The focus keyword XRP indicates a turbulent day in the digital asset market, as nearly all cryptocurrencies within the CoinDesk 20 Index posted losses, reflecting a shift in investor sentiment.

The focus keyword XRP highlights a turbulent day in the digital asset market, as nearly all cryptocurrencies within the CoinDesk 20 Index posted losses, reflecting a shift in investor sentiment.

CoinDesk 20 Index Sees Broad Downward Trend

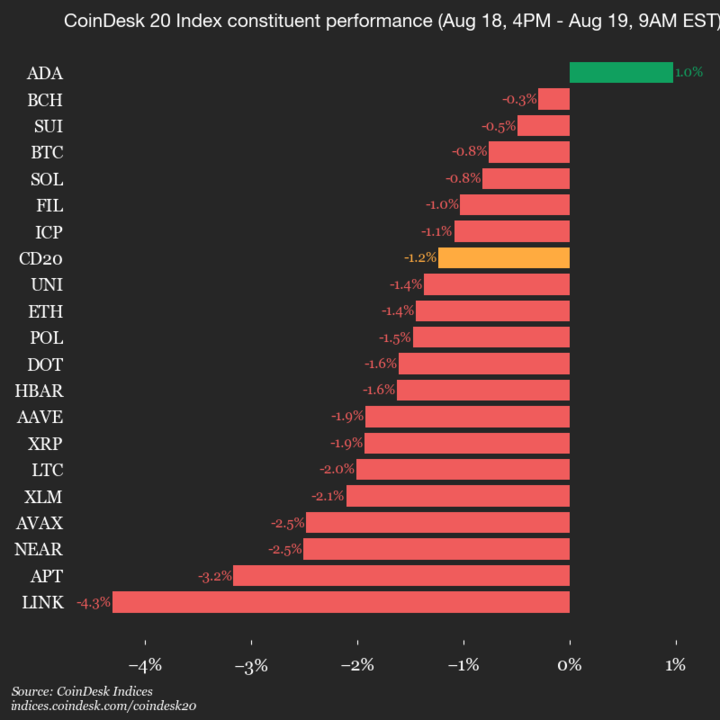

The CoinDesk Indices reported a significant dip in its flagship CoinDesk 20 Index, which measures the performance of twenty leading digital assets. As of the latest update, the index was trading at 4076.62 — down by 1.2%, or 51.06 points, from its close at 4 p.m. ET on Monday.

Out of the twenty assets tracked, only one recorded gains, highlighting the breadth of today’s downturn. This movement underscores growing market volatility and possibly marks a cooling off following recent rallies across the cryptocurrency landscape.

9 A.M. snapshot showing a vertical drop in the CoinDesk 20 performance update for August 19, 2025.

Top and Bottom Performers

Among the better-performing assets, Cardano (ADA) rose modestly by 1.0%, making it the only token with a positive return in the session. Bitcoin Cash (BCH) also stood out, though just barely in the green, posting a relatively flat return at -0.3%.

On the downside, Chainlink (LINK) was the hardest hit, falling by 4.3%, while Aptos (APT) retreated 3.2%. These moves suggest that despite robust utility and developer ecosystems, many tokens remain vulnerable to broader market forces.

XRP and Market Implications

While XRP is not explicitly noted as a top mover in today’s data, the overall market downturn within the CoinDesk 20 is highly relevant to XRP holders and followers. As a component of this globally traded index, XRP’s performance is indirectly affected by index changes, internal market pressures, and external economic signals. Traders and analysts often look to index-wide movements like this to spot early signs of capital rotation or industry-wide sentiment shifts.

About the CoinDesk 20

The CoinDesk 20 Index is a benchmark that aggregates pricing and performance data from a diversified basket of 20 of the most liquid and traded digital assets globally. This makes it a go-to indicator for institutional investors, researchers, and developers seeking a pulse on the broader crypto economy.

Related: XRP Price: $12M Max Pain for Bears

By covering assets across various ecosystems, including proof-of-stake networks, stablecoins, privacy coins, and DeFi tokens, the index serves as an essential barometer for market health.

Quick Summary

The focus keyword XRP highlights a turbulent day in the digital asset market, as nearly all cryptocurrencies within the CoinDesk 20 Index posted losses, reflecting a shift in investor sentiment.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.