Franklin Templeton, a $1.6 trillion asset manager, has recognized XRP as foundational to global settlement infrastructure, highlighting its potential beyond price speculation.

What to Know:

- Franklin Templeton, a $1.6 trillion asset manager, has recognized XRP as foundational to global settlement infrastructure, highlighting its potential beyond price speculation.

- The launch of spot XRP ETFs, including Franklin Templeton’s XRPZ, signals growing institutional acceptance and provides a regulated avenue for investment.

- Despite past regulatory hurdles, XRP is witnessing renewed interest from financial institutions, driven by its utility in payment rails, settlement systems, and cross-border value transfer.

XRP, once sidelined due to regulatory uncertainties, is now garnering significant attention from institutional players like Franklin Templeton. The asset manager’s recognition of XRP as foundational to global settlement, coupled with the launch of XRP-based ETFs, marks a turning point for the digital asset. This shift underscores a broader trend of institutions focusing on the utility and infrastructure aspects of cryptocurrencies, rather than just speculative price movements, potentially reshaping the market landscape.

ETF Inflows and Market Validation

The recent launch of spot XRP ETFs and subsequent inflows demonstrate a clear institutional appetite for the asset. Franklin Templeton’s XRPZ ETF, along with others, has collectively attracted significant capital, signaling a vote of confidence from professional investors. This influx of funds can have a stabilizing effect on XRP’s price, reducing volatility and increasing liquidity, making it more attractive for larger institutional portfolios. The ETF structure also provides a familiar and regulated framework for institutions to gain exposure, further facilitating adoption.

Regulatory Hurdles and Institutional Hesitation

XRP’s journey to institutional acceptance hasn’t been without its challenges. The SEC’s lawsuit against Ripple caused many institutions to steer clear of XRP, fearing regulatory repercussions. This hesitation highlights the significant impact regulatory uncertainty can have on institutional adoption of digital assets. However, Franklin Templeton’s decision to launch an XRP ETF despite the ongoing legal battle suggests a growing confidence in XRP’s long-term viability and a potential shift in the regulatory landscape.

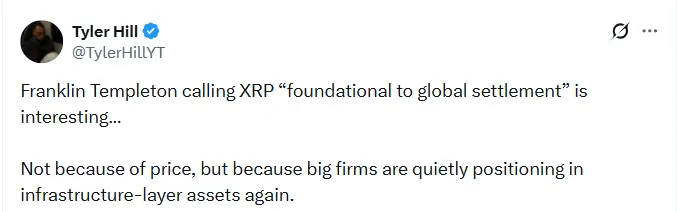

XRP as Infrastructure Layer

Tyler Hill’s observation that institutions are quietly rebuilding exposure to digital assets at the infrastructure layer of global finance is particularly insightful. XRP’s ability to facilitate fast and low-cost cross-border payments positions it as a key player in modernizing global settlement systems. This utility-driven narrative resonates with institutions seeking long-term value and real-world applications of blockchain technology. As traditional financial institutions look to integrate blockchain solutions, XRP’s established presence in the payments space gives it a competitive advantage.

Broader Institutional Adoption

Beyond ETFs, the increasing number of firms launching corporate XRP treasuries indicates a broader trend of institutional adoption. These treasuries allow companies to hold XRP as part of their corporate reserves, potentially using it for payments, hedging, or investment purposes. This trend suggests that XRP is not just seen as a speculative asset but also as a functional tool for businesses operating in the global economy. The involvement of established financial bodies like the IIF and IMF further validates XRP’s potential in cross-border payments.

Parallels to Previous ETF Launches

The market’s reaction to XRP ETFs mirrors the initial response to Bitcoin ETFs, where institutional interest surged following the launch of regulated investment vehicles. The increased accessibility and regulatory clarity provided by ETFs can unlock significant capital from institutional investors who were previously hesitant to invest directly in digital assets. While past performance is not indicative of future results, the historical precedent suggests that XRP ETFs could drive further adoption and price appreciation in the long term.

In conclusion, Franklin Templeton’s endorsement of XRP as foundational to global settlement, coupled with the launch of XRP ETFs and growing institutional interest, marks a significant milestone for the digital asset. While regulatory uncertainties remain, XRP’s utility in cross-border payments and its increasing acceptance among institutional players suggest a promising future within the evolving landscape of global finance. This shift towards utility and infrastructure could reshape the digital asset market, attracting long-term investment and fostering innovation.

Related: Crypto News: XRP Liquidation, Ethereum, Bitcoin

Source: Original article

Quick Summary

Franklin Templeton, a $1.6 trillion asset manager, has recognized XRP as foundational to global settlement infrastructure, highlighting its potential beyond price speculation. The launch of spot XRP ETFs, including Franklin Templeton’s XRPZ, signals growing institutional acceptance and provides a regulated avenue for investment.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.