XRP is finding new ways to operate alongside established financial systems like SWIFT, even without an official partnership. A recent analysis by a researcher in the XRP community reveals how Ripple Payments can indirectly interface with SWIFT infrastructure through third-party vendors and API connections.

XRP is finding new ways to operate alongside established financial systems like SWIFT, even without an official partnership. A recent analysis by a researcher in the XRP community reveals how Ripple Payments can indirectly interface with SWIFT infrastructure through third-party vendors and API connections.

How the XRP and SWIFT Communication Flow Operates

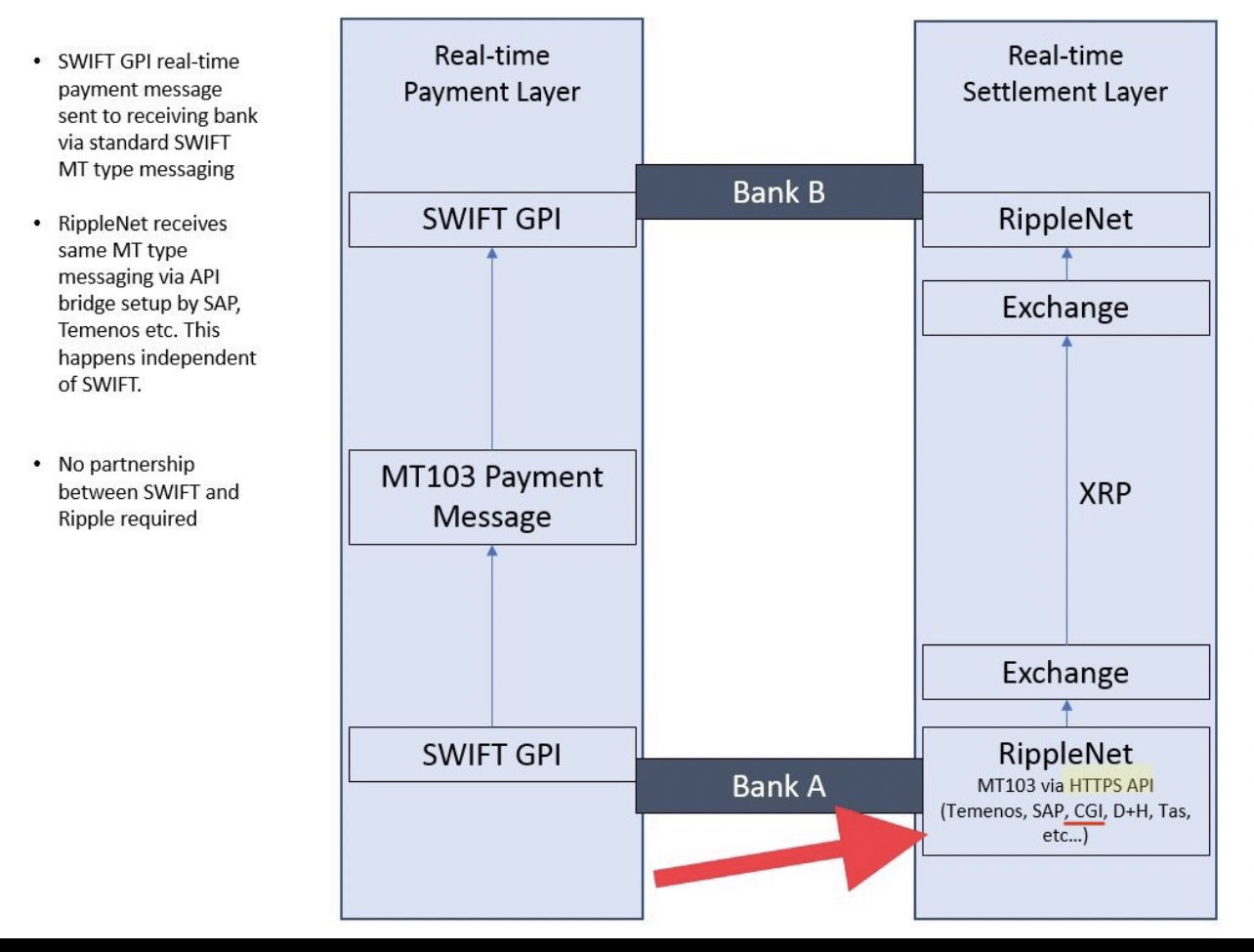

According to researcher SMQKE, the integration doesn’t rely on a direct link between Ripple and SWIFT. Instead, intermediary companies such as SAP, Temenos, and CGI offer API solutions that allow RippleNet to receive MT103 messages—SWIFT’s standard format for international payment instructions—via secure HTTPS protocols.

This method enables banks using RippleNet to effectively process incoming SWIFT GPI messages and, through Ripple’s system, convert and route them using XRP as a liquidity vehicle. The process works as follows: a cross-border payment triggers a SWIFT MT103 message within the traditional banking environment. Vendors act as bridges, forwarding the payment data through APIs compatible with RippleNet systems. XRP is then used within Ripple’s payment flow to settle the transaction.

Illustration of how banks can bridge SWIFT and Ripple using XRP for settlement through vendor APIs.

Experts Debate the Technical Viability

The broader XRP community responded with curiosity and skepticism. Notably, well-known XRP advocate and YouTuber Crypto Eri questioned the analysis’ legitimacy and asked for insights from Ripple’s engineering team.

Neil Hartner, a software engineer at Ripple specializing in Ripple Payments, responded and provided technical clarity. While he wouldn’t confirm any specific vendors, he acknowledged that transmitting SWIFT’s MT103 messages into Ripple’s system using an API with the additional_info field is a “plausible” architecture. His comment reinforced that such a bridge could be developed even in the absence of a formal agreement between Ripple and SWIFT. However, he cautioned users to “not read too much into [his] answer.”

His response can be reviewed here.

ISO 20022 Enables Network Compatibility

A key enabler of this indirect integration is the adoption of ISO 20022, a universal messaging standard increasingly embraced across financial institutions worldwide. Ripple was among the early adopters of this standard, aligning its system architecture with traditional banking protocols and laying the groundwork for API-based interconnectivity.

As a result, RippleNet is able to communicate effectively with established and next-generation financial systems, reducing fragmentation and paving the way for seamless interactions with trusted networks like SWIFT, even if indirectly. API bridges and distributed ledger technology can work in tandem to offer faster, more transparent, and more efficient cross-border payments.

XRP Ledger’s Potential to Capture SWIFT Volume

Although no official collaboration exists between Ripple and SWIFT, many in the XRP community continue to speculate about a future partnership or even the possibility that Ripple’s network could eventually supersede SWIFT.

At the 2025 XRPL Apex event, Ripple CEO Brad Garlinghouse shared a bold projection: the XRP Ledger (XRPL) might handle up to 14% of SWIFT’s transaction volume by 2030. As per Forbes, SWIFT processes roughly $150 trillion annually. If XRPL were to manage 14% of this value, it would mean processing around $21 trillion each year.

Based on these figures, an analysis estimated that this level of liquidity turnover would necessitate a pool worth approximately $700 billion. Assuming each XRP token is utilized 30 times annually, that projection would translate to a potential token value between $11 and $24—though it is essential to remember that this remains speculative territory.

Related: XRP Price: $12M Max Pain for Bears

A Strategic Future, Even Without Formal Ties

While Ripple and SWIFT don’t officially collaborate, technological bridges may offer a practical workaround, enabling XRP to play a key role in international payments. As financial messaging continues its evolution under global standards like ISO 20022, intermediaries and smart network design can continue to drive adoption for blockchain-based solutions like those offered by Ripple.

Quick Summary

XRP is finding new ways to operate alongside established financial systems like SWIFT, even without an official partnership. A recent analysis by a researcher in the XRP community reveals how Ripple Payments can indirectly interface with SWIFT infrastructure through third-party vendors and API connections.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.