FXRP, the wrapped XRP asset on the Flare Network, has surpassed 100 million tokens in circulation, indicating strong adoption of XRP-based decentralized finance (DeFi).

What to Know:

- FXRP, the wrapped XRP asset on the Flare Network, has surpassed 100 million tokens in circulation, indicating strong adoption of XRP-based decentralized finance (DeFi).

- This milestone reflects growing interest in yield-generating opportunities within the XRP ecosystem and the broader trend of bringing real-world assets into DeFi.

- The surge in FXRP supply and its utilization in DeFi protocols highlights the potential for institutional flows into XRPFi, while a temporary pause in minting underscores the importance of security in this nascent market.

The Flare Network has seen its wrapped XRP asset, FXRP, achieve a significant milestone, exceeding 100 million tokens in circulation. This development, occurring just five months after the launch of FAssets, signals a robust appetite for XRP-based decentralized finance (DeFi) solutions. The increasing demand for yield-generating products within the XRP ecosystem is a key driver behind this growth, suggesting a potential shift in how XRP holders engage with their assets.

FXRP Adoption and Market Dynamics

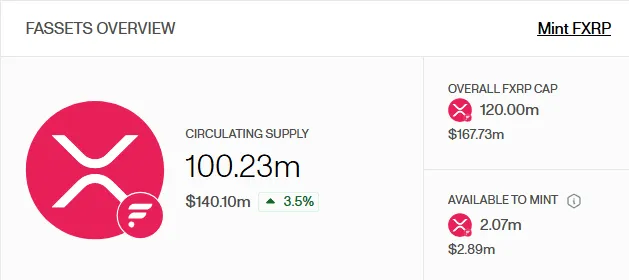

FXRP’s circulating supply recently crossed the 100 million mark, reflecting increased demand for XRP DeFi solutions. At the time of writing, the supply stands at 100.23 million tokens, valued at approximately $140.10 million, minted across 38,030 transactions. This indicates that a substantial amount of XRP is being actively utilized to generate yield on the Flare network.

The majority of FXRP tokens are locked within Flare-native DeFi platforms like Kinetic and Firelight, where users deploy these assets to earn yield. This high utilization rate points to practical application rather than speculative accumulation, suggesting a healthy and sustainable market dynamic.

Flare’s Perspective on XRPFi

Flare’s official commentary emphasizes that the significance of this milestone lies not in the numerical value alone, but in what it represents for the XRP ecosystem. XRPFi is designed as a platform for managing large XRP balances, providing access to yield opportunities through verifiable smart contracts and robust distribution mechanisms. The focus is on delivering a seamless user experience while maintaining a structured, risk-aware approach to DeFi.

FXRP serves as a crucial infrastructure component, enabling predictable, reliable, and scalable participation in decentralized finance. This framework aims to attract institutional investors seeking exposure to DeFi yields while adhering to established risk management practices.

Temporary Suspension of FAssets Bridging

Amidst the growing adoption of FXRP, Flare has proactively suspended the minting of new tokens. This decision was prompted by a report from a security partner, highlighting the network’s commitment to maintaining a secure environment. According to Flare’s co-founder, Hugo Philion, the suspension is not due to any active exploit or breach, and no funds have been compromised.

The team is preparing a contract upgrade to further enhance security measures. This update will be deployed on both the Flare and Songbird networks, with additional details to be communicated prior to implementation. The minting of the remaining 2.07 million FXRP tokens will remain paused until the upgrade is complete and all identified issues are resolved.

Implications for Institutional Investors

The increasing adoption of FXRP and the development of XRPFi present potential opportunities for institutional investors looking to diversify their portfolios with digital assets. The ability to earn yield on XRP holdings through DeFi platforms may attract institutions seeking to generate passive income from their crypto investments. However, it’s crucial to acknowledge the inherent risks associated with DeFi, including smart contract vulnerabilities and regulatory uncertainty.

The temporary suspension of FXRP minting serves as a reminder of the importance of security and risk management in the DeFi space. Institutional investors should conduct thorough due diligence and carefully assess the risks before allocating capital to XRPFi or any other DeFi platform. The long-term success of XRPFi will depend on its ability to provide a secure, reliable, and scalable environment for institutional participation.

The surge in FXRP adoption and the development of XRPFi represent a significant step forward for the XRP ecosystem, potentially opening doors for institutional investment and further integration of XRP into the broader DeFi landscape. While the temporary pause in minting underscores the need for robust security measures, the overall trend suggests a growing appetite for XRP-based yield-generating opportunities. As the market matures and regulatory clarity emerges, XRPFi could become an increasingly attractive option for institutional investors seeking exposure to digital assets.

Related: Bitcoin Bubble Claims Persist, Schiff Admits Error

Source: Original article

Quick Summary

FXRP, the wrapped XRP asset on the Flare Network, has surpassed 100 million tokens in circulation, indicating strong adoption of XRP-based decentralized finance (DeFi). This milestone reflects growing interest in yield-generating opportunities within the XRP ecosystem and the broader trend of bringing real-world assets into DeFi.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.