A prominent crypto investor, ChartFu, has announced a short position on XRP, anticipating a price decline. This contrasts with ongoing inflows into XRP ETFs and bullish sentiment from some high-profile figures, creating a mixed outlook.

What to Know:

- A prominent crypto investor, ChartFu, has announced a short position on XRP, anticipating a price decline.

- This contrasts with ongoing inflows into XRP ETFs and bullish sentiment from some high-profile figures, creating a mixed outlook.

- The divergence highlights the complexities of XRP’s market dynamics and the varied perspectives among institutional and retail investors.

XRP finds itself at a crossroads as 2025 draws to a close. Despite positive momentum from ETF inflows, skepticism persists among some market participants. The tug-of-war between bullish accumulation narratives and bearish short positions creates uncertainty for XRP’s near-term trajectory.

Mixed Reactions From Crypto Analysts

ChartFu’s recent disclosure of a short position on XRP has stirred debate among crypto analysts. While some express surprise, others reinforce concerns about XRP’s trading dynamics. This divergence underscores the varying risk appetites and investment strategies within the crypto community.

XRP ETF Inflows and Whale Accumulation Narrative

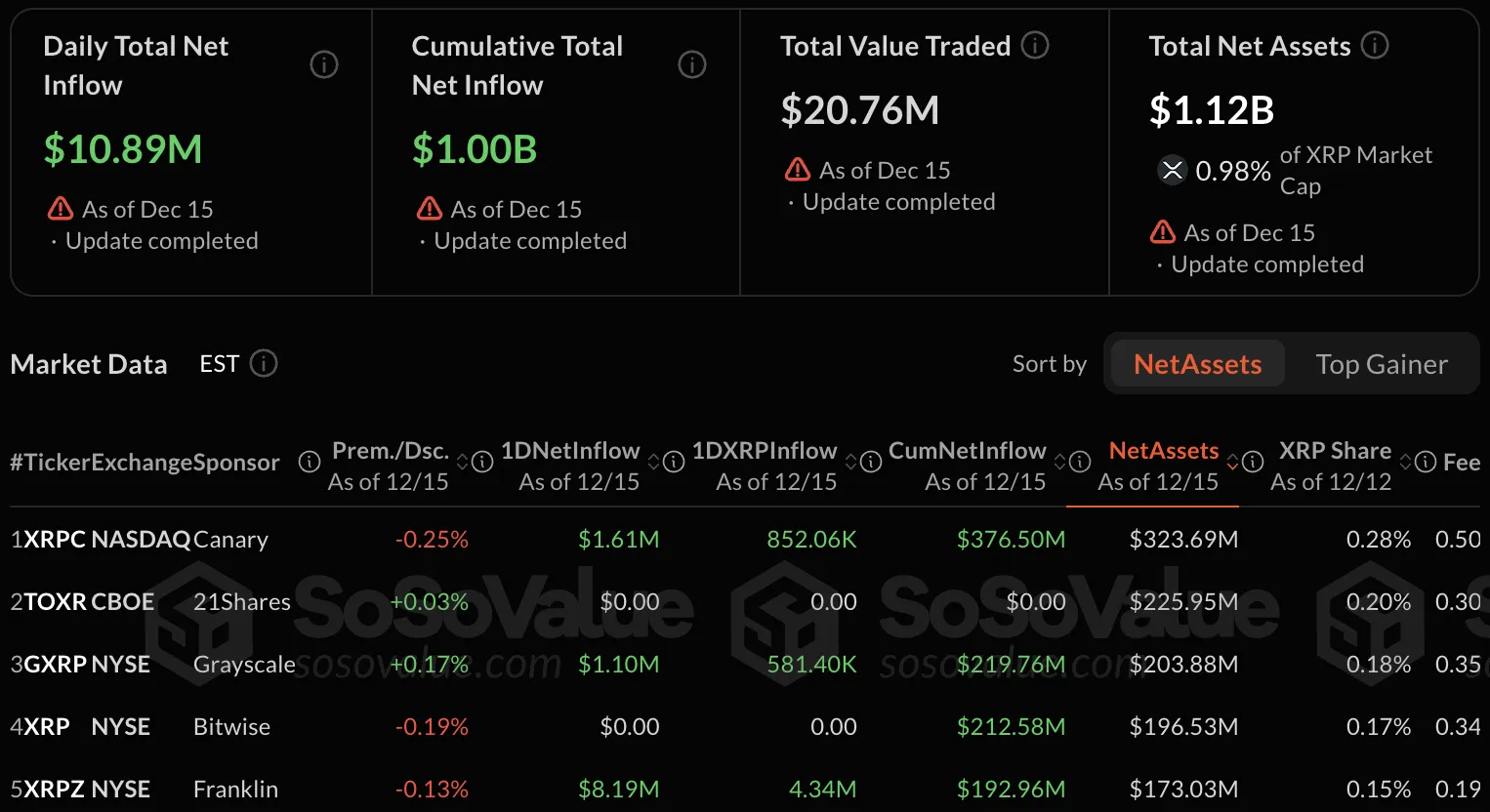

XRP ETFs have experienced a notable trend of consecutive daily inflows, reaching over $1 billion in total assets under management. This sustained demand suggests institutional interest in XRP exposure through regulated investment vehicles. However, some analysts remain cautious, questioning whether these inflows will translate to sustained price appreciation.

Contrasting Views and Market Sentiment

Adding to the complexity, prominent figures like YoungHoon Kim have voiced strong bullish sentiments on XRP, while others like Peter Brandt express skepticism. This contrast in viewpoints highlights the subjective nature of market analysis and the importance of considering diverse perspectives when evaluating XRP’s potential.

XRP’s Unique Value Proposition

XRP’s appeal lies in its focus on infrastructure, cross-border payments, and regulatory compliance. Unlike some cryptocurrencies driven by hype, XRP aims to provide practical solutions for financial institutions and payment providers. This fundamental value proposition may attract long-term investors seeking assets with real-world utility.

Navigating Uncertainty

As XRP navigates the push and pull of ETF inflows, analyst opinions, and market sentiment, investors must exercise caution and conduct thorough research. Monitoring regulatory developments, technological advancements, and adoption rates will be crucial in assessing XRP’s long-term prospects. While the ETF narrative provides a bullish backdrop, the presence of short positions and contrasting views underscores the inherent risks and uncertainties in the crypto market.

In conclusion, XRP’s future remains uncertain amid conflicting signals. The ongoing ETF inflows provide a supportive tailwind, but the presence of bearish sentiment and differing opinions warrants caution. Investors should carefully weigh the risks and potential rewards before making investment decisions.

Related: XRP Demand Evaporates: Signals Next Target?

Source: Original article

Quick Summary

A prominent crypto investor, ChartFu, has announced a short position on XRP, anticipating a price decline. This contrasts with ongoing inflows into XRP ETFs and bullish sentiment from some high-profile figures, creating a mixed outlook.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.