XRP’s recent price drop has pushed its SOPR below 1.0, indicating that holders are now realizing losses on average. This shift in SOPR reflects a broader market correction after a period of significant gains, driven by profit-taking and distribution.

What to Know:

- XRP’s recent price drop has pushed its SOPR below 1.0, indicating that holders are now realizing losses on average.

- This shift in SOPR reflects a broader market correction after a period of significant gains, driven by profit-taking and distribution.

- The SOPR breakdown matters because it highlights a potential change in market sentiment and investor behavior, which can influence XRP’s price trajectory and institutional interest.

XRP has experienced a notable correction, falling below its average holder cost basis as market sentiment shifts from profit-taking to loss realization. After a substantial rally that peaked in July 2025, XRP has retraced significantly, impacting on-chain metrics and investor profitability. The current market dynamics raise questions about potential support levels and the possibility of prolonged consolidation.

SOPR: A Key Indicator

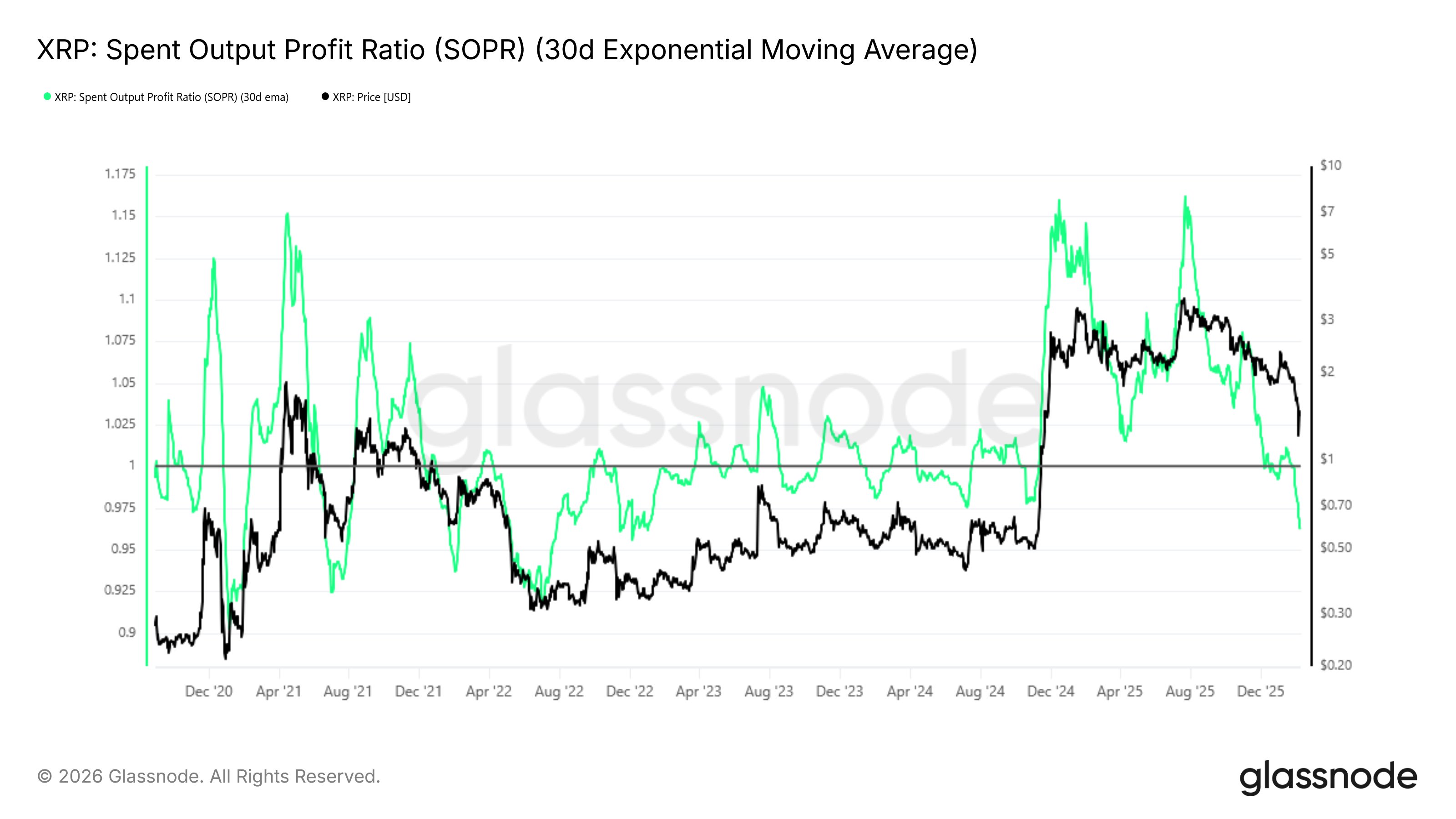

The Spent Output Profit Ratio (SOPR) is a critical metric for gauging market profitability. Glassnode data confirms that XRP’s SOPR, using a 7-day EMA, has declined from 1.16 in July 2025 to 0.96. This indicates a shift from holders realizing an average profit of 16% to incurring an average loss of 4% when transferring coins on-chain. The 1.0 SOPR level represents the aggregate holder breakeven point, and XRP’s break below this threshold signals increased selling pressure and potential capitulation.

Historical Context and Market Behavior

Historical data shows that when SOPR drops below 1.0, short-term holders often rush to exit positions, while long-term holders may step in to absorb supply. This behavior can lead to a period of sideways movement as the market seeks equilibrium. Examining XRP’s 2025 rally, the 30-day EMA SOPR climbed above 1.10, reaching 1.15-1.16, coinciding with XRP breaking above $1 and surging past $3 to a high of $3.65. These high SOPR readings indicated heavy profit-taking during the rally, with distribution occurring as the price traded between $3.00 and $3.60.

Similarities to the 2021/2022 Downturn

The current market situation shares similarities with the period between September 2021 and May 2022. During that time, XRP traded around $1.30 to $1.40 with SOPR readings above 1.0. However, a subsequent price collapse led to SOPR remaining below 1.0 for an extended period, with XRP eventually bottoming out around $0.30 to $0.35 by mid-2022. This historical parallel suggests that XRP could experience a prolonged period of consolidation before finding stability.

Potential Support Levels and Market Outlook

As XRP navigates this downturn, key levels to watch include $1.00 as structural support. Should the weakness persist, potential lower support zones lie between $0.70-$0.80 and $0.50. The market’s ability to hold above $1.00 and rebuild profitability will be crucial in determining its next phase. If SOPR can regain and sustain levels above 1.0, it could signal a return to expansion. However, failure to do so may result in further downside pressure and a prolonged period of accumulation.

Derivatives Positioning and Institutional Flows

Institutional investors should closely monitor derivatives positioning and ETF mechanics related to XRP. Changes in open interest, funding rates, and ETF inflows can provide insights into market sentiment and potential price movements. A sustained increase in institutional participation could help stabilize XRP and drive its recovery. Conversely, continued outflows and negative derivatives positioning could exacerbate the current downtrend.

In conclusion, XRP’s recent price drop and SOPR breakdown highlight a challenging market environment. While historical patterns suggest a potential for long-term opportunities, the market must first navigate a period of capitulation and consolidation. Monitoring key support levels, derivatives positioning, and institutional flows will be essential for investors seeking to capitalize on future opportunities in XRP.

Related: XRP: Garlinghouse Says It’s Ripple’s North Star

Source: Original article

Quick Summary

XRP’s recent price drop has pushed its SOPR below 1.0, indicating that holders are now realizing losses on average. This shift in SOPR reflects a broader market correction after a period of significant gains, driven by profit-taking and distribution.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.