XRP is displaying signs of bullish momentum, currently trading around $2.20, but faces a critical resistance level that must be overcome to unlock further upside potential.

What to Know:

- XRP is displaying signs of bullish momentum, currently trading around $2.20, but faces a critical resistance level that must be overcome to unlock further upside potential.

- Technical analysis reveals that a daily close above $2.17-$2.28 is crucial for confirming a breakout and resuming the broader uptrend towards targets like $2.6.

- Derivatives data shows a recent shift in futures positioning with short-term inflows, although longer-term flows suggest some participants are still de-risking.

XRP is catching the eye of institutional investors as it attempts to break through key resistance levels. Amidst a backdrop of evolving regulatory clarity and increasing acceptance of digital assets, XRP’s ability to sustain its bullish momentum is critical for its continued relevance in institutional portfolios. The current price action and derivatives data provide valuable insights into the potential for further gains.

Technical Setup

XRP is currently navigating a crucial juncture, attempting to establish a stable position above the $2.10 to $2.20 range after a recent correction that bottomed around $1.82. The price is testing the upper boundary of the 1-day Fibonacci framework, with the key 0.236 Fibonacci level at $2.17 acting as immediate overhead resistance. A successful daily close above this level would pave the way for a move towards the $2.28 resistance zone, which has historically triggered selling pressure.

The importance of these technical levels cannot be overstated, as they often serve as key decision points for institutional traders. A confirmed breakout above $2.28 could signal renewed confidence, potentially attracting further investment. Conversely, failure to breach this level may lead to a period of consolidation or a pullback towards lower support levels.

Support Levels and Bullish Indicators

XRP has established a series of support levels that are essential for maintaining its current recovery bias. Immediate support lies at the 0.382 Fibonacci level around $2.10, followed by $2.05 (0.50 Fib) and $1.99 (0.618 Fib), forming a robust demand cluster. Should these levels fail to hold, the next significant defense is at $1.91 (0.786 Fib), with a potential full retracement to the $1.81 low if bearish momentum intensifies.

The Moving Average Convergence Divergence (MACD) indicator offers a cautiously optimistic outlook. The MACD line has crossed above the signal line, and the histogram is turning green, suggesting increasing buying interest and early upside momentum. This bullish signal could attract additional buyers, providing further support for XRP’s price.

XRP Futures Market Dynamics

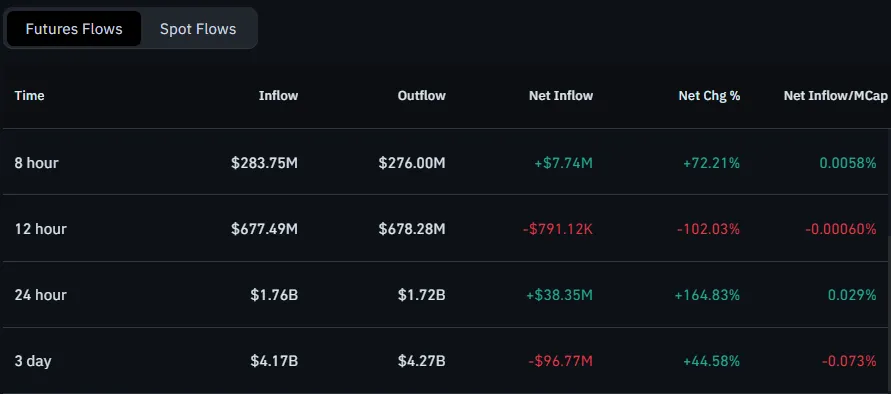

Analysis of XRP derivatives data reveals a notable shift in futures positioning over the past day. Futures venues have recorded approximately $1.76 billion in inflows against $1.72 billion in outflows, resulting in a net inflow of around $38.35 million, representing a net change of approximately +165%. This positive skew indicates that traders have been adding long positions or closing short positions as XRP’s spot price stabilizes above $2.

The futures market often provides a leading indicator of potential price movements. The recent inflows suggest that traders are increasingly confident in XRP’s short-term prospects. However, it is important to consider longer-term trends to gain a more comprehensive view of market sentiment.

Longer-Term Sentiment and Risk Management

While short-term futures sentiment has turned constructive, longer-term data suggests a more cautious approach. The 12-hour flows show a small net outflow of about $791,000, indicating that some participants used earlier strength to reduce risk. The 3-day reading remains negative, with around $96.77 million in net outflows, although the net change percentage has improved.

This mixed sentiment reflects the inherent uncertainty in the digital asset market. While some traders are capitalizing on short-term gains, others are maintaining a more conservative stance, mindful of potential risks. Institutional investors often employ sophisticated risk management strategies, carefully balancing potential rewards with downside protection.

Historical Context and Market Parallels

XRP’s current market dynamics can be viewed in the context of previous digital asset cycles. The launch of Bitcoin ETFs, for example, triggered significant inflows and price appreciation, but also periods of volatility and correction. Similarly, regulatory developments, such as the ongoing discussions surrounding digital asset regulation, can have a profound impact on market sentiment and investment decisions.

Drawing parallels to these historical events can provide valuable insights for investors. By understanding how the market has reacted to similar developments in the past, investors can better anticipate potential future outcomes.

In conclusion, XRP is at a pivotal juncture, with its ability to overcome key resistance levels and sustain bullish momentum determining its near-term trajectory. While short-term indicators are positive, longer-term sentiment remains cautious, reflecting the inherent risks in the digital asset market. Institutional investors should closely monitor these developments, employing robust risk management strategies to navigate the evolving landscape.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP is displaying signs of bullish momentum, currently trading around $2.20, but faces a critical resistance level that must be overcome to unlock further upside potential. Technical analysis reveals that a daily close above $2.17-$2.28 is crucial for confirming a breakout and resuming the broader uptrend towards targets like $2.6.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.