CoinDesk Indices recently released a daily snapshot of the broader crypto market, showing minor shifts among major digital assets. In a relatively calm session, the focus keyword XRP did not lead price movements as market momentum remained tepid.

CoinDesk Indices recently released a daily snapshot of the broader crypto market, showing minor shifts among major digital assets. In a relatively calm session, the focus keyword XRP did not lead price movements as market momentum remained tepid.

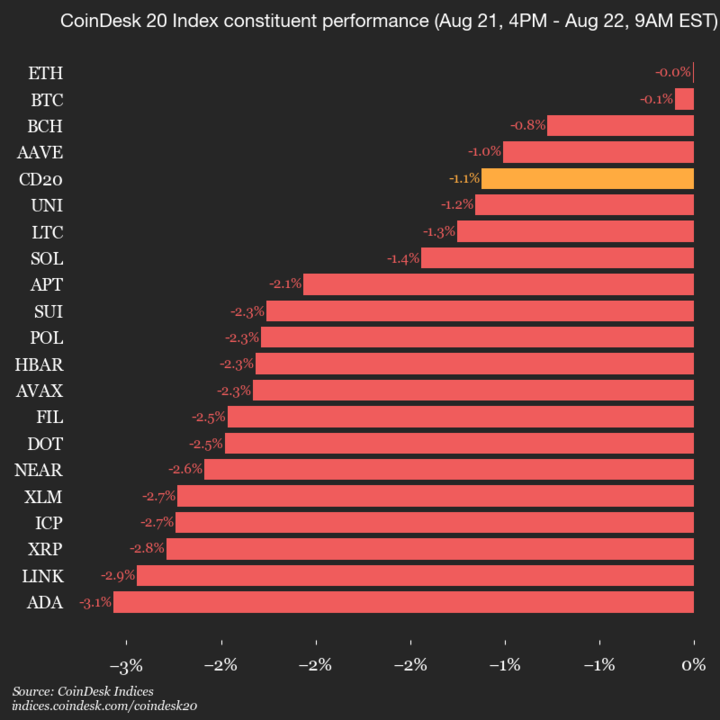

As of the most recent update, the CoinDesk 20 Index is posted at 3,926.49, showing a 1.1% drop from the previous 4 p.m. ET reading, equivalent to a 44.65-point decline. This dip reflects a downward move across all 20 tracked digital assets.

A visual update from CoinDesk highlights flat trading from top cryptocurrencies in the August 22, 2025 session.

Bitcoin and Ethereum Hold Steady Amid Market Softness

Bitcoin (BTC) and Ethereum (ETH), the two largest digital assets by market capitalization, remained relatively unchanged during this stretch. Ethereum managed to hold steady with a 0.0% change, while Bitcoin edged slightly lower by only 0.1%. This signals a quieter trading day with neither asset experiencing major volatility.

Despite the minor decreases, the flat performance of these two tokens brings some relative stability to a weak broader market. XRP, although not most affected today, continues to be part of the wider trend impacted by lackluster investor engagement as reflected by composite index activity.

Altcoins Under Pressure: ADA and LINK Lead Declines

Other altcoins didn’t fare as well. Cardano (ADA) posted the steepest drop among the group, with a 3.1% decline. Close behind was Chainlink (LINK), which fell 2.9%. These losses were enough to drag the CoinDesk 20 index downward, unreinforced by gains from other assets as none of the 20 posted positive returns for the day.

This underperformance among smaller-cap crypto tokens highlights the current market’s risk-averse sentiment. Both ADA and LINK’s negative movements showcase investor hesitancy in embracing highly volatile assets given broader market uncertainty.

Global Reach of the CoinDesk 20 Index

The CoinDesk 20 Index serves as a benchmark for measuring comprehensive performance across leading crypto assets. It is traded on multiple platforms and monitored across several international markets, providing a global perspective on digital asset trends.

Traders and analysts use the index to track movements across key tokens, with particular attention to assets like XRP, Bitcoin, and Ethereum due to their strong impact on broader market sentiment. A synchronized decline across all 20 assets—without any trading higher—underscores a collective pause in bullish sentiment.

Related: XRP Price: $12M Max Pain for Bears

Overall, while Bitcoin and Ethereum remain relatively steady, the general market tone remains weak. XRP and its peers continue to reflect this broader pattern, giving investors little direction in terms of momentum or breakout signals.

Quick Summary

CoinDesk Indices recently released a daily snapshot of the broader crypto market, showing minor shifts among major digital assets. In a relatively calm session, the focus keyword XRP did not lead price movements as market momentum remained tepid.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.