XRP experienced a significant liquidation imbalance, primarily driven by long positions being wiped out. Tether disclosed a substantial Bitcoin purchase, reinforcing its commitment to BTC as a core reserve asset.

What to Know:

- XRP experienced a significant liquidation imbalance, primarily driven by long positions being wiped out.

- Tether disclosed a substantial Bitcoin purchase, reinforcing its commitment to BTC as a core reserve asset.

- A meme coin on Binance, BROCCOLI714, suffered a steep decline due to a hacker-related incident, highlighting the risks in low-liquidity tokens.

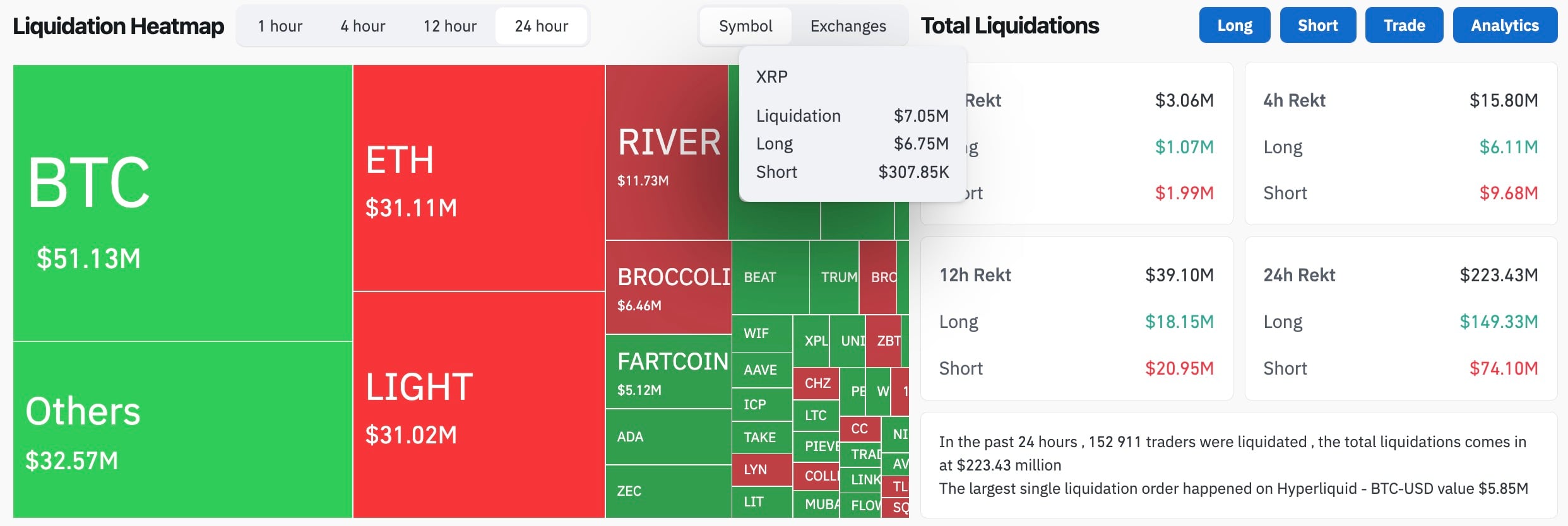

The first trading day of 2026 saw a broad deleveraging event across both major and smaller crypto assets, resulting in a liquidation map characterized by large clusters and isolated incidents alongside Bitcoin and Ethereum. This underscores the continued volatility and risk inherent in the digital asset market, particularly for leveraged positions. For institutional investors, understanding these dynamics is crucial for risk management and portfolio construction.

XRP Liquidation Imbalance

XRP’s trading day was marked by a notable liquidation imbalance, with over 95% of liquidations occurring on long positions. This one-sided wipeout, totaling $7.05 million, suggests a directional hit that specifically targeted over-leveraged longs. Such imbalances can create short-term price dislocations, as the market clears out excess leverage before potentially reversing course. The XRP/USDT chart reflects this pattern, with a dip to the $1.82 area followed by a rebound, indicative of the market absorbing the forced liquidations.

The significance of liquidation imbalances lies not in their predictive power alone, but in their ability to reveal shifts in market positioning. By removing a substantial portion of one-sided exposure, the market’s sensitivity to further price movements changes. Institutional investors should monitor these imbalances as potential indicators of short-term trading opportunities or as signals of broader market sentiment shifts.

Tether’s Bitcoin Acquisition

Tether’s disclosure of a $780 million Bitcoin purchase, representing 8,888.888888 BTC acquired in Q4 2025, is a notable development for several reasons. First, it underscores Tether’s ongoing strategy of incorporating Bitcoin into its reserves, providing a degree of transparency that is closely watched by the market. Second, the size of the purchase, executed at an average price of approximately $87,750 per BTC, demonstrates a continued bullish outlook on Bitcoin’s long-term value.

Tether’s actions carry weight due to its position as the largest stablecoin issuer. By actively accumulating Bitcoin, Tether is effectively signaling confidence in the asset’s store-of-value proposition. This can have a positive influence on market sentiment and potentially attract further institutional interest in Bitcoin as a reserve asset.

Meme Coin Carnage

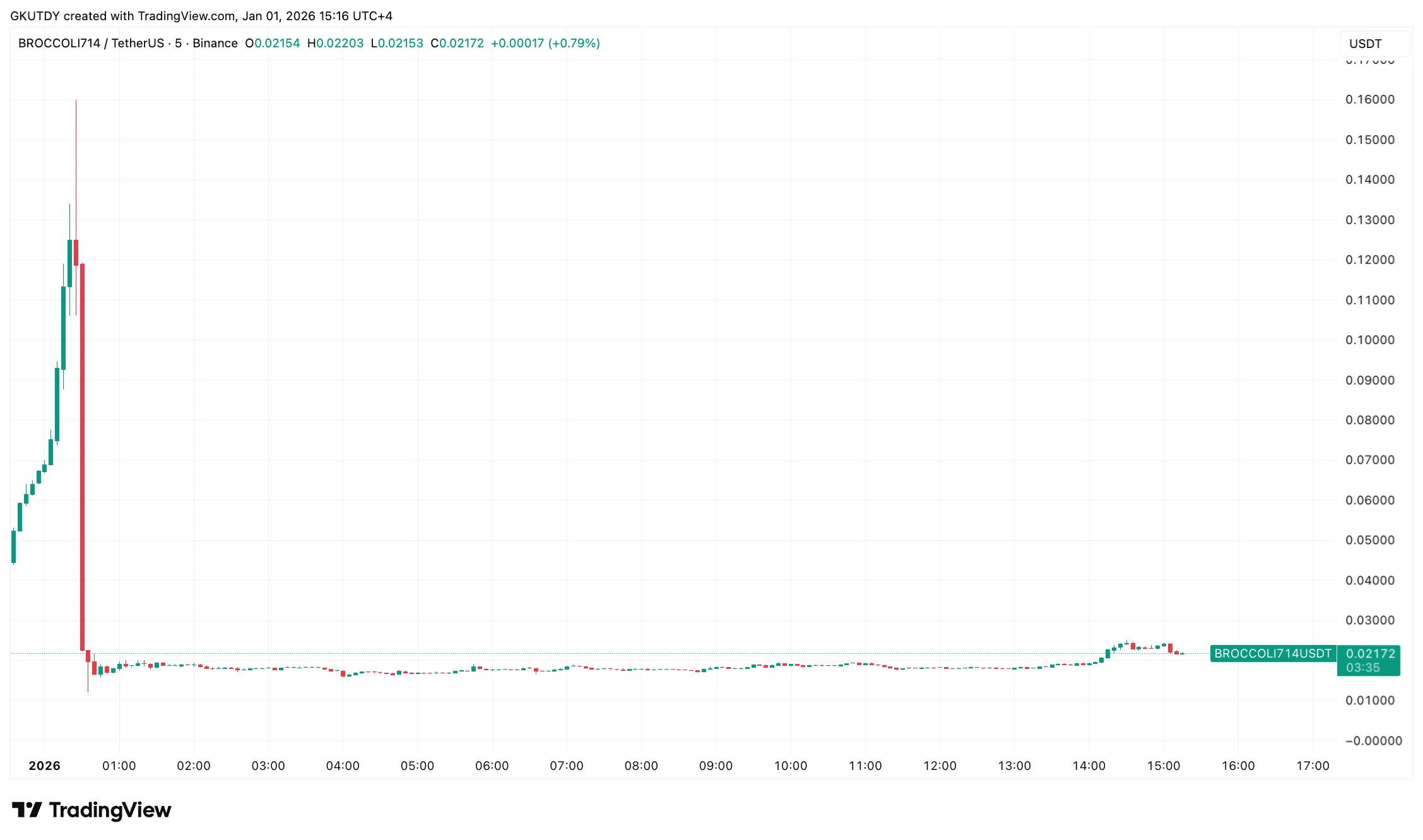

The dramatic 88% collapse of the Binance meme coin BROCCOLI714 following a hacker-linked incident serves as a cautionary tale for investors in low-liquidity tokens. The incident, reportedly involving an attacker gaining access to market-maker accounts and manipulating the token’s price through coordinated trading activity, highlights the vulnerabilities inherent in less established digital assets.

The rapid price spike followed by an equally rapid decline underscores the risks of investing in assets with thin order books and limited market depth. While meme coins can offer the potential for quick gains, they are also susceptible to manipulation and extreme volatility. Institutional investors should exercise extreme caution when considering exposure to such assets, focusing instead on more established cryptocurrencies with greater liquidity and regulatory oversight.

Navigating the Crypto Landscape

As the crypto market matures, it is crucial for investors to maintain a balanced perspective. While the overall sentiment on crypto timelines may be bullish, it is essential to remain grounded in fundamental analysis and risk management. Events such as liquidation imbalances and meme coin crashes serve as reminders of the market’s inherent volatility and the importance of due diligence.

In conclusion, the start of 2026 in the crypto market has presented a mixed bag of developments, from XRP’s liquidation dynamics to Tether’s Bitcoin accumulation and the cautionary tale of BROCCOLI714. These events underscore the importance of understanding market structure, managing risk, and maintaining a long-term perspective when navigating the digital asset landscape.

Related: XRP Liquidity Signals Potential Price Move

Source: Original article

Quick Summary

XRP experienced a significant liquidation imbalance, primarily driven by long positions being wiped out. Tether disclosed a substantial Bitcoin purchase, reinforcing its commitment to BTC as a core reserve asset. A meme coin on Binance, BROCCOLI714, suffered a steep decline due to a hacker-related incident, highlighting the risks in low-liquidity tokens.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.