XRP experienced notable outflows primarily from a single U.S. ETF, while global flows suggest underlying strength. Bitcoin saw significant outflows, but analysts argue the traditional halving cycle is outdated, suggesting a potential for substantial future growth.

What to Know:

- XRP experienced notable outflows primarily from a single U.S. ETF, while global flows suggest underlying strength.

- Bitcoin saw significant outflows, but analysts argue the traditional halving cycle is outdated, suggesting a potential for substantial future growth.

- Market sentiment, as reflected by the Dogecoin creator’s reaction, indicates exhaustion, often a precursor to market consolidation and potential reversal.

XRP is drawing increased attention from institutional investors amid evolving regulatory clarity and ETF developments. Recent market data reveals a nuanced picture, with headline outflows masking underlying bullish signals. Understanding these dynamics is crucial for assessing XRP’s potential within the broader digital asset landscape.

XRP Outflows: A U.S. ETF Story

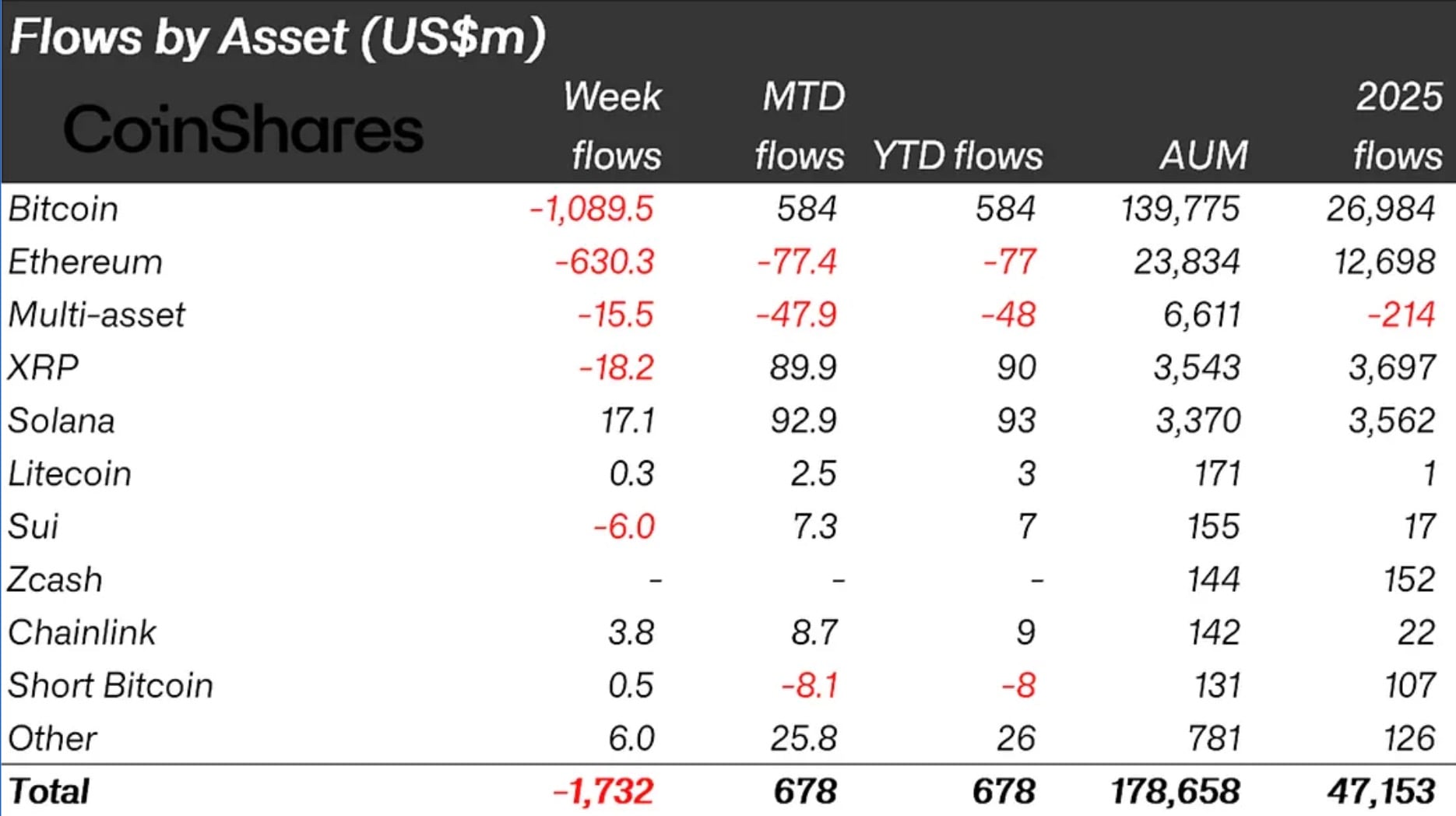

CoinShares data highlighted XRP outflows of $18.2 million, positioning it among the worst weekly performers alongside Bitcoin and Ethereum. However, a deeper analysis reveals that the overwhelming majority of these outflows, approximately $40.64 million, originated from a single U.S. spot ETF. This suggests a localized rebalancing event rather than a broad-based sell-off, with European and Canadian investors showing strong accumulation. Such regional divergences often reflect differing regulatory landscapes and investment strategies, reminiscent of the early days of Bitcoin ETFs where flows were heavily influenced by regional news.

Strategic Accumulation Amidst Weakness

While U.S. markets experienced outflows, Europe and Canada demonstrated significant inflows into XRP ETPs. Switzerland added $32.5 million, Germany $19.1 million, and Canada $33.5 million. This accumulation during a period of flat-to-declining prices indicates strategic positioning, potentially involving arbitrage between spot and derivative markets. Institutional investors often capitalize on such price discrepancies, and this behavior mirrors past accumulation patterns observed in other digital assets during periods of regulatory uncertainty.

XRP’s Positive Month-to-Date Flow

Despite the weekly outflow headline, XRP’s month-to-date flow remains positive at $89.9 million, surpassing most altcoins except for Solana. With assets under management (AUM) at $3.54 billion, XRP’s market presence remains robust. The narrative of panic-selling appears unfounded, with the data suggesting a structural rotation rather than a fundamental shift in sentiment. Such rotations are common in maturing asset classes as investors adjust their portfolios based on evolving market conditions and regulatory developments.

Samson Mow’s “Omegacycle” Thesis

Samson Mow challenges the conventional four-year halving cycle narrative for Bitcoin, arguing that institutional inflows and cross-border monetary dynamics have disrupted historical patterns. He posits an “Omegacycle,” where Bitcoin’s price is governed by monetary compression, liquidity spillovers, and sovereign accumulation. This perspective suggests that traditional models may no longer accurately predict Bitcoin’s future performance, and investors should focus on macroeconomic factors instead. This shift aligns with the increasing integration of Bitcoin into the broader financial system.

The most bullish things for #Bitcoin happened in the last year: two popular myths were shattered.

1⃣ The 4-year cycle. The illusion is over. An Omegacycle is in the cards.

2⃣ Bitcoin is too big to see a 10x. Gold saw almost 2x. Silver 3.4x.Now we just wait patiently. 🚀

— Samson Mow (@Excellion) January 25, 2026

Bitcoin’s Potential 10x Growth

Mow’s bullish outlook extends to Bitcoin’s potential for a 10x increase, citing the asset’s growing role as a reserve layer. Comparing Bitcoin’s market cap to that of gold and silver, he suggests significant upside potential remains. Despite recent outflows, the limited gains in short-Bitcoin products indicate a lack of conviction in the sell-off, suggesting it was primarily driven by positioning adjustments. This resilience mirrors past market corrections where long-term holders maintained their positions, anticipating future gains.

Market Sentiment and Exhaustion

The co-founder of Dogecoin, Billy Markus, captured the current market sentiment with a single word: “sigh.” This reaction reflects a broader sense of exhaustion and disinterest, as engagement metrics across various platforms decline. Such emotional flatlines often precede periods of consolidation and potential price reversals. Historically, these periods of low engagement have presented opportunities for strategic accumulation, as the market prepares for its next phase of growth.

In conclusion, while headline data may suggest bearish trends, a deeper analysis reveals nuanced dynamics within the crypto market. XRP’s outflows are primarily localized to a single U.S. ETF, while global flows indicate continued accumulation. Samson Mow’s “Omegacycle” thesis challenges traditional Bitcoin narratives, and market sentiment suggests potential consolidation and reversal. These factors highlight the importance of understanding market structure and institutional positioning for informed investment decisions.

Related: Cardano (ADA) Fundamentals Signal Market Shift

Source: Original article

Quick Summary

XRP experienced notable outflows primarily from a single U.S. ETF, while global flows suggest underlying strength. Bitcoin saw significant outflows, but analysts argue the traditional halving cycle is outdated, suggesting a potential for substantial future growth.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.