Global crypto investment products saw over $47 billion in inflows in 2025, driven by new spot XRP ETFs and renewed interest in Ethereum. Bitcoin inflows decreased year-over-year, while XRP and Solana funds saw exponential growth, highlighting shifting preferences among institutional investors.

What to Know:

- Global crypto investment products saw over $47 billion in inflows in 2025, driven by new spot XRP ETFs and renewed interest in Ethereum.

- Bitcoin inflows decreased year-over-year, while XRP and Solana funds saw exponential growth, highlighting shifting preferences among institutional investors.

- The launch of spot XRP ETFs in the U.S. significantly boosted XRP’s appeal, attracting substantial capital and impacting market dynamics.

Crypto investment products experienced a year of significant growth and shifting asset preferences in 2025. Despite Bitcoin’s dominance, alternative assets like XRP and Solana captured substantial inflows, fueled by new investment vehicles and evolving market narratives. The launch of spot XRP ETFs in the U.S. marked a pivotal moment, driving unprecedented demand and reshaping the landscape for digital asset investments.

XRP Investments Surge on ETF Launches

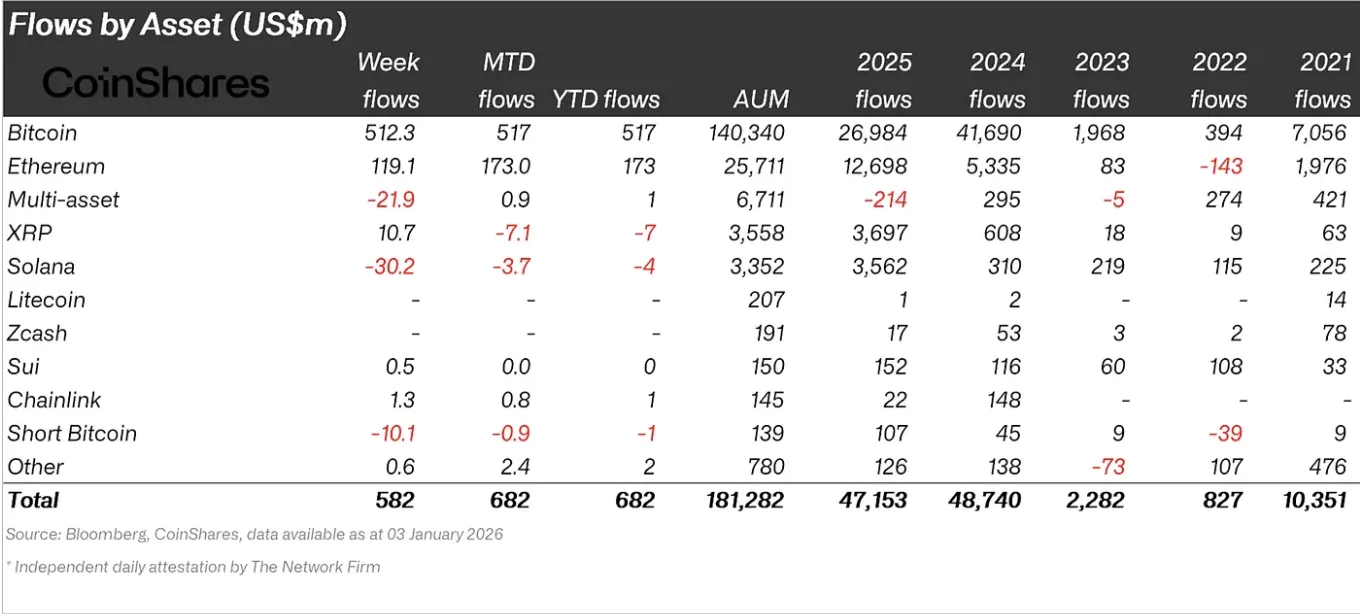

XRP emerged as a standout performer in 2025, largely due to the introduction of spot XRP ETFs. Inflows into XRP-focused investment products surged to $3.7 billion, a remarkable 500% increase from the previous year. This growth can be attributed to the launch of five spot XRP ETFs in the U.S. during the final quarter of the year, which quickly amassed approximately $1.2 billion in cumulative net assets after the first full ETF launched in mid-November. The successful launch of these ETFs provided institutional investors with a regulated and accessible avenue to gain exposure to XRP, driving significant capital inflows.

Ethereum and Solana Attract Strong Inflows

Ethereum also demonstrated robust performance, attracting $12.7 billion in inflows, a 138% year-over-year increase. This surge reflects renewed institutional interest in Ethereum’s evolving ecosystem and its potential for decentralized finance (DeFi) and other applications. Solana, another prominent altcoin, experienced even more impressive growth, with inflows into SOL-focused investment products jumping 1,000% year-over-year to $3.6 billion. These figures suggest a broadening appetite among institutional investors for a diverse range of digital assets beyond Bitcoin.

Regional Flow Dynamics

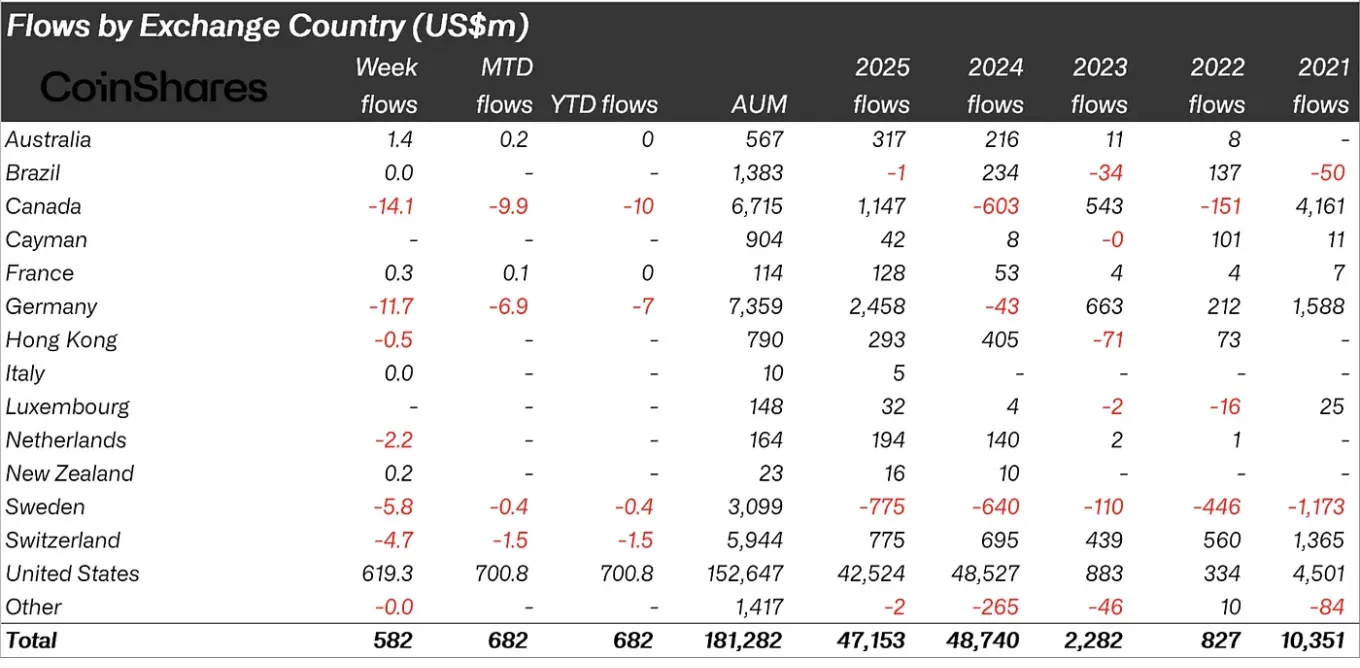

The United States dominated global inflows into crypto investment products, accounting for the majority of the $47.2 billion total. U.S.-based funds attracted $42.52 billion, although this represents a 12% year-over-year decline, suggesting a possible shift in investment strategies or reallocation of capital. Germany, Canada, Switzerland, Hong Kong, and the Netherlands also contributed significantly, attracting $2.46 billion, $1.14 billion, $775 million, $293 million, and $194 million, respectively. These regional variations highlight the global nature of crypto investment and the diverse regulatory landscapes shaping institutional participation.

Early 2026 Shows Mixed Performance

While 2025 concluded on a positive trajectory, the start of 2026 revealed a mixed performance across different assets. In the first two days of the new year, crypto investment products attracted $682 million in inflows, with Bitcoin leading at approximately $517 million and Ethereum at $173 million. However, XRP and Solana experienced early headwinds, with investment products posting year-to-date outflows of $7.1 million and $3.7 million, respectively. This suggests that the initial enthusiasm for these assets may be cooling off, or that investors are rebalancing their portfolios after the strong gains of 2025.

Looking Ahead

The crypto investment landscape in 2025 was defined by the rise of altcoins and the impact of new investment products like spot XRP ETFs. While Bitcoin and Ethereum remain dominant, the increasing interest in alternative assets signals a maturing market and a growing appetite for diversification among institutional investors. As the regulatory environment evolves and new investment vehicles emerge, the dynamics of crypto inflows are likely to continue shifting, creating both opportunities and challenges for market participants.

Related: XRP Price Prediction: 2026, 2027, 2028

Source: Original article

Quick Summary

Global crypto investment products saw over $47 billion in inflows in 2025, driven by new spot XRP ETFs and renewed interest in Ethereum. Bitcoin inflows decreased year-over-year, while XRP and Solana funds saw exponential growth, highlighting shifting preferences among institutional investors. The launch of spot XRP ETFs in the U.S.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.