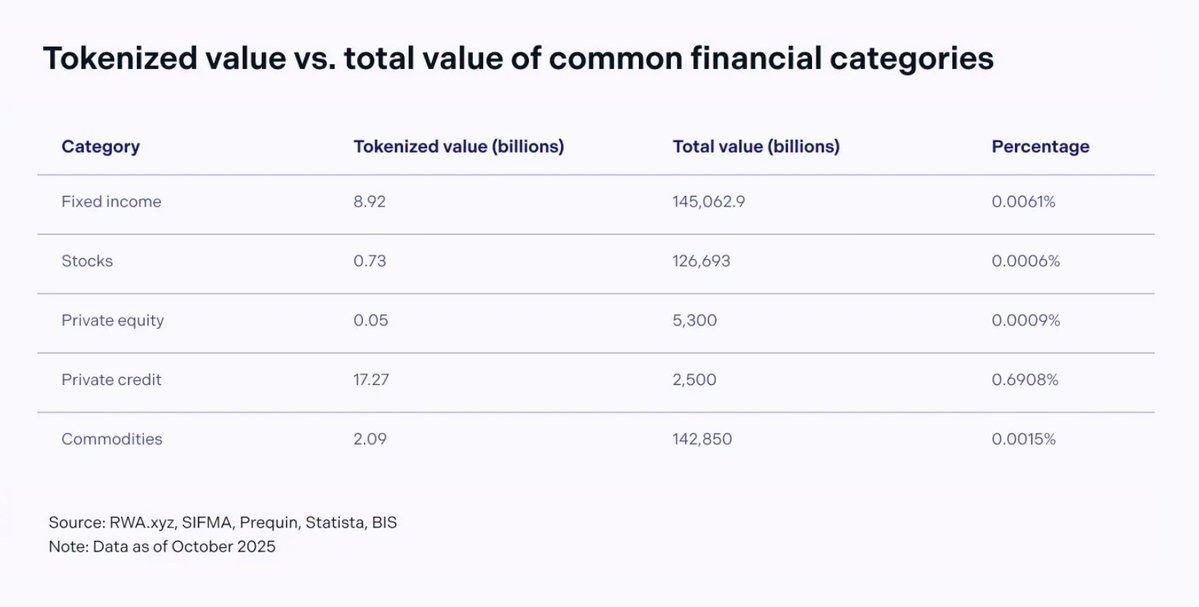

Steingraber suggests 2026 will be a build-up period, characterized by steady growth in tokenized assets. Data from RWA.xyz and other sources indicates that tokenized assets currently represent a small fraction of the overall global financial markets. For instance, tokenized fixed income is valued at less than $9 billion, compared to a total market value exceeding $145 trillion. Similarly, tokenized stocks account for less than $1 billion out of approximately $126 trillion. Even in private credit, the most advanced category, tokenization remains below 1% of the total value.

These figures suggest that the sector is still in its nascent stages, with the most substantial growth phase yet to come. For institutional investors, this presents both an opportunity and a challenge, requiring careful consideration of the market’s potential trajectory.

Analysts See XRP Ledger as Built for Scale

X Finance Bull, another XRP analyst, concurs with Steingraber’s timeline, viewing 2026 as the onboarding phase and 2027 as the point at which liquidity dynamics shift. This perspective suggests that once liquidity concentrates on-chain, it will attract other assets and participants, favoring ledgers that offer high throughput and regulatory compliance. The XRP Ledger is often cited as a network capable of meeting these demands, positioning it favorably for institutional adoption as tokenization scales.

Other commentators share similar expectations, with one analyst suggesting that 15–20% of markets could be tokenized in 2026, with the remainder following in 2027. However, more cautious voices emphasize that tokenization alone does not guarantee demand unless assets are actively used, settled, and traded. This highlights the need for robust market infrastructure and active participation to drive meaningful growth.

SEC Chair Confirms the Tokenization Narrative

SEC Chair Paul Atkins has previously stated that all U.S. markets will move on-chain within a few years. Atkins cited benefits such as instant settlement, improved transparency, and reduced counterparty risk as key drivers of this transition. This regulatory shift is seen by the XRP community as a significant catalyst, as enterprise networks like XRPL are perceived to be better positioned than other chains to support regulated financial markets. The SEC’s posture on digital assets will continue to shape institutional investment strategies.

What It Could Mean for XRP’s Price

While XRP currently trades under $2, analysts’ opinions on how tokenization could translate into price appreciation vary significantly. X Finance Bull has speculated that XRP could reach $100 within two years if trillions of dollars move on-chain. More conservative forecasts suggest a longer timeline extending into the 2030s or beyond for this price target. Regardless of specific price predictions, the consensus is that 2027 could bring a major shift, with XRP’s price potentially benefiting from increased tokenization and transaction volumes on the XRPL.

Ripple’s Prediction for Tokenization Market

Ripple has projected that the tokenization market could reach $19 trillion by 2033. Analyst Brad Kimes suggests that XRP could reach $10 by 2026, $54 by 2029, and $189 by 2033 if Ripple fully capitalizes on this market. These projections underscore the potential for significant growth in the coming years, contingent on Ripple’s ability to leverage the tokenization trend.

The convergence of regulatory endorsements, technological readiness, and market demand paints a promising, albeit uncertain, picture for XRP. While the exact timeline and magnitude of growth remain speculative, the underlying trend toward tokenization appears increasingly likely to shape the future of finance and the role of digital assets like XRP.

Related: Crypto ETF Flows Show Third Week of Gains

Source: Original article

Quick Summary

An analyst projects significant growth for XRP in 2027 due to large-scale tokenization of U.S. financial markets. This forecast aligns with broader discussions about the tokenization of real-world assets and its potential impact on the crypto space.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.