XRP exchange balances have hit multi-year lows, sparking speculation about a potential price surge. Historical data suggests that low exchange reserves don’t automatically lead to immediate rallies. The current market environment, with the presence of XRP ETFs, introduces new dynamics to supply and demand.

What to Know:

- XRP exchange balances have hit multi-year lows, sparking speculation about a potential price surge.

- Historical data suggests that low exchange reserves don’t automatically lead to immediate rallies.

- The current market environment, with the presence of XRP ETFs, introduces new dynamics to supply and demand.

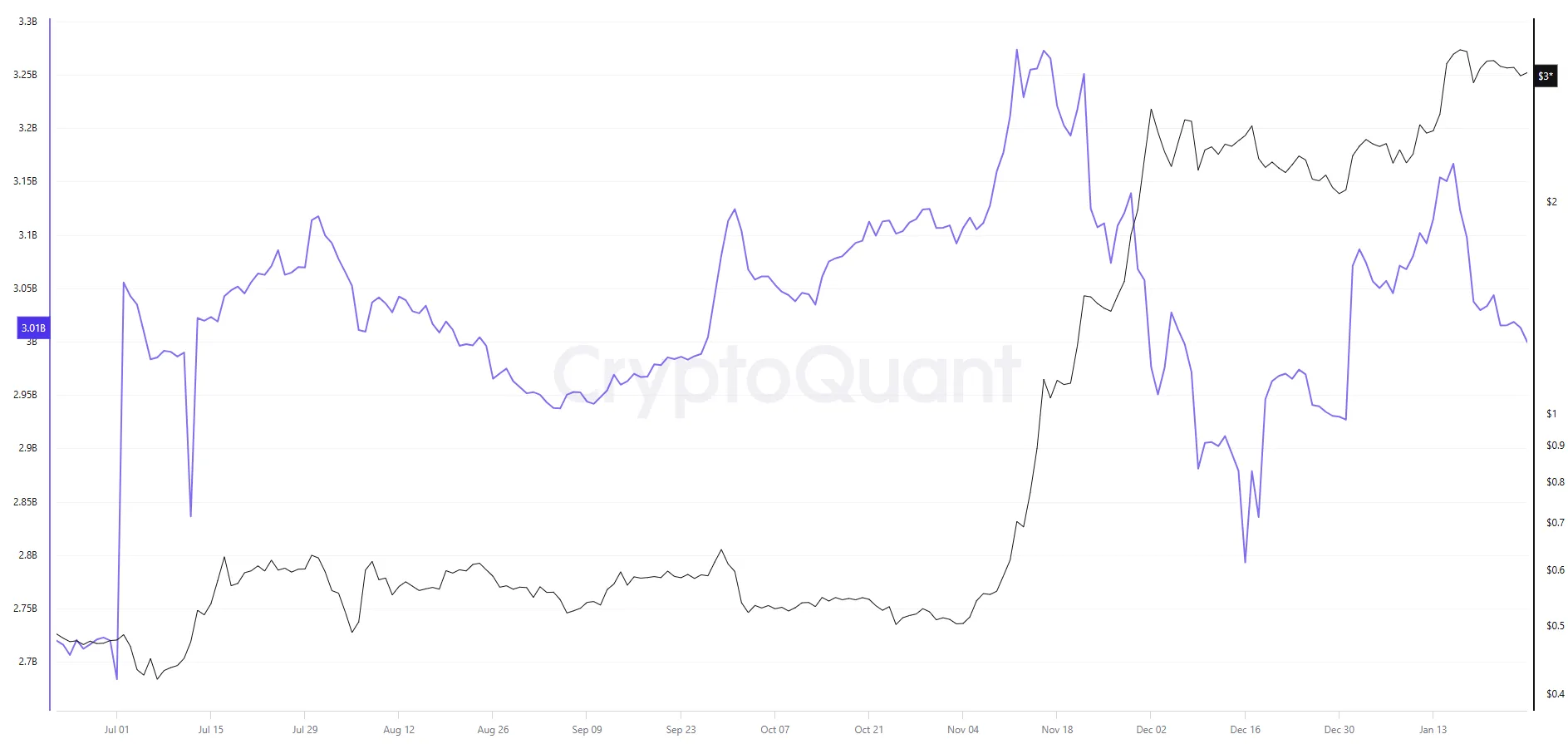

XRP’s exchange balances have plummeted to levels not seen since 2018, igniting discussions about a possible accumulation phase and the impact of tightening supply. Examining historical data offers insights into whether these troughs typically precede significant rallies. By analyzing Binance’s XRP reserves, we can assess if previous instances of similarly low reserves resulted in medium-term outperformance, or if this pattern is simply market noise.

After building up from approximately 2.6 billion to over 3.0 billion XRP in early 2024, Binance reserves declined from late March into early July, bottoming near 2.7 billion. During the second quarter of 2024, XRP traded between $0.48 and $0.71, averaging $0.56. The significant price surge from under $1 in October to around $2 by November and over $3 in January 2025 occurred months later, after reserves had increased back above 3 billion.

Following the price spike in late 2024, Binance reserves remained above 3.2 billion XRP in October and November before trending down into early 2025, reaching around 2.8 billion by March. During this second tightening episode, XRP’s price cooled off, with monthly closes slipping from a peak near $3.04 in January 2025 to around $2.09 between February and March. This suggests that the tightening may have been driven by profit-taking as the price corrected.

The most recent tightening began after a spike in XRP reserves across major exchanges on September 1. Since October, Binance reserves have steadily decreased, reaching approximately 2.6 billion by mid-December, the lowest level since July 2024. During this period, XRP’s monthly closes declined from around $2.85 in September to $2.03 in December, indicating a roughly 30% price drawdown despite the tightening supply on Binance.

The current drawdown is happening in a market where XRP spot ETFs have attracted over $1 billion in net inflows. These coins are held in custodial wallets rather than on trading venues, meaning that exchange scarcity could reflect structural demand and ETF mechanics. The presence of ETFs introduces a new dynamic, as they shift coins off centralized order books, distinguishing this situation from pure accumulation by conviction buyers.

In conclusion, while low exchange supply has been a necessary condition for XRP’s upside, it has not been sufficient on its own. The data suggests that tight supply does not automatically lead to rallies. However, reduced exchange supply means that when the next catalyst occurs, whether regulatory clarity, institutional adoption, or a shift in macro sentiment, there will be less supply available on exchanges to meet demand.

Related: Bitcoin Ends 2025 in Red: Market Watch

Source: Original article

Quick Summary

XRP exchange balances have hit multi-year lows, sparking speculation about a potential price surge. Historical data suggests that low exchange reserves don’t automatically lead to immediate rallies. The current market environment, with the presence of XRP ETFs, introduces new dynamics to supply and demand.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.