Japan is positioning itself as a major player in the institutional crypto space through progressive regulatory reforms. XRP is uniquely positioned to benefit from these changes, due to its existing infrastructure and strategic partnerships in the region.

What to Know:

- Japan is positioning itself as a major player in the institutional crypto space through progressive regulatory reforms.

- XRP is uniquely positioned to benefit from these changes, due to its existing infrastructure and strategic partnerships in the region.

- The anticipated approval of crypto ETFs, including a potential Bitcoin-XRP dual-asset ETF, could further drive institutional adoption of XRP in Japan.

Japan is strategically positioning itself as a hub for institutional crypto investment, with a series of regulatory changes designed to integrate digital assets into traditional financial systems. These policy shifts, including tax cuts and the reclassification of major cryptoassets, create a clear pathway for institutional exposure in Asia, potentially setting a new standard for crypto regulation. XRP, with its established infrastructure and partnerships, stands to gain significantly from these developments.

Japan’s Financial Services Agency (FSA) is reclassifying 105 major cryptoassets as “financial products,” subjecting them to stricter regulations akin to those governing traditional securities, which signals a move towards mainstream acceptance. This reclassification is coupled with a reduction in the effective tax rate on eligible crypto income, aligning it with stock investments and making crypto more attractive to both individuals and institutions.

The FSA is also advancing a yen-pegged stablecoin initiative, with the first licensed JPY stablecoin already in circulation, which will provide regulated avenues for using JPY-backed stablecoins within the domestic market. These changes collectively aim to integrate crypto into Japan’s financial infrastructure, opening doors for banks and other institutions to participate in the crypto market.

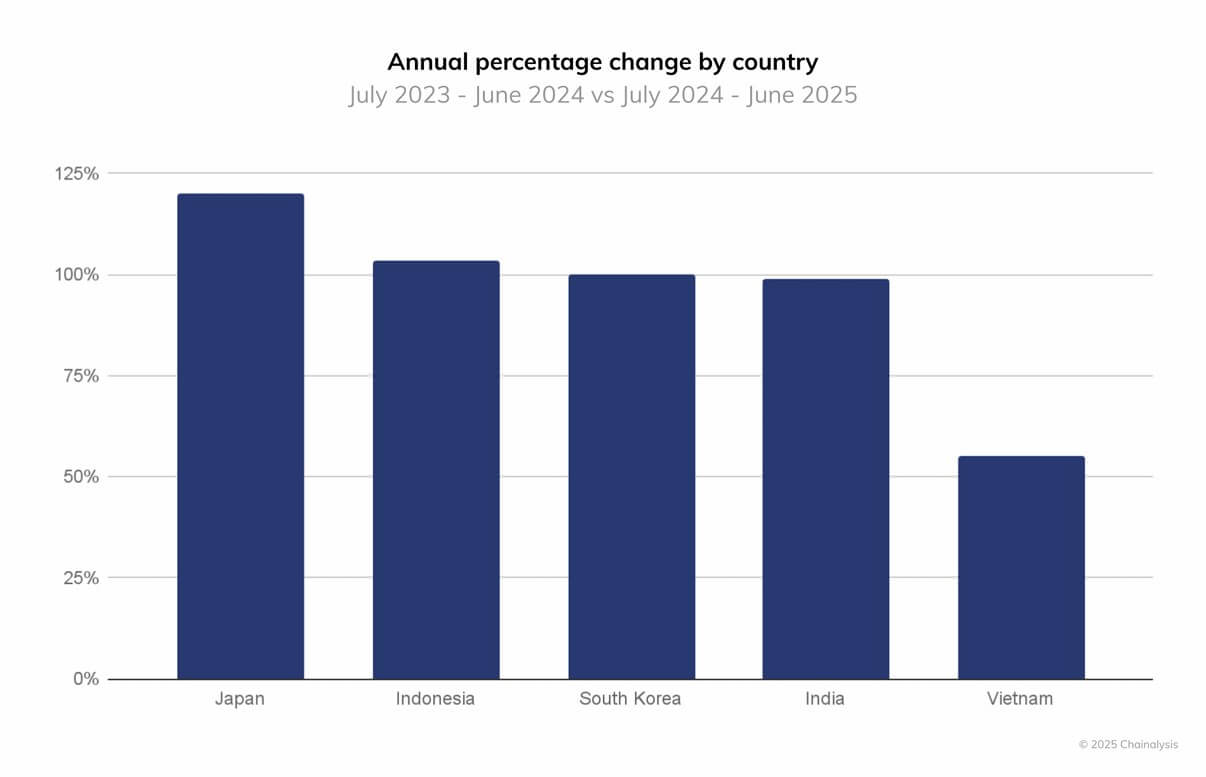

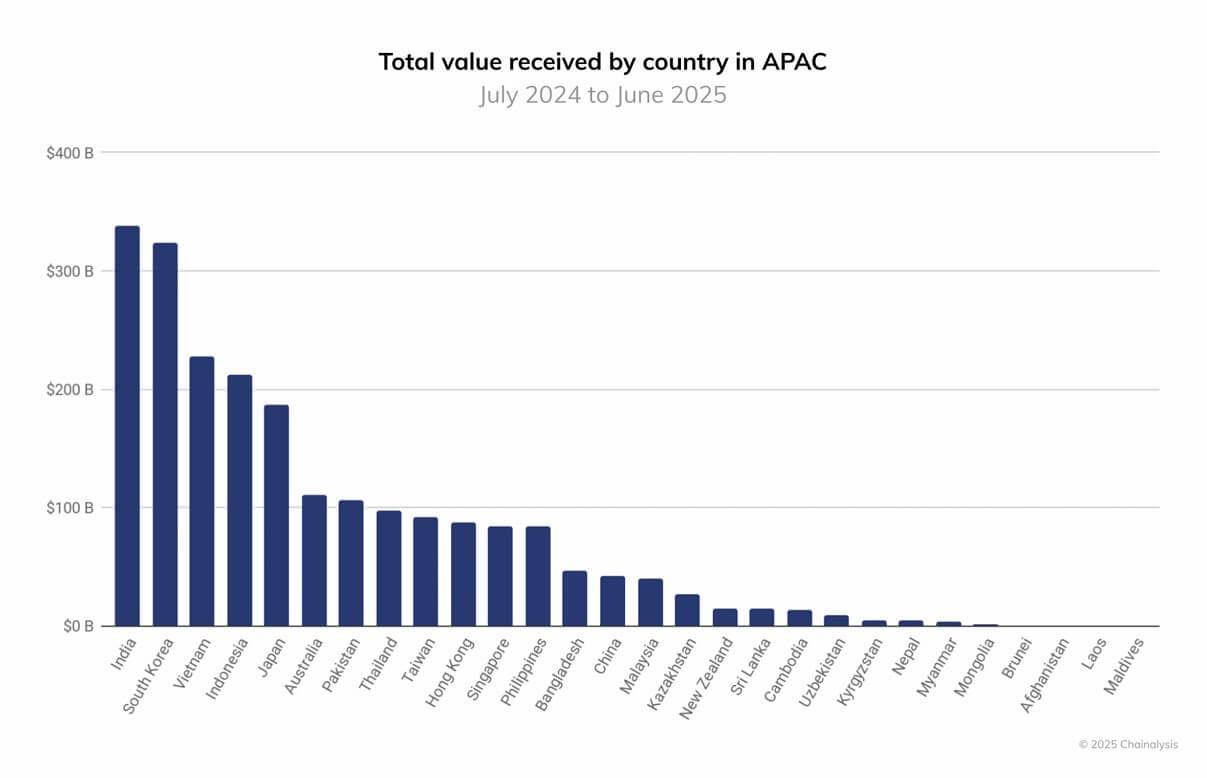

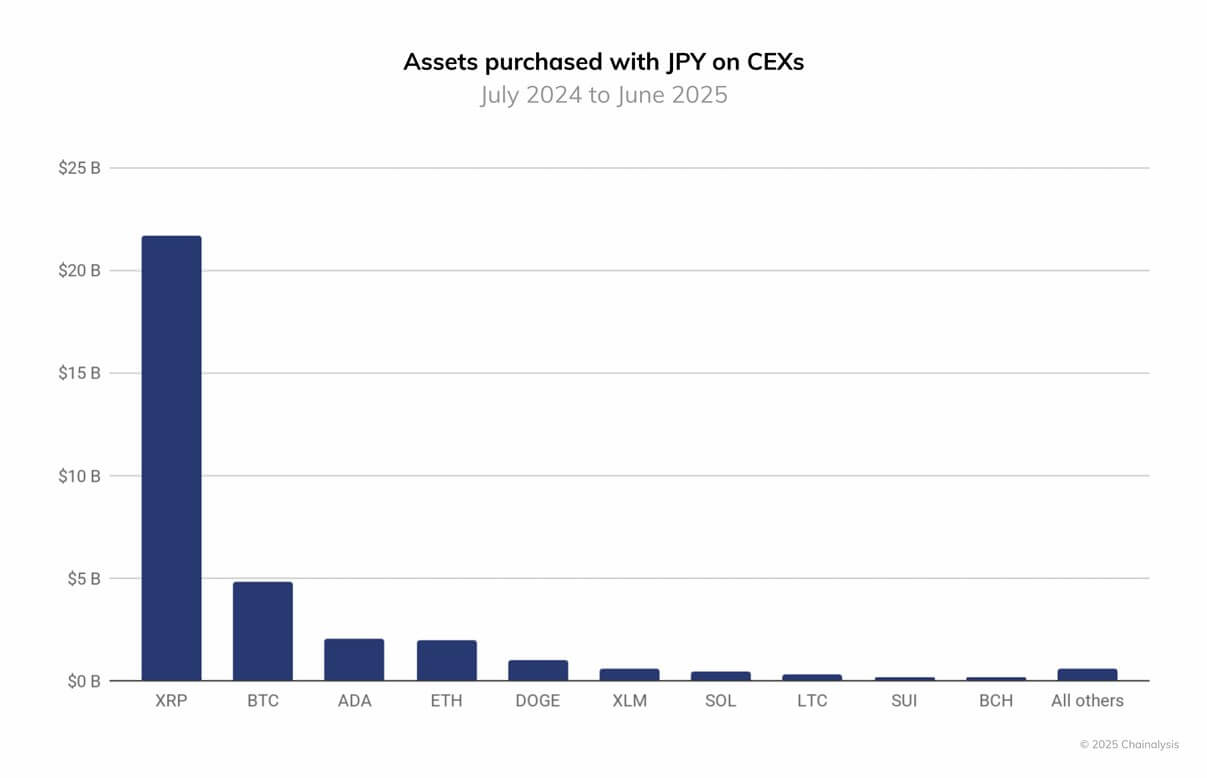

Chainalysis data shows Japan’s on-chain value received grew 120% year-over-year, outpacing several other countries in the region, which indicates a growing interest in crypto within Japan. Notably, XRP purchases using JPY on centralized exchanges have significantly outpaced Bitcoin and other cryptocurrencies, suggesting strong investor confidence in XRP’s utility.

Ripple’s strategic partnership with SBI Holdings has positioned XRP at the center of Japan’s crypto infrastructure. SBI Remit has been utilizing Ripple’s payment technology since 2017, using XRP as a bridge asset for remittances, which highlights XRP’s practical application in cross-border payments.

Furthermore, SBI’s plans for a dual-asset crypto ETF featuring Bitcoin and XRP, pending regulatory approval, underscore the potential for XRP to gain further institutional exposure through traditional investment vehicles. This ETF, if approved, would be listed on the Tokyo Stock Exchange, making XRP accessible to a wider range of investors.

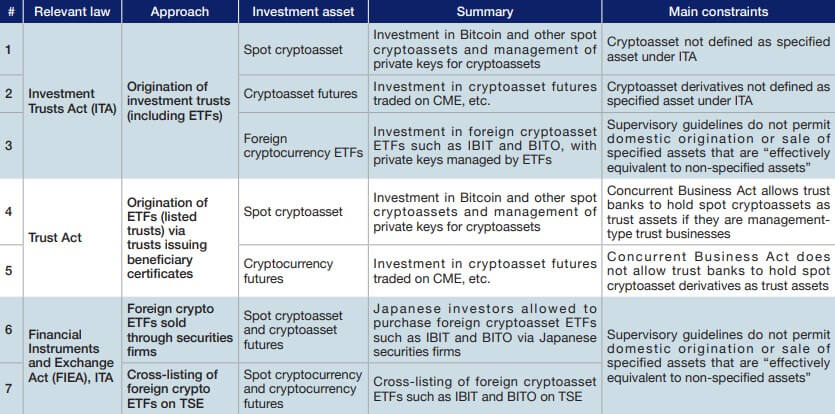

The reclassification of cryptoassets under the Financial Instruments and Exchange Act (FIEA) will enable the existing financial infrastructure to support crypto investments. This includes securities firms, banks, and exchange-listed products, offering investors a variety of regulated avenues for crypto exposure.

As Japan embraces crypto through regulated exchanges and ETF wrappers, XRP’s existing presence in the country’s financial ecosystem gives it a significant advantage. With its established partnerships, real-world utility in remittance corridors, and potential inclusion in ETFs, XRP is well-positioned to capitalize on Japan’s growing institutional crypto market.

Japan’s strategic moves to integrate crypto into its financial system, coupled with XRP’s unique position in the market, suggest a promising future for digital asset adoption in the region. The combination of regulatory clarity, institutional interest, and practical applications positions Japan as a key player in the global crypto landscape.

Related: XRP Rejected: Bitcoin Volatility Signals Market Turn

Source: Original article

Quick Summary

Japan is positioning itself as a major player in the institutional crypto space through progressive regulatory reforms. XRP is uniquely positioned to benefit from these changes, due to its existing infrastructure and strategic partnerships in the region.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.