XRP continues to gain traction in the decentralized finance (DeFi) space, as Ripple-backed offerings increasingly set new benchmarks in crypto innovation.

XRP continues to gain traction in the decentralized finance (DeFi) space, as Ripple-backed offerings increasingly set new benchmarks in crypto innovation. A recent report has spotlighted Hyperliquid, a decentralized derivatives exchange reshaping the market with impressive volume metrics and technical prowess, showcasing how XRP-related infrastructure plays into this evolving ecosystem.

Hyperliquid’s Growth in DeFi Derivatives

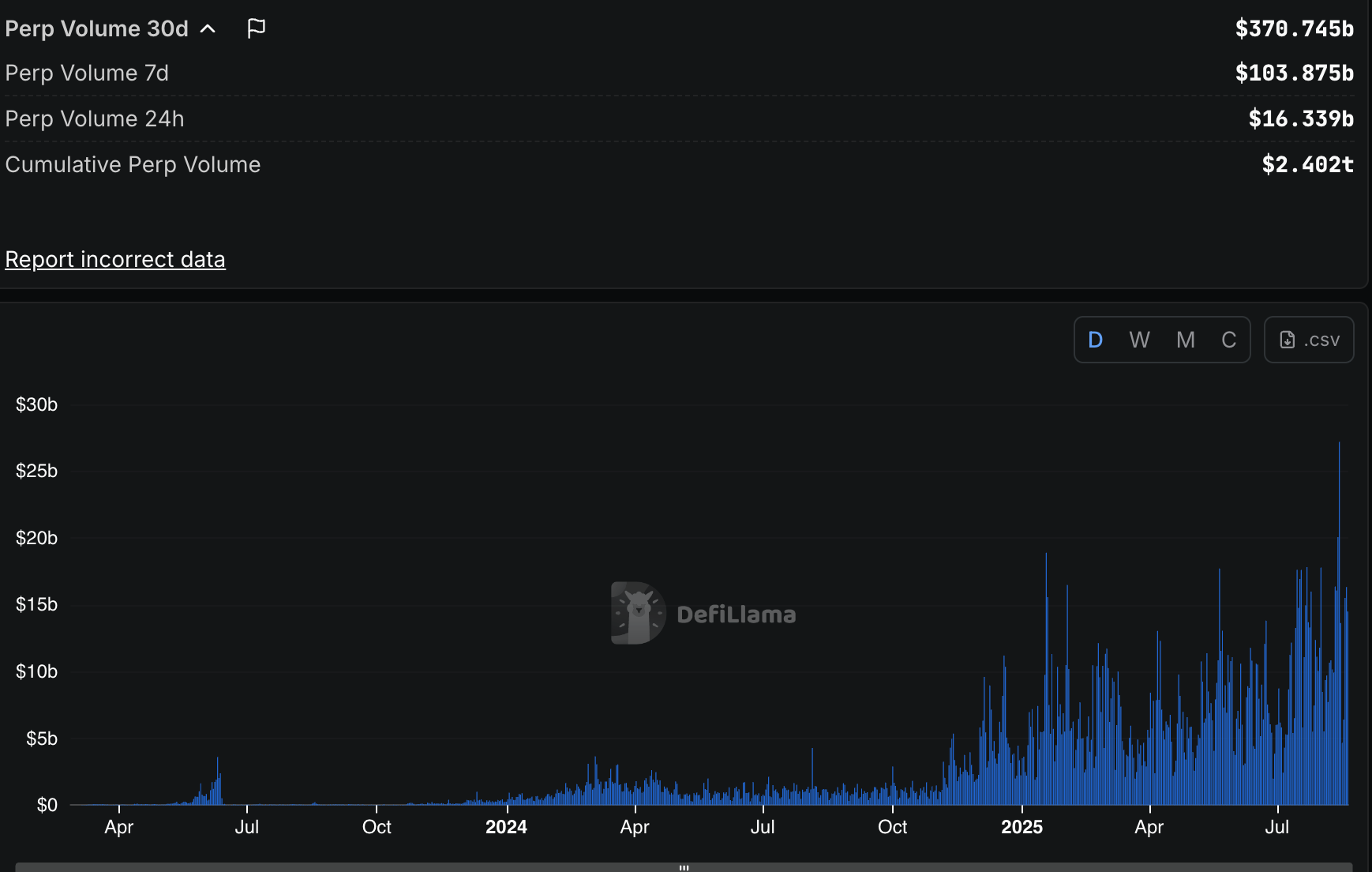

According to a new report by data provider RedStone, Hyperliquid has rapidly emerged as the market leader in decentralized perpetual contracts. Over the past 12 months, the platform has captured more than 80% of the decentralized perps market. Daily trading volume now exceeds a staggering $30 billion—comparable to volume levels of major centralized exchanges.

Much of this growth is due to innovations in Hyperliquid’s core structure. Its fully on-chain order book matches centralized exchanges in spread tightness and execution speed, vital elements for serious traders. This performance has propelled Hyperliquid to be viewed not just as another DEX, but as a foundational infrastructure layer for DeFi as a whole.

Technological Advantages Fueling Expansion

RedStone’s analysis identifies three major advantages that explain Hyperliquid’s explosive rise: its high-throughput on-chain system, a permissionless market creation tool, and an innovative dual architecture.

- On-chain Order Book: The exchange uses a fully decentralized, on-chain mechanism that rivals centralized platforms in execution quality, giving traders a seamless experience with minimal latency.

- HIP-3 Protocol: This permissionless framework allows developers to spin up new markets independently. Its unique incentive model gives a larger revenue share to developers than to the protocol itself, catalyzing a vibrant and active builder community.

- Dual Architecture (HyperCore and HyperEVM): This architecture facilitates the deployment of advanced financial tools such as tokenized perpetual positions and delta-neutral strategies, opening new doors for institutional DeFi adoption.

Chart depicting Hyperliquid’s trading volume surge, showcasing its dominance in the DeFi derivatives market.

Architecting the Future of On-chain Markets

Hyperliquid’s network operates as both a trading interface and a framework for DeFi development. As of today, it holds roughly $2.2 billion in total value locked (TVL), according to DefiLlama. The DEX has facilitated over $330 billion in cumulative trading volume in the past month alone—a testament to its growing influence.

This development is significant for XRP, as Ripple’s ecosystem increasingly integrates with new-generation DeFi architecture that mirrors Hyperliquid’s model. As Hyperliquid gains institutional attention, its composable framework offers new pathways for developers and financial institutions working with Ripple technologies to build robust, permissionless financial services.

Community-Driven Success and XRP’s Expanding Role

The RedStone report praises Hyperliquid’s dual-layer system and transparent incentive model as key to attracting developers and traders alike. Unlike venture-backed rivals, the self-funded Hyperliquid team has built a sustainable growth engine fueled by community participation and practical innovation.

Related: XRP Price: $12M Max Pain for Bears

With continued XRP integration into similar DeFi structures, Ripple-backed assets may benefit from a broader infrastructure that prioritizes performance and openness. If these trends continue, XRP is poised to play a pivotal role in expanding DeFi’s reach beyond speculative trading to become a backbone of future on-chain financial systems.

Quick Summary

XRP continues to gain traction in the decentralized finance (DeFi) space, as Ripple-backed offerings increasingly set new benchmarks in crypto innovation. A recent report has spotlighted Hyperliquid, a decentralized derivatives exchange reshaping the market with impressive volume metrics and technical prowess, showcasing how XRP-related infrastructure plays into this evolving ecosystem.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.