Hyperliquid’s HYPE token has shown remarkable strength, rallying against the prevailing bearish trend in the broader crypto market. The protocol’s design mechanically links trading fees to HYPE token demand, potentially creating a self-reinforcing cycle during periods of high volatility.

What to Know:

- Hyperliquid’s HYPE token has shown remarkable strength, rallying against the prevailing bearish trend in the broader crypto market.

- The protocol’s design mechanically links trading fees to HYPE token demand, potentially creating a self-reinforcing cycle during periods of high volatility.

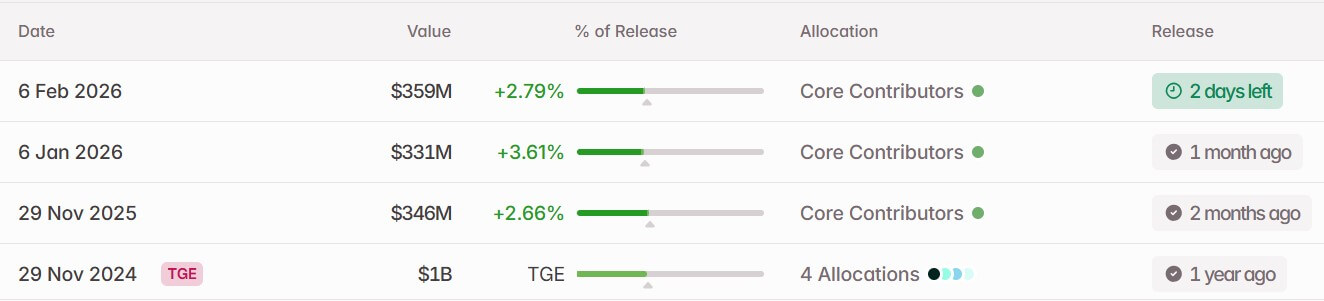

- Upcoming token unlocks pose a short-term headwind, but the long-term outlook remains positive as Hyperliquid expands its product offerings, including Real World Assets (RWAs) and event-based markets.

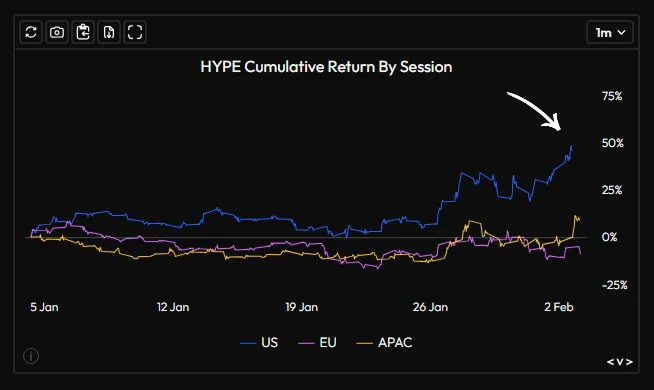

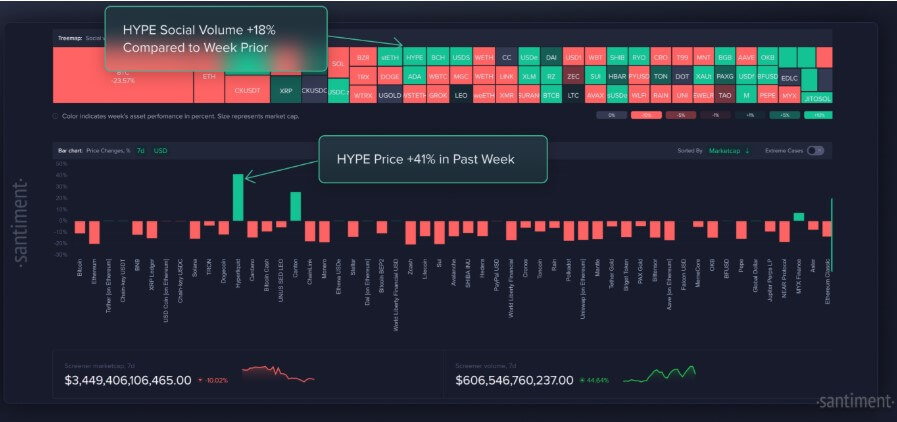

Hyperliquid’s HYPE token has defied the recent market downturn, showcasing its unique value proposition within the crypto space. While Bitcoin and other major altcoins like XRP have struggled, HYPE has experienced a significant rally, driven by positive sentiment surrounding the protocol’s expansion and innovative features. This divergence highlights the potential for specific crypto assets to thrive even amidst broader market uncertainty.

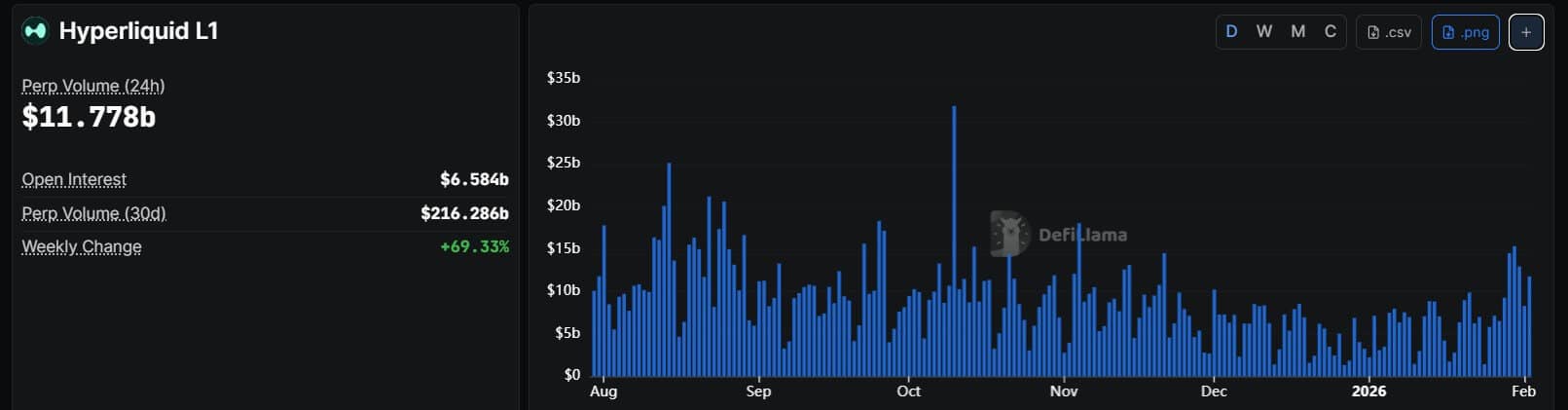

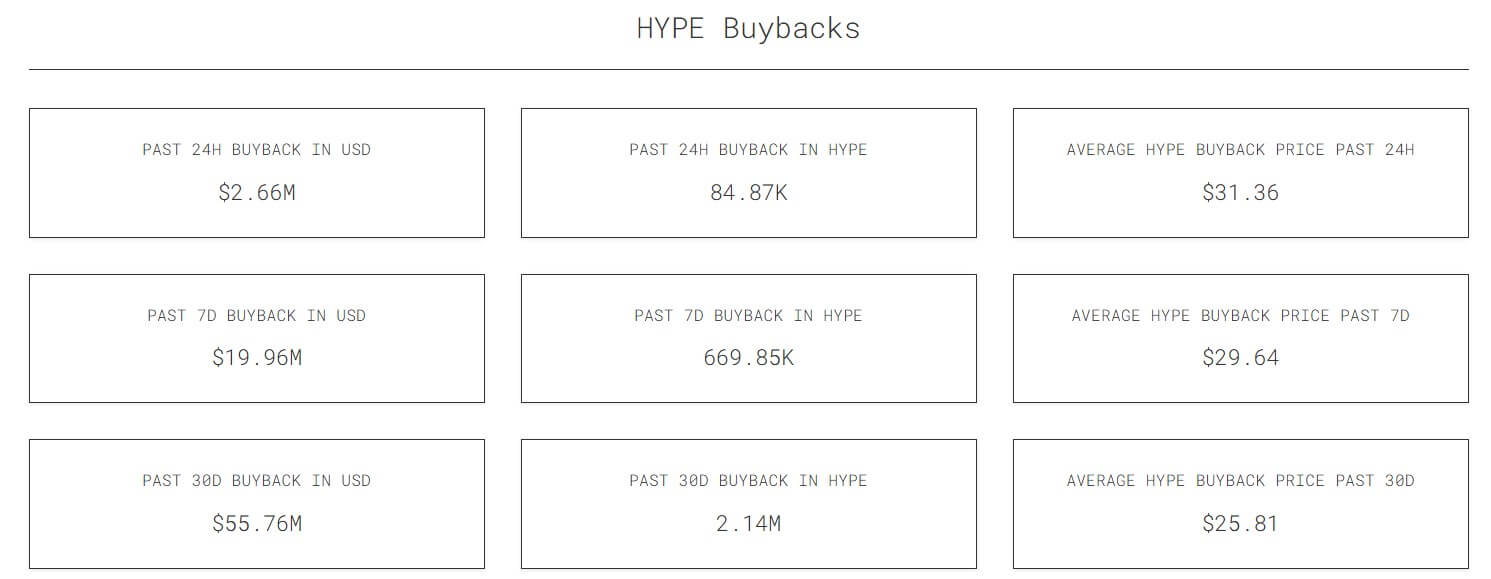

The core strength of Hyperliquid lies in its design, which directly ties trading activity to token demand. When market volatility increases, the protocol benefits from higher trading volumes, generating more fees that are then used to buy back HYPE tokens. This mechanism creates a positive feedback loop, potentially bolstering the token’s price even as other cryptocurrencies face downward pressure.

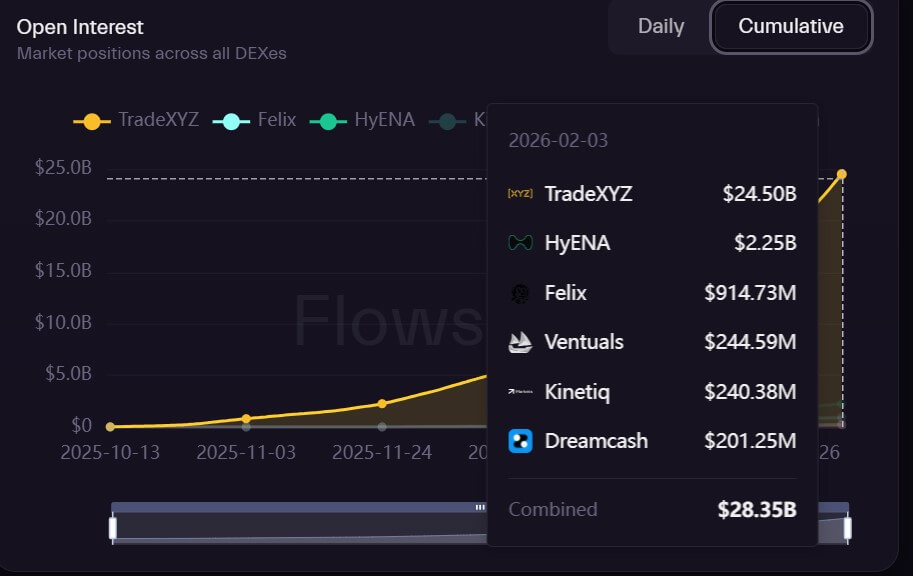

Hyperliquid’s strategic move into Real World Assets (RWAs) and permissionless markets is expanding its reach and attracting new users. The HIP-3 upgrade has enabled the platform to support builder-deployed perpetual markets, creating a cost of entry for those seeking to rapidly list new assets. This has facilitated the integration of commodities like silver, demonstrating the potential for HYPE to capture a significant share of traditional markets.

The introduction of HIP-4, which focuses on outcome-style, event-based markets, further enhances Hyperliquid’s appeal. These new instruments offer users limited-risk, options-style structures that avoid margin calls and liquidation cascades. By providing an alternative to traditional leveraged trading, Hyperliquid is positioning itself as a competitor to existing prediction platforms and attracting a broader audience.

Looking ahead, HYPE faces an impending token unlock that could introduce short-term volatility. However, the long-term outlook remains positive, driven by the protocol’s innovative features and growing adoption. As Hyperliquid continues to expand its product offerings and attract new users, the HYPE token is well-positioned to capitalize on the evolving crypto landscape.

In conclusion, Hyperliquid’s HYPE token presents a compelling case study of a crypto asset that can thrive even during market downturns. Its unique tokenomics, strategic expansion into new markets, and innovative product offerings position it for continued growth and success. While upcoming token unlocks may present short-term challenges, the long-term outlook for HYPE remains bright.

Related: XRP Price: DeFi Boom Impact on XRP Ledger

Source: Original article

Quick Summary

Hyperliquid’s HYPE token has shown remarkable strength, rallying against the prevailing bearish trend in the broader crypto market. The protocol’s design mechanically links trading fees to HYPE token demand, potentially creating a self-reinforcing cycle during periods of high volatility.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.