To break into XRP’s top 1%, a wallet must hold at least 46,426 XRP, a feat achieved by just 76,412 wallets today. The analysis arrives amid broader debates around crypto wealth concentration and market participation.

What to Know:

- To break into XRP’s top 1%, a wallet must hold at least 46,426 XRP, a feat achieved by just 76,412 wallets today.

- The analysis arrives amid broader debates around crypto wealth concentration and market participation.

- Understanding these tiers is increasingly relevant as institutional interest in XRP and Ripple’s regulatory posture evolve.

As XRP navigates the choppy waters of regulatory scrutiny and market volatility, investors are keenly eyeing accumulation strategies. New data from the XRP rich list offers a glimpse into the holdings required to reach elite tiers. The analysis highlights the concentration of XRP wealth and the investment needed to join the top echelons of holders.

The Price of Admission to the Top 1%

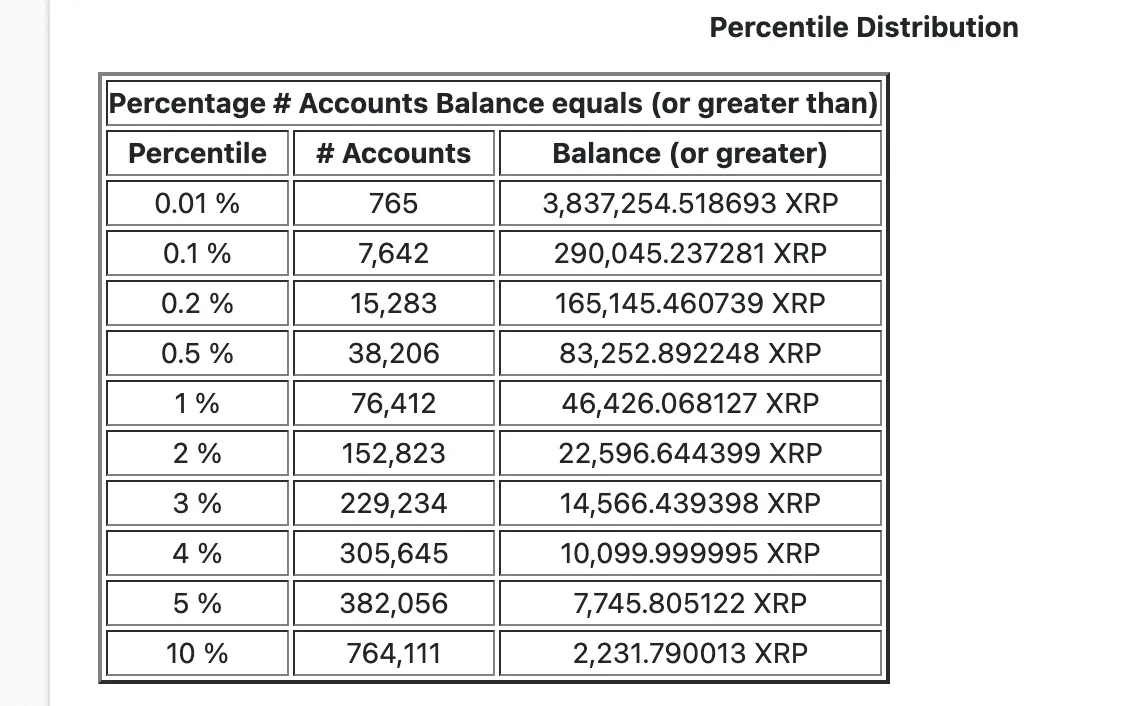

Currently, to enter the top 1% of XRP holders, a wallet must contain at least 46,426 XRP. With XRP trading around $1.40, accumulating this stack would require an investment of approximately $64,996. Only 76,412 wallets out of 7.64 million XRP holders meet or exceed this threshold, underscoring the exclusivity of this tier.

For institutional investors, this figure represents a relatively modest entry point, potentially offering significant upside if XRP gains further traction. For high net worth individuals, securing a position in the top 1% could be a strategic move to capitalize on future price appreciation.

Top 5% and 10% Thresholds: More Accessible Tiers

For those targeting slightly lower but still significant brackets, the entry requirements are more accessible. To rank among the top 5% of XRP holders, a wallet needs at least 7,745 XRP, representing an investment of around $10,843 at current prices. This tier includes 382,056 addresses.

Joining the top 10% requires 2,231 XRP or more, with approximately 764,111 wallets in this category. Acquiring this amount would cost roughly $3,123. These figures indicate that while the top 1% demands a significant capital commitment, entering the top 10% or 5% remains within reach for a broader range of investors.

The Reality for Most XRP Holders

The distribution of XRP holdings reveals a stark contrast between smaller holders and the wealthier brackets. A significant portion of XRP holders, 3,707,244 wallets, hold between 0 and 20 XRP. An additional 2,549,199 wallets hold between 20 and 500 XRP. This means that the vast majority of participants hold relatively small balances, highlighting the broad base of retail investors in the XRP ecosystem.

Moving up the ladder, 260,186 wallets hold between 500 and 1,000 XRP, while 612,985 wallets hold between 1,000 and 5,000 XRP. These segments are closer to entering the higher wealth brackets but still represent a minority of total holders. This distribution pattern is not unique to XRP and is observed across many digital assets, reflecting the inherent concentration of wealth in financial markets.

Strategic Implications and Market Psychology

While reaching the top 1% of XRP holders is largely a symbolic milestone, it carries strategic implications for long-term investors. Securing a higher bracket at lower prices could lead to substantial portfolio growth if XRP appreciates over time. This strategy aligns with the broader trend of accumulating digital assets during market dips, a common practice among sophisticated investors.

Moreover, understanding the distribution of XRP holdings can inform risk management and portfolio diversification strategies. Institutional investors often analyze rich list data to assess market sentiment and potential whale activity, which can influence short-term price movements. The psychological aspect of holding a significant amount of XRP should not be overlooked, as it can reinforce conviction and long-term commitment.

Looking Ahead: Regulatory Clarity and Market Growth

As Ripple continues to navigate regulatory challenges and expand its enterprise solutions, the value proposition of XRP remains a key factor for investors. Clarity on XRP’s regulatory status could unlock new institutional inflows and drive further price appreciation. In this environment, the cost of entering the top tiers of XRP holders may increase significantly, making early accumulation a potentially rewarding strategy.

Ultimately, the decision to accumulate XRP and target specific wealth brackets depends on individual risk tolerance, investment horizon, and belief in the long-term potential of Ripple’s technology. However, understanding the current distribution of XRP holdings provides valuable context for making informed investment decisions.

Related: Bitcoin Options Show Lingering Panic Premium

Source: Original article

Quick Summary

To break into XRP’s top 1%, a wallet must hold at least 46,426 XRP, a feat achieved by just 76,412 wallets today. The analysis arrives amid broader debates around crypto wealth concentration and market participation. Understanding these tiers is increasingly relevant as institutional interest in XRP and Ripple’s regulatory posture evolve.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.