SBI Holdings shareholders who opted to receive XRP as a benefit are seeing substantial gains. The distributions, started in 2020, provided XRP at an average acquisition price well below current market values.

What to Know:

- SBI Holdings shareholders who opted to receive XRP as a benefit are seeing substantial gains.

- The distributions, started in 2020, provided XRP at an average acquisition price well below current market values.

- This demonstrates the potential benefits of long-term XRP exposure, aligning with SBI’s broader support for Ripple.

SBI Holdings’ decision to offer XRP as part of its shareholder benefits program has proven lucrative for its investors. Since distributions began in 2020, those who chose XRP over other options are now witnessing returns exceeding four times their average acquisition cost. This highlights the potential of strategic, long-term crypto investments, especially when coupled with strong institutional backing. Let’s delve into the details of this successful program and its implications for XRP and the broader market.

XRP Distributions as Shareholder Benefits

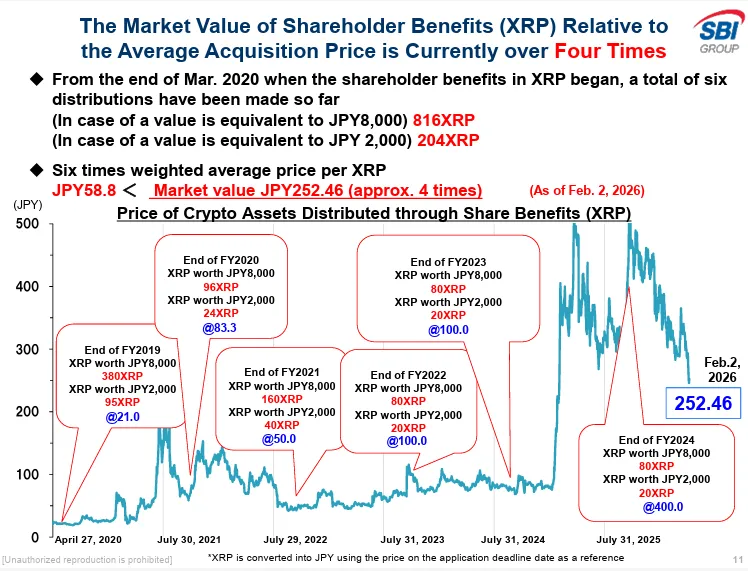

In March 2020, SBI Holdings initiated a program to distribute XRP to eligible shareholders. The structure was straightforward: shareholders could opt to receive XRP equivalent to either JPY 8,000 or JPY 2,000, translating to 816 XRP or 204 XRP, respectively, based on prevailing market prices. Over six distribution rounds, the weighted average acquisition price for XRP stood at an attractive JPY 58.8 per token.

Gains Exceeding 4X Acquisition Cost

As of early February 2026, the market value of XRP reached approximately JPY 252.46 per token. This surge translates to roughly four times the average acquisition price for SBI shareholders who received XRP through the benefit program. Notably, earlier distributions from fiscal years 2019 to 2022 occurred when XRP traded significantly lower, ranging from around ¥20 to ¥100. These early allocations have seen particularly substantial appreciation.

USD Parity and Market Dynamics

It’s worth noting the close alignment between the Japanese yen and U.S. dollar values of XRP. For instance, XRP traded around $0.285 in 2019, remaining within that range for several years. The breakout above $0.50 in November 2024, followed by a surge to $1, $2, and $3 within three months, mirrors the 7x price surge observed in the Japanese market. While XRP has since corrected, trading around $1.45, SBI investors remain significantly ahead.

Long-Term Vision Pays Off

The success of SBI’s shareholder program underscores the benefits of a long-term investment horizon in the crypto space. By providing XRP at an average price far below current market values, SBI enabled its shareholders to capitalize on the asset’s growth potential. This strategy contrasts with buying at market highs, often driven by short-term speculation.

SBI’s Enduring Ripple Partnership

SBI Holdings has consistently demonstrated its commitment to Ripple and XRP, solidifying its position as a key institutional supporter in Asia. Chairman Yoshitaka Kitao has publicly stated that SBI’s 9% stake in Ripple is valued at over $10 billion in XRP. This unwavering support, combined with the success of the shareholder program, reinforces confidence in SBI’s crypto-related initiatives.

Implications for Institutional Flows

The SBI case study offers valuable insights for institutional investors considering digital asset exposure. Strategic distribution programs, coupled with a long-term investment horizon, can yield significant returns. Moreover, SBI’s continued support for Ripple, despite regulatory uncertainties and market volatility, highlights the importance of strong partnerships and conviction in the underlying technology. As institutional interest in crypto grows, expect to see more innovative strategies emerge, leveraging the unique characteristics of digital assets to enhance shareholder value.

In conclusion, SBI Holdings’ XRP shareholder program exemplifies the potential of strategic crypto investments. By providing XRP at attractive acquisition prices and maintaining a long-term vision, SBI has created significant value for its shareholders. This success story underscores the importance of institutional support, patient investment strategies, and a deep understanding of the evolving crypto landscape.

Related: XRP Overtakes Ethereum: Grayscale Reveals Data

Source: Original article

Quick Summary

SBI Holdings shareholders who opted to receive XRP as a benefit are seeing substantial gains. The distributions, started in 2020, provided XRP at an average acquisition price well below current market values. This demonstrates the potential benefits of long-term XRP exposure, aligning with SBI’s broader support for Ripple.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.