XRP and other top cryptocurrencies faced downward pressure as markets opened on Monday, with broad sell-offs pushing the CoinDesk 20 Index lower. Among major digital assets, XRP continues to show resilience even as peers like Uniswap (UNI) experienced double-digit losses.

XRP and other top cryptocurrencies faced downward pressure as markets opened on Monday, with broad sell-offs pushing the CoinDesk 20 Index lower. Among major digital assets, XRP continues to show resilience even as peers like Uniswap (UNI) experienced double-digit losses.

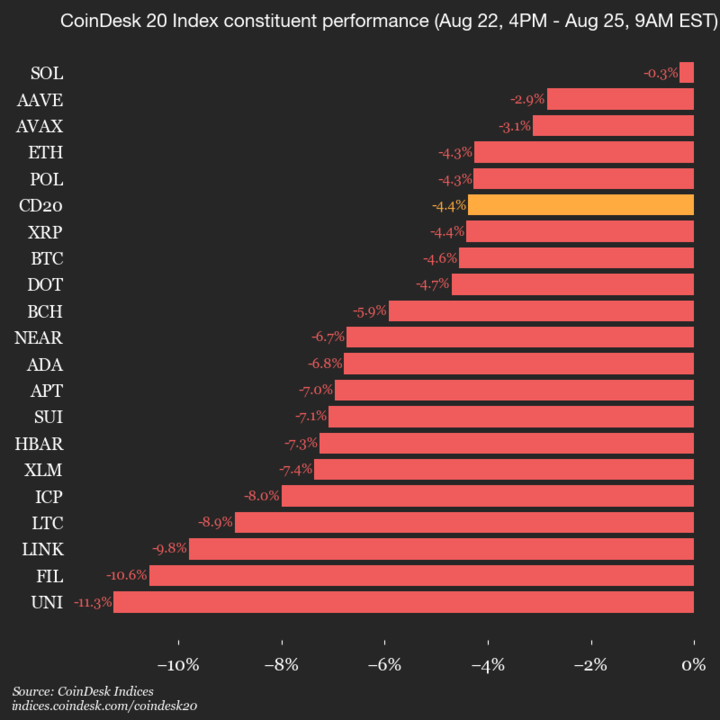

As of the latest update, the CoinDesk 20 Index was trading at 4114.26, marking a 4.4% decline — down 188.51 points — since the end of trading on Friday at 4 p.m. ET.

Weak Start for Digital Markets as All Assets Decline

Monday’s opening session paints a grim picture across the cryptocurrency sector. None of the 20 assets tracked by the index are in the green, a clear sign of widespread market weakness. The downturn was led by Uniswap (UNI), which dropped 11.3%, followed closely by Filecoin (FIL), down 10.6%.

This across-the-board red performance indicates a cautious investor sentiment, with high-volatility tokens taking the steepest hit. Although XRP remains under performance pressure like the rest of the market, it has not ranked among the biggest losers, underscoring its relatively more stable footing.

Visual chart of CoinDesk 20 Index on August 25 reflecting a steep decline driven by key coin losses.

Smaller Declines Lead the Day’s Gains

While most of the digital assets tracked posted significant declines, Solana (SOL) and Aave (AAVE) were the relative “leaders” — losing only 0.3% and 2.9% respectively. This classification simply underscores how widespread the losses were, as even the best performers failed to post gains.

XRP’s absence from this list doesn’t put it in the top tier of daily performance but does signal that the coin might be emerging as a more stable option for investors amidst high volatility elsewhere.

Global Market Exposure Keeps XRP in the Spotlight

The value and relevance of the CoinDesk 20 Index lie in its broad coverage. The index tracks 20 of the most liquid digital assets based on real volume across geographically diverse platforms. This reach strengthens its role as a barometer for institutional and retail investor sentiment worldwide.

Related: XRP Price: $12M Max Pain for Bears

As investment interest in blockchain and DeFi solutions grows, XRP continues to be a closely monitored asset due to its consistent integration in payment frameworks and discussions around regulatory clarity. While this update offers a snapshot of short-term action, analysts will watch closely to see how assets like XRP rebound or stabilize during the week.

Quick Summary

XRP and other top cryptocurrencies faced downward pressure as markets opened on Monday, with broad sell-offs pushing the CoinDesk 20 Index lower. Among major digital assets, XRP continues to show resilience even as peers like Uniswap (UNI) experienced double-digit losses.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.