Ripple obtained an Electronic Money Institution (EMI) license and Money Laundering Regulations (MLR) registration from the UK’s Financial Conduct Authority (FCA).

What to Know:

- Ripple obtained an Electronic Money Institution (EMI) license and Money Laundering Regulations (MLR) registration from the UK’s Financial Conduct Authority (FCA).

- This regulatory approval allows Ripple to expand its operations in the UK, particularly with its RLUSD stablecoin, within the context of evolving digital asset regulations.

- The license enhances Ripple’s global regulatory standing, facilitating institutional adoption and XRP market confidence, despite some restrictions on retail investor services and exchange operations.

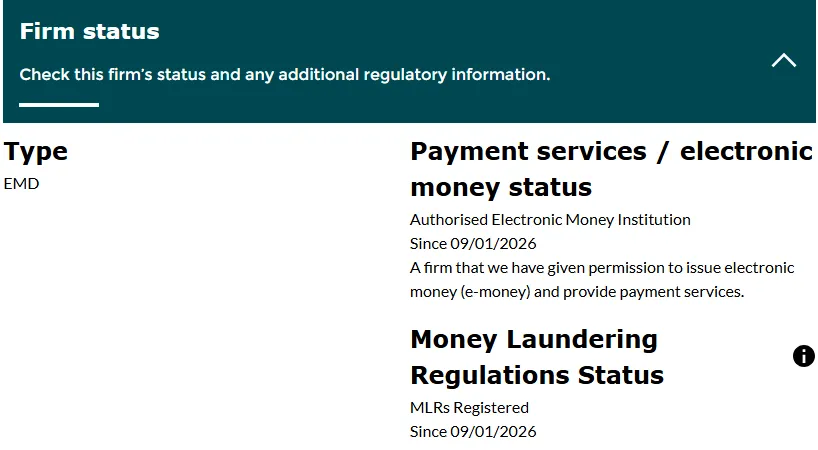

Ripple, the San Francisco-based blockchain firm, continues its strategic global expansion by securing an operating license in the United Kingdom. This move underscores Ripple’s commitment to regulatory compliance and its ambition to solidify its presence in key financial markets. The UK’s FCA has officially registered Ripple Markets UK, Ripple’s UK subsidiary, under the Money Laundering Regulations (MLRs) and issued it an Electronic Money Institution (EMI) license. This approval marks a significant milestone for Ripple as it navigates the complex landscape of digital asset regulation.

Regulatory Green Light in the UK

Effective January 9, Ripple is now MLR-registered, confirming its ability to conduct business in the UK. The EMI license empowers Ripple to issue electronic money and provide payment services to UK residents. A key aspect of this license is the ability to utilize its RLUSD stablecoin within the UK market, potentially broadening the asset’s utility and reach. This regulatory nod aligns with the FCA’s updated timeline, requiring MLR-certified firms to fully register under the Financial Services and Markets Act (FSMA) by October 2027.

RLUSD Stablecoin Implications

Ripple’s RLUSD stablecoin, boasting a market capitalization of $1.38 billion with a 6.8% growth in the past 30 days, stands to benefit significantly from this UK expansion. With the EMI license, Ripple can fully integrate the stablecoin into its payment processing business, enhancing its appeal for institutional clients seeking stable and efficient cross-border transactions. The strategic deployment of RLUSD could drive further adoption and increase liquidity, reinforcing its position in the competitive stablecoin market.

Navigating Operational Restrictions

The FCA’s license comes with specific limitations. Ripple is restricted from operating a crypto exchange without prior regulatory approval and cannot offer services to retail investors. Additionally, the license restricts Ripple from issuing electronic money or providing payment services to “customers, micro-enterprises, or charity.” These restrictions suggest a cautious approach by regulators, focusing on institutional-level applications and risk management. Ripple is also barred from appointing agents or distributors in the UK, indicating a direct oversight model.

Global Regulatory Footprint

The UK license adds to Ripple’s growing list of regulatory approvals worldwide. In the United States, Ripple holds a Money Transmitter License (MTL) and recently secured a conditional banking license from the OCC, bolstering trust in its RLUSD stablecoin. Furthermore, Ripple is licensed by the Monetary Authority of Singapore (MAS) and is a registered Virtual Asset Service Provider (VASP) in the Central Bank of Ireland. With over 55 licenses globally, Ripple has strategically positioned itself to comply with diverse regulatory frameworks, fostering confidence among institutional investors and partners.

Strategic Outlook

While Ripple continues to expand its regulatory footprint and operational capabilities, the company remains focused on long-term growth. Recent statements from Ripple’s president, Monica Long, indicate that there are no immediate plans for an initial public offering (IPO). This suggests that Ripple is prioritizing strategic expansion and market penetration over short-term financial gains, potentially waiting for more favorable market conditions and regulatory clarity before considering a public offering. The firm’s commitment to regulatory compliance and strategic partnerships positions it well for future growth in the evolving digital asset landscape.

In conclusion, Ripple’s acquisition of the EMI license and MLR registration in the UK marks a pivotal step in its global expansion strategy. Despite existing operational restrictions, this regulatory milestone enhances Ripple’s credibility, promotes the use of its RLUSD stablecoin, and reinforces its commitment to regulatory compliance. These developments are likely to positively influence market sentiment and institutional interest in XRP and Ripple’s broader ecosystem.

Related: XRP Regulatory Win Signals UK Market Entry

Source: Original article

Quick Summary

Ripple obtained an Electronic Money Institution (EMI) license and Money Laundering Regulations (MLR) registration from the UK’s Financial Conduct Authority (FCA). This regulatory approval allows Ripple to expand its operations in the UK, particularly with its RLUSD stablecoin, within the context of evolving digital asset regulations.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.