Ethereum faces resistance at $3,340, while Ripple contests the $2 support level. Broader market trends suggest a potential for sustained rallies if key resistance levels are breached. XRP’s ability to maintain its position above $2 is critical for its near-term price action and liquidity.

What to Know:

- Ethereum faces resistance at $3,340, while Ripple contests the $2 support level.

- Broader market trends suggest a potential for sustained rallies if key resistance levels are breached.

- XRP’s ability to maintain its position above $2 is critical for its near-term price action and liquidity.

This week’s crypto market update reveals key levels for major cryptocurrencies as they navigate a landscape ripe with potential for both gains and pullbacks. Ethereum is attempting to overcome resistance, while Ripple is focused on maintaining crucial support. These technical levels could dictate the direction of short-term price action.

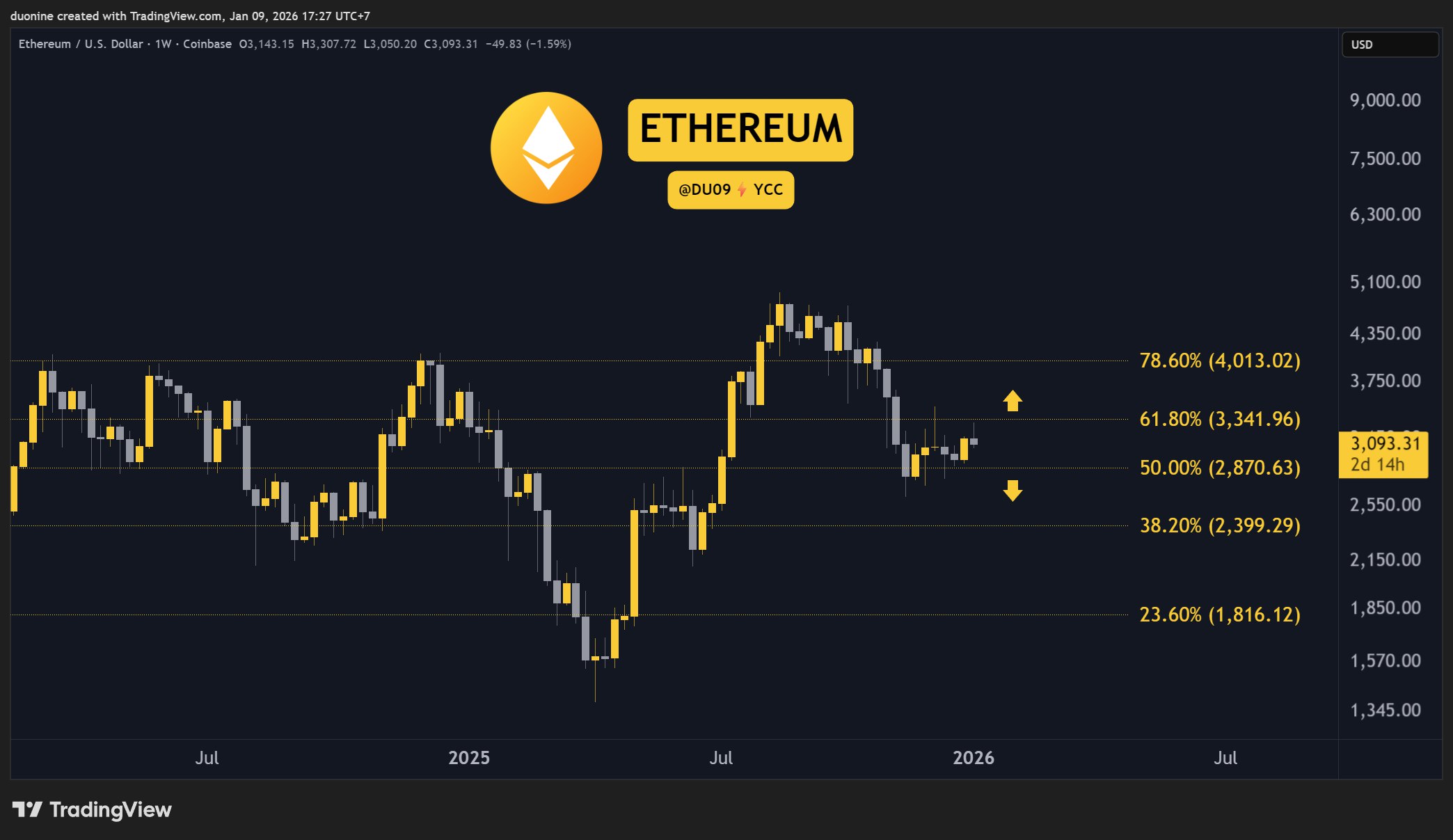

Ethereum’s Standoff at $3,340

Ethereum (ETH) has encountered resistance at the $3,340 level after starting the year positively. While buyers have shown strength, maintaining support above $3,000 is crucial. A successful breach of the $3,340 resistance could signal a sustained rally, turning the level into a key support zone.

Ripple’s Battle for $2

Ripple (XRP) demonstrated an 11% rally this week, bringing it to the critical $2 mark, which is now being tested. Holding this level is essential for maintaining bullish momentum. Failure to maintain support at $2 could invite sellers, potentially leading to a retest of the $1.8 support level. The $2 level, therefore, acts as a pivotal point for XRP’s immediate trajectory.

Cardano’s Crossroads at $0.40

Cardano (ADA) faced rejection at the $0.40 resistance, despite a 7% weekly gain. The cryptocurrency’s ability to sustain an uptrend hinges on reclaiming this level. A failure to do so could empower sellers and exert downward pressure. The $0.40 mark, therefore, represents a critical juncture for Cardano, with its future direction heavily dependent on whether it can establish a firm footing above this price point.

Binance Coin’s Resistance at $900

Binance Coin (BNB) has repeatedly struggled to overcome resistance at $900, a level tested four times since November 2025. Despite these rejections, each attempt weakens the resistance, increasing the likelihood of a future breakout. Should BNB successfully turn $900 into support, the next targets lie at $1,000 and potentially $1,200, paving the way for new price records.

Hyperliquid (HYPE) Faces Downtrend

Hyperliquid (HYPE) closed the week with a modest 2% gain but faces resistance at $30. Sellers have dominated price action since Wednesday, suggesting a potential retest of the $24 support. Overcoming the $30 resistance and establishing it as support is crucial for HYPE to reverse its current downtrend.

Market Outlook

The cryptocurrency market is at a critical juncture, with several major coins facing key resistance and support levels. The ability of these cryptocurrencies to overcome these hurdles will likely dictate their short-term performance and influence broader market sentiment. Investors should closely monitor these levels for potential trading opportunities.

Related: XRP Adoption Boosted by Key Partnership

Source: Original article

Quick Summary

Ethereum faces resistance at $3,340, while Ripple contests the $2 support level. Broader market trends suggest a potential for sustained rallies if key resistance levels are breached. XRP’s ability to maintain its position above $2 is critical for its near-term price action and liquidity.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.