XRP, the digital asset associated with Ripple’s global payment platform, continues to draw attention as it trades below the $5 mark. While the low token price might appear attractive on the surface, a deeper dive into XRP’s fundamentals is essential before making a buy-or-sell decision.

XRP, the digital asset associated with Ripple’s global payment platform, continues to draw attention as it trades below the $5 mark. While the low token price might appear attractive on the surface, a deeper dive into XRP’s fundamentals is essential before making a buy-or-sell decision.

Unlike many novice crypto investors who equate low prices with value, experienced market participants understand that token price alone doesn’t determine an asset’s worth. XRP’s current valuation, based on market capitalization, tells a much more nuanced story about its relative standing in the crypto landscape.

Why XRP’s Low Price Can Be Misleading

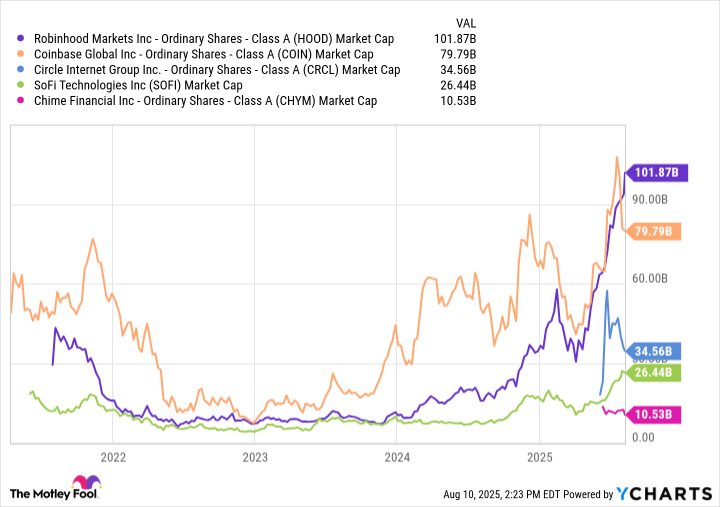

At around $3.22 per token, XRP may look inexpensive compared to giants like Bitcoin or Ethereum. However, its market capitalization paints a different picture. With a valuation of nearly $191 billion, XRP surpasses the combined worth of more established financial technology companies like Robinhood and Coinbase. In fact, it’s also well ahead of a broader set of fintech players including SoFi Technologies, Chime, and stablecoin issuer Circle Internet Group—all together still falling short of XRP’s valuation.

This contrast highlights why relying solely on token price can be deceptive. Valuation through the lens of market cap gives a more accurate picture of how much value investors ascribe to an asset. XRP’s massive market cap implies that, despite its modest per-token cost, it already carries high market expectations.

Ripple’s Success Doesn’t Guarantee XRP’s Rise

The distinction between XRP and Ripple—the company behind the payment network leveraging XRP—is key. The Ripple network aims to improve cross-border transaction efficiency, tapping into a market expected to grow from $212 trillion in 2025 to $320 trillion by 2030. While Ripple’s technological prospects look promising, it’s important to note that Ripple’s success doesn’t necessarily translate into widespread use of XRP itself.

Should Ripple gain more traction globally, scenarios may emerge where its payment solutions function seamlessly without heavy reliance on XRP tokens. In that case, even if Ripple scales, there’s no guarantee that XRP will appreciate in value accordingly. The utility and adoption of XRP remain critical uncertainties in this framework.

Is XRP a Strategic Bet Today?

XRP sits in an unusual spot in the crypto ecosystem. It’s both broadly recognized and inherently speculative. While the token’s price might tempt those looking for the next major breakout in crypto, investors should remain cautious. The token’s valuation already seems to reflect high expectations about future use cases, rather than current financial performance or revenue generation.

XRP doesn’t yet demonstrate the traditional markers of a solid investment—like proven operational profitability or consistent revenue growth. Its appeal lies largely in a narrative about future disruption in international finance, a story yet to be fully written. For anyone investing based on such projections, trust in Ripple’s long-term adoption strategy and XRP’s role within it is crucial.

In this light, labeling XRP as “cheap” just because it trades below $5 can be a misstep. Smart investors recognize that price is just one part of a broader value equation. When an asset already holds a multi-billion-dollar valuation, the risk-to-reward calculus becomes more complex.

Related: XRP Price: $12M Max Pain for Bears

Ultimately, XRP represents a speculative play tied to bold visions about transforming global payments. While long-term rewards are possible, they would require massive proof of adoption, functionality, and utility—factors currently subject to numerous unknowns.

Quick Summary

XRP, the digital asset associated with Ripple’s global payment platform, continues to draw attention as it trades below the $5 mark. While the low token price might appear attractive on the surface, a deeper dive into XRP’s fundamentals is essential before making a buy-or-sell decision.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.