Ripple executive Luke Judges suggests XRP Ledger could benefit from Solana’s rapid execution and developer focus. Judges emphasizes that technical prowess alone doesn’t guarantee long-term success in the competitive layer-1 landscape.

What to Know:

- Ripple executive Luke Judges suggests XRP Ledger could benefit from Solana’s rapid execution and developer focus.

- Judges emphasizes that technical prowess alone doesn’t guarantee long-term success in the competitive layer-1 landscape.

- Ripple CTO David Schwartz counters that XRPL’s reliability and stability are paramount, distinguishing it from high-throughput chains.

The XRP Ledger (XRPL), long recognized for its efficiency in cross-border payments, faces a rapidly evolving landscape as smart contract functionality comes online. While technical advancements are crucial, Ripple executives are debating the importance of operational agility and developer experience, drawing comparisons to Solana’s rise. This discussion arrives as institutional interest in digital assets deepens, making strategic choices around network design and developer tooling more critical than ever.

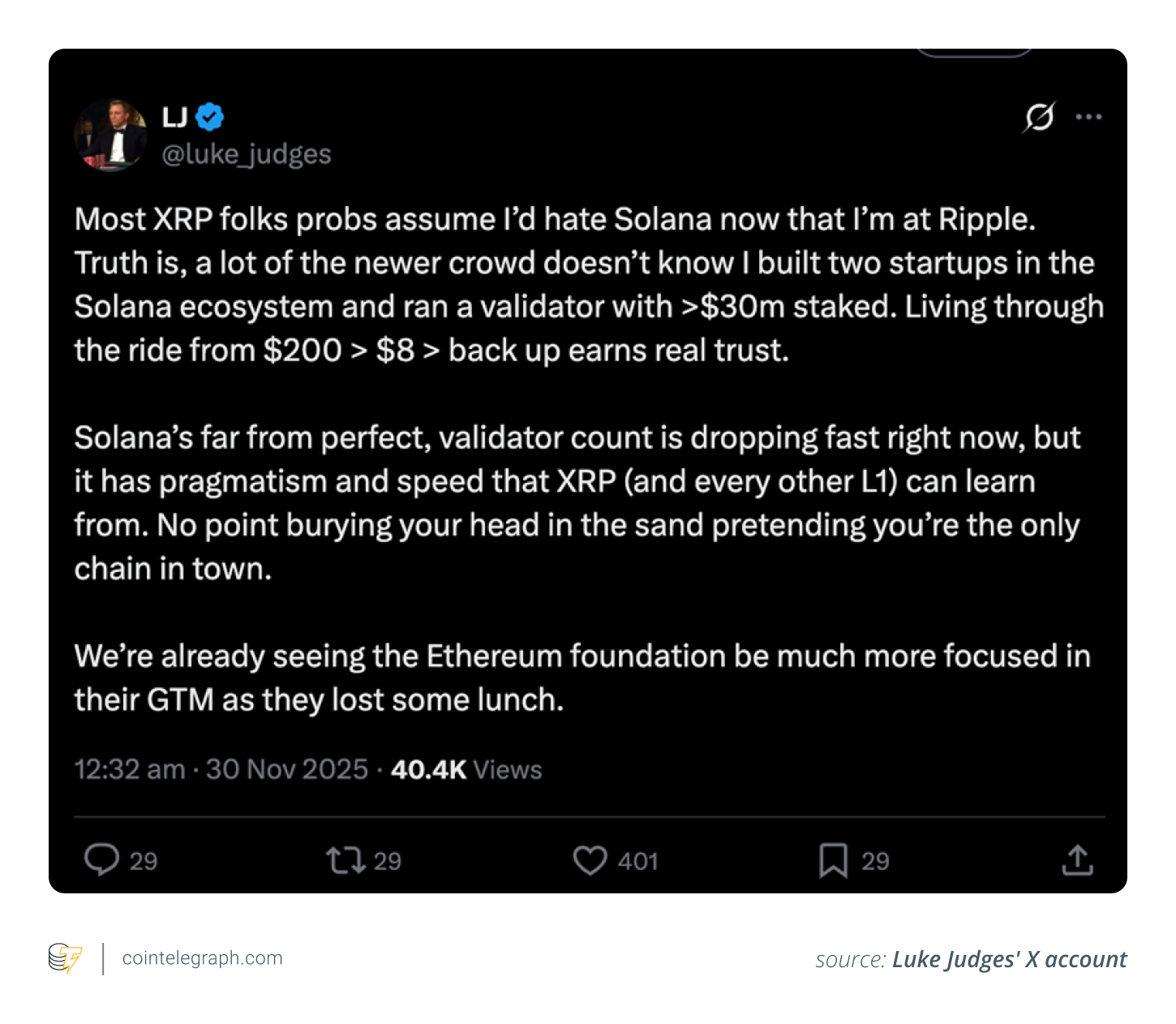

Luke Judges, a global partner success lead at Ripple with prior experience managing a Solana validator, argues that technical strength alone isn’t enough. He points to Solana’s “pragmatism and speed” as key factors in attracting developers and gaining market traction. This perspective suggests that a fast go-to-market strategy and practical engineering can outweigh theoretical advantages in protocol design. We’ve seen similar dynamics play out in traditional finance, where first-mover advantage and user-friendly interfaces often trump superior technology.

Judges’ observations highlight the need for XRPL to focus on developer onboarding, tooling, and validator incentives. A seamless developer experience is crucial for fostering a vibrant ecosystem and attracting projects that drive network usage. Moreover, sustainable validator economics are essential for maintaining decentralization and security. The risk of validator concentration, as Judges notes is happening on Solana, is a cautionary tale for any layer-1 network seeking long-term viability.

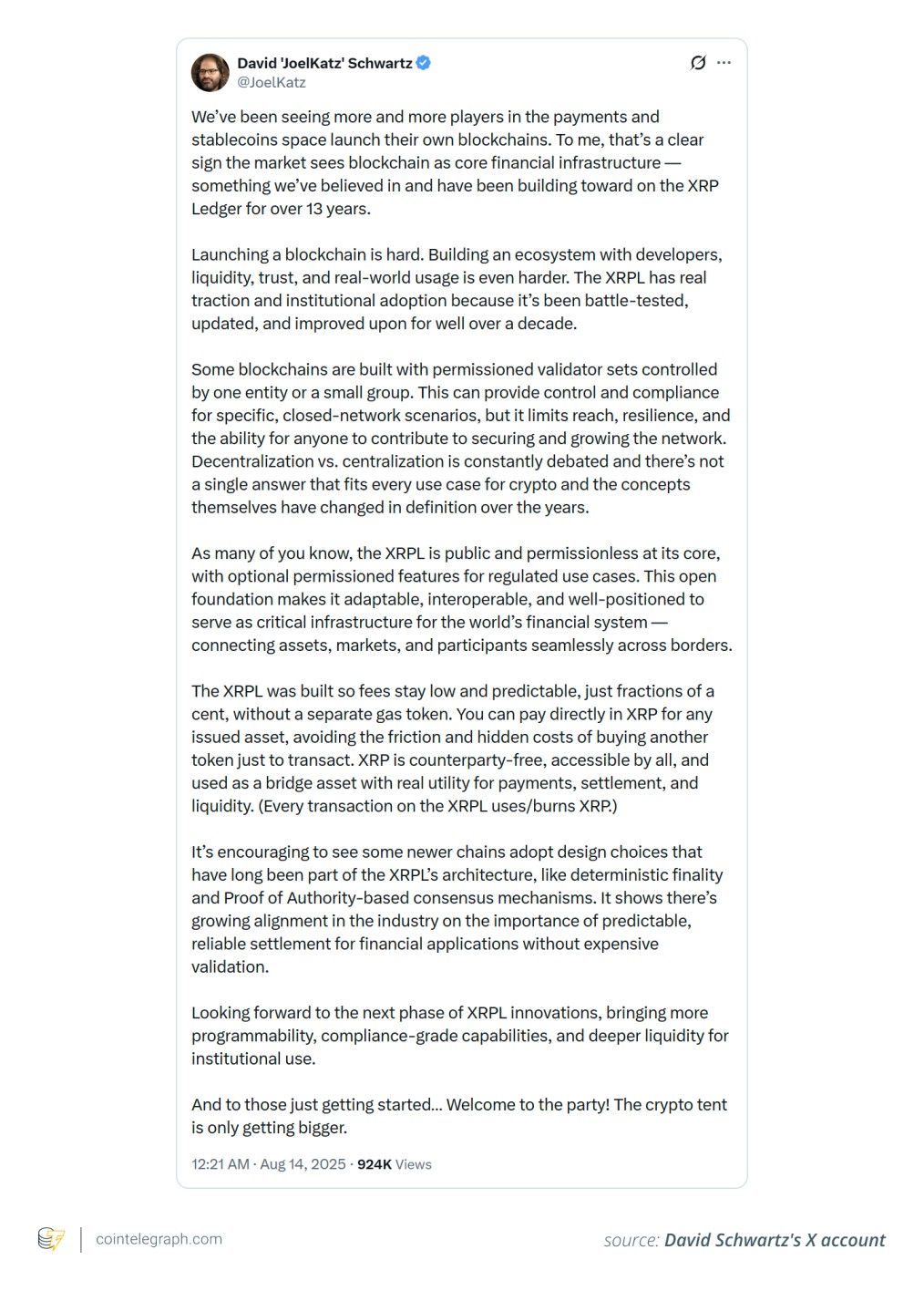

However, Ripple CTO David Schwartz offers a contrasting view, emphasizing the importance of reliability and stability. Schwartz argues that XRPL’s design philosophy prioritizes institutional-grade performance over raw speed, setting it apart from high-throughput chains like Solana. He points to Solana’s history of network outages as evidence that prioritizing speed at the expense of stability is unsuitable for real-world financial applications. This is a valid concern, especially as institutions demand predictable and reliable settlement systems.

The debate between Judges and Schwartz underscores a fundamental tension in blockchain development: the trade-off between speed and stability. While high throughput is desirable, it shouldn’t come at the cost of frequent outages or security vulnerabilities. XRPL’s focus on reliability aligns with the needs of institutional clients who require predictable performance for their financial operations. This is reminiscent of how traditional settlement systems like SWIFT prioritize reliability over cutting-edge speed.

The launch of smart contracts on XRPL presents both an opportunity and a challenge. While it expands the network’s functionality and opens up new use cases in DeFi, it also introduces new complexities and potential risks. XRPL must carefully manage this transition to ensure that its smart contract implementation doesn’t compromise its core value proposition of reliability and efficiency. This requires rigorous testing, security audits, and a focus on developing robust developer tools.

It’s also important to note that the Ethereum Foundation is becoming much more focused in their GTM. See rollups for example. If you’re not paying attention to what others are doing, you’re likely to get out-competed.

— Luke Judge (@lukemjudge) November 30, 2023

Ultimately, XRPL’s success will depend on its ability to strike a balance between technical innovation and operational excellence. While maintaining its focus on reliability is crucial, it must also adapt to the evolving needs of developers and users. This requires a proactive go-to-market strategy, a commitment to developer tooling, and a willingness to learn from the successes and failures of other layer-1 networks. The digital asset space is intensely competitive, and resting on past achievements is not an option.

The insights from Ripple’s executives highlight a critical aspect of the layer-1 competition: execution matters as much as technology. For institutional investors, this means evaluating not just the technical specifications of a blockchain, but also the team’s ability to deliver on its promises and adapt to changing market conditions. As XRPL navigates its expansion into smart contracts and DeFi, its ability to combine its strengths in reliability with a more agile and developer-centric approach will determine its long-term success.

Related: XRP Army Defends Token’s Utility

Source: Original article

Quick Summary

Ripple executive Luke Judges suggests XRP Ledger could benefit from Solana’s rapid execution and developer focus. Judges emphasizes that technical prowess alone doesn’t guarantee long-term success in the competitive layer-1 landscape. Ripple CTO David Schwartz counters that XRPL’s reliability and stability are paramount, distinguishing it from high-throughput chains.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.