XRP Ledger payment volumes have surged nearly 10x, indicating strong on-chain expansion. This increase in network activity, driven by potentially institutional flows, hasn’t yet translated to price appreciation for XRP.

What to Know:

- XRP Ledger payment volumes have surged nearly 10x, indicating strong on-chain expansion.

- This increase in network activity, driven by potentially institutional flows, hasn’t yet translated to price appreciation for XRP.

- Despite bearish technical indicators, sustained network growth historically precedes market liquidity expansion, suggesting a potential medium-term bullish outlook.

XRP and the Ripple network have long been a focal point for institutional interest, particularly concerning cross-border payments and liquidity solutions. Recent on-chain data reveals a significant surge in payment volumes, a development that warrants a closer look at its potential implications for XRP’s price and broader market dynamics. This analysis will explore the nuances of this on-chain activity and its possible translation into future market performance.

On-Chain Payment Volume Surge

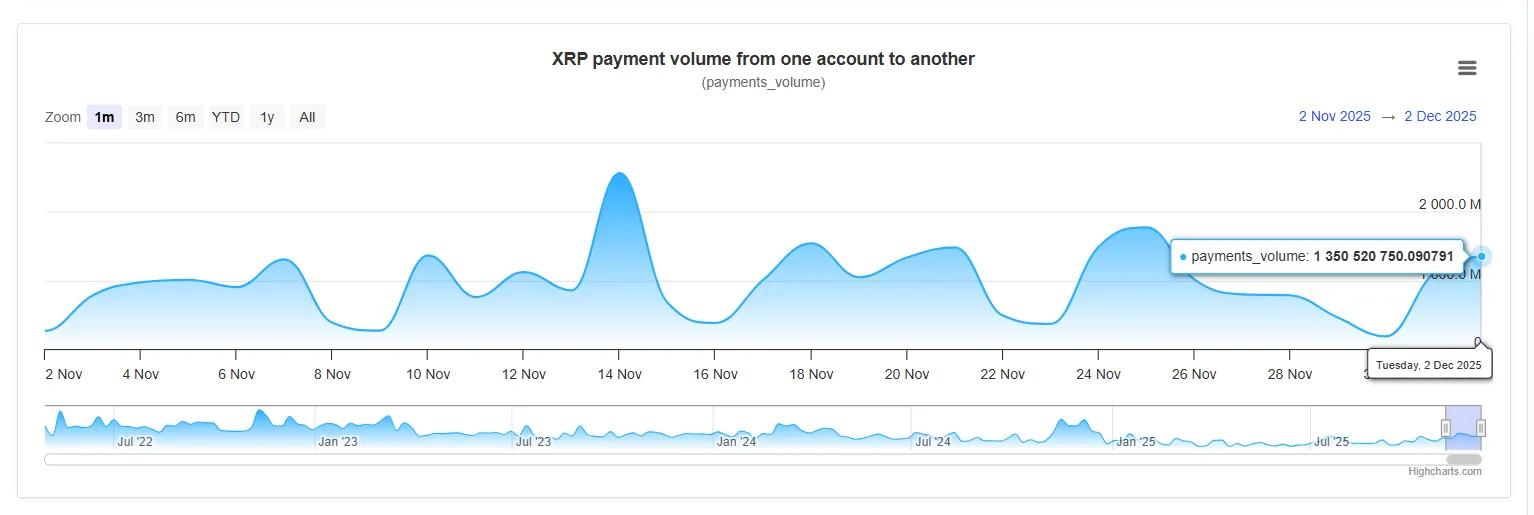

The XRP Ledger has recently experienced a notable increase in payment volumes, jumping to 1.35 billion XRP in a single day, far exceeding its typical range. This nearly tenfold increase suggests a substantial uptick in network utilization, potentially driven by institutional settlement, liquidity routing, or high-volume automated flows. Such a surge in on-chain activity often reflects growing demand for the network’s capabilities and can be a precursor to increased market liquidity.

This kind of sustained increase in network throughput has historically preceded expansions in XRP market liquidity, even if immediate price appreciation is not guaranteed. What’s notable is the accompanying rise in volatility in the payment-count chart, indicating broader user participation. This suggests a more robust and sustainable bullish signal compared to isolated volume spikes driven by a few large players.

Technical Price Weakness Persists

Despite the encouraging on-chain metrics, XRP’s price continues to struggle within a defined descending channel. The price recently rejected the channel’s midline, failing to maintain momentum above $2.15, with subsequent selling pressure pushing it back toward the lower boundary. This technical weakness highlights the disconnect between on-chain fundamentals and immediate market sentiment.

The current technical setup, with the 50 EMA below the 100 EMA forming a mini-death cross and the price below major moving averages, paints a bearish picture. The RSI struggling to maintain its mid-40s further confirms the lack of momentum. This technical resistance underscores the challenges XRP faces in translating positive on-chain developments into price gains.

Historical Parallels and Future Outlook

It’s important to remember that market reactions to on-chain activity are not always immediate. Historically, similar surges in network usage have preceded periods of increased liquidity and, eventually, price appreciation for other crypto assets. The key is whether this increased activity is sustained and reflects genuine demand for the network’s utility.

We have seen similar patterns play out in other crypto assets, where strong on-chain metrics eventually led to price appreciation, albeit with a lag. The market often needs time to digest and validate the significance of such developments. This suggests that while the short-term technical outlook for XRP remains challenging, the underlying network growth could set the stage for a more favorable medium-term trajectory.

Navigating Market Uncertainty

The current divergence between XRP’s on-chain strength and price action highlights the inherent complexities of the crypto market. Short-term price volatility is to be expected, and a potential fall out of the current channel could open the door to further declines toward the $1.90-$2.00 range. However, the network’s aggressive expansion is a meaningful signal that networks rarely expand this aggressively without eventually pulling the asset upward.

Investors should be prepared for potential short-term volatility while keeping an eye on the longer-term implications of sustained network growth. As always, risk management and a diversified portfolio remain crucial in navigating the uncertainties of the crypto market.

In conclusion, the recent surge in XRP Ledger payment volumes represents a positive development for the Ripple ecosystem, indicating growing network utilization and potential institutional adoption. While this on-chain strength has yet to translate into price appreciation, historical parallels suggest that sustained network growth can eventually lead to increased liquidity and market value. Investors should closely monitor these trends, balancing short-term technical risks with the potential for medium-term gains driven by fundamental network growth.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP Ledger payment volumes have surged nearly 10x, indicating strong on-chain expansion. This increase in network activity, driven by potentially institutional flows, hasn’t yet translated to price appreciation for XRP. Despite bearish technical indicators, sustained network growth historically precedes market liquidity expansion, suggesting a potential medium-term bullish outlook.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.