XRP Ledger has experienced a significant decline in on-chain activity, with payment volumes and transaction counts down approximately 90% from their peaks. Despite the drop in ledger activity, XRP’s price has not collapsed, suggesting that this decline has already been priced into the asset’s valuation.

What to Know:

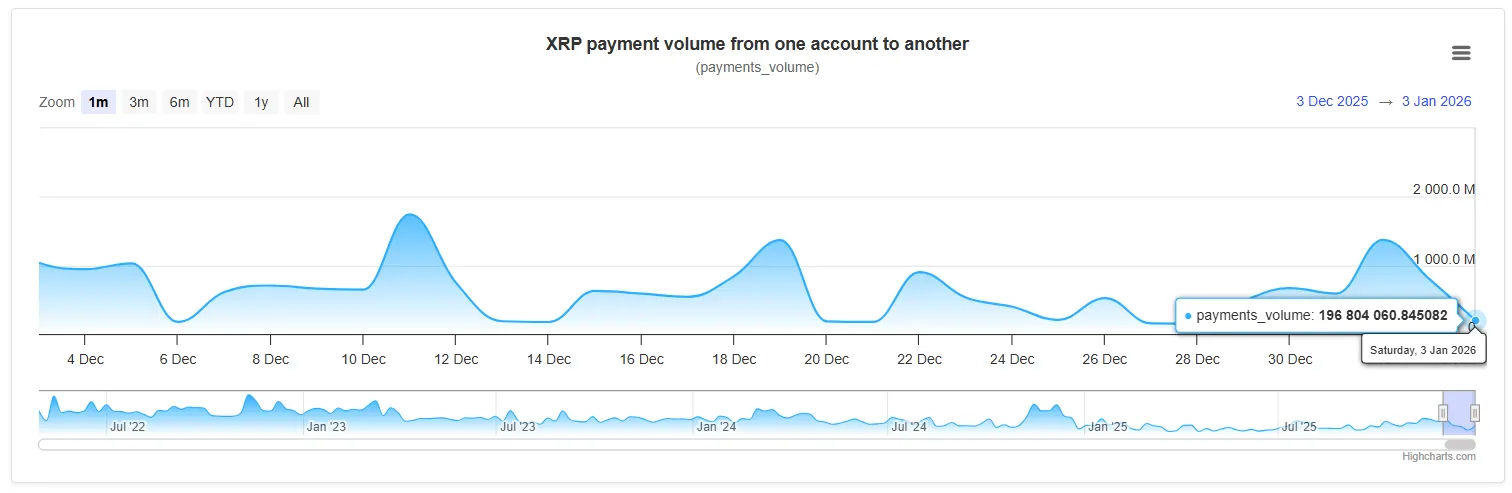

- XRP Ledger has experienced a significant decline in on-chain activity, with payment volumes and transaction counts down approximately 90% from their peaks.

- Despite the drop in ledger activity, XRP’s price has not collapsed, suggesting that this decline has already been priced into the asset’s valuation.

- Investors should focus on price-driven catalysts, macro liquidity, and regulatory developments rather than expecting an immediate resurgence in on-chain payment volume to drive future growth.

XRP has long been a focus for both retail and institutional investors, particularly given Ripple’s ongoing regulatory engagements. Recent on-chain data reveals a dramatic contraction in XRP Ledger activity, with payment volumes and transaction counts plummeting. Understanding the implications of this decline, and whether it represents a buying opportunity or a warning sign, is crucial for investors navigating the digital asset landscape.

Transactions are Plummeting

The XRP Ledger has seen a substantial decrease in transaction volumes and the number of payments processed. While a 90% drop sounds catastrophic, the market has largely priced this in over time. This divergence between price and on-chain activity is not uncommon in late-cycle cryptocurrency markets. The key takeaway is that the decline in ledger activity has not triggered a corresponding collapse in XRP’s price, suggesting that the market had already anticipated and adjusted for this reduction in network usage.

Compression Precedes Expansion

For months, XRP has been characterized by range-bound trading and decreasing volatility, indicative of a prolonged period of leverage flushing and market reset. This extended period of compression often precedes a significant expansion in volatility. Historically, assets undergoing such a contraction phase tend to experience violent breakouts, though the direction of these moves remains uncertain. This suggests that while the recent price action may seem uneventful, a substantial move is likely on the horizon.

Filtering Weak Demand

The 90% drop in ledger activity acts as a filter, removing speculative and low-quality usage from the network. What remains is a baseline of actual transfers, treasury movements, and infrastructure-level utilization. This filtering process is vital for establishing a more stable foundation for future growth. Whether XRP evolves into a speculative relic or a viable platform hinges on its ability to reestablish usage on this more solid ground.

Oversold Conditions

As the Relative Strength Index (RSI) gradually exits oversold territory, XRP’s price is reacting to the lower boundary of its declining channel. Meanwhile, ledger payments remain subdued but stable, indicating a potential bottoming process. This slow-motion bottoming is characterized by a cessation of further decline before any improvement occurs. This is a typical pattern observed in assets that are undergoing a period of accumulation after a significant sell-off.

Catalysts for Future Growth

Investors should not expect an immediate surge in on-chain volume to drive XRP’s price. Instead, potential catalysts include price-driven momentum, macro liquidity conditions, and regulatory developments. The expansion of volatility is inevitable following a prolonged period of compression. Ultimately, the reduced baseline of activity will determine whether XRP can transition from a speculative asset to a platform capable of re-establishing sustainable usage.

Regulatory Clarity and Institutional Adoption

Ripple’s ongoing regulatory engagements with the SEC remain a critical factor influencing XRP’s future. A favorable resolution could unlock significant institutional adoption and drive renewed interest in the asset. Furthermore, broader macroeconomic factors, such as changes in monetary policy and increased liquidity in the financial system, could provide additional tailwinds for XRP and the wider crypto market. The launch of spot Bitcoin ETFs, for example, has demonstrated the impact of regulatory approval and institutional access on asset prices.

In conclusion, while the dramatic decline in XRP Ledger activity raises concerns, the market’s muted reaction suggests that this has already been priced in. Investors should focus on broader market dynamics, regulatory outcomes, and potential shifts in macro liquidity to gauge XRP’s future prospects. The asset’s ability to transition from a speculative instrument to a platform with sustainable usage will ultimately determine its long-term viability.

Related: XRP Targets $2; What’s Left?

Source: Original article

Quick Summary

XRP Ledger has experienced a significant decline in on-chain activity, with payment volumes and transaction counts down approximately 90% from their peaks. Despite the drop in ledger activity, XRP’s price has not collapsed, suggesting that this decline has already been priced into the asset’s valuation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.