XRP options expiry is once again drawing investor attention due to rising demand for downside protection, mirroring behavior observed in larger markets like Bitcoin and Ethereum.

XRP options expiry is once again drawing investor attention due to rising demand for downside protection, mirroring behavior observed in larger markets like Bitcoin and Ethereum.

High-Stakes Derivatives Event Centers on Bitcoin

Over $14.6 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to expire this Friday on Deribit. According to Deribit Metrics, this marks one of the most impactful derivative expiries of 2025. The majority of that volume is skewed toward Bitcoin puts, suggesting continued hedging efforts against potential market pullbacks. The ETH options show a more even distribution between bullish and bearish positions.

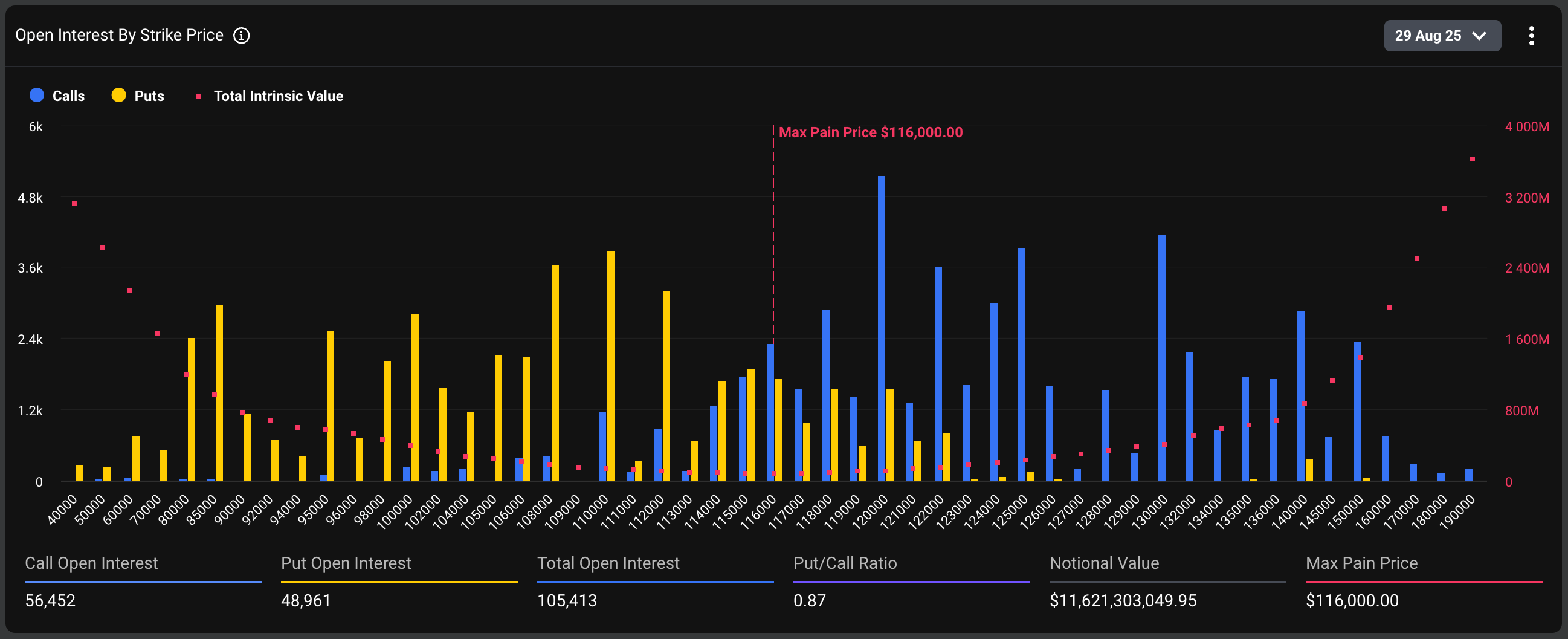

Currently, there are 56,452 Bitcoin call options and 48,961 put options nearing settlement—collectively representing a notional value of $11.62 billion. Since one contract on Deribit equals one unit of BTC or ETH, the size of this expiry underscores its significance for the crypto derivatives market. Deribit continues to dominate this segment, holding 80% of global crypto options activity.

Bitcoin open interest clustered around $108K to $120K for puts and calls respectively.

Strikes Reveal Market Sentiment Toward BTC and ETH

An analysis of open interest in BTC options reveals most activity is centered around near-the-money puts priced between $108,000 and $112,000. On the upside, call options with strike prices starting at $120,000 are seeing the most action, pointing to a cautious optimism among some traders for a price rally.

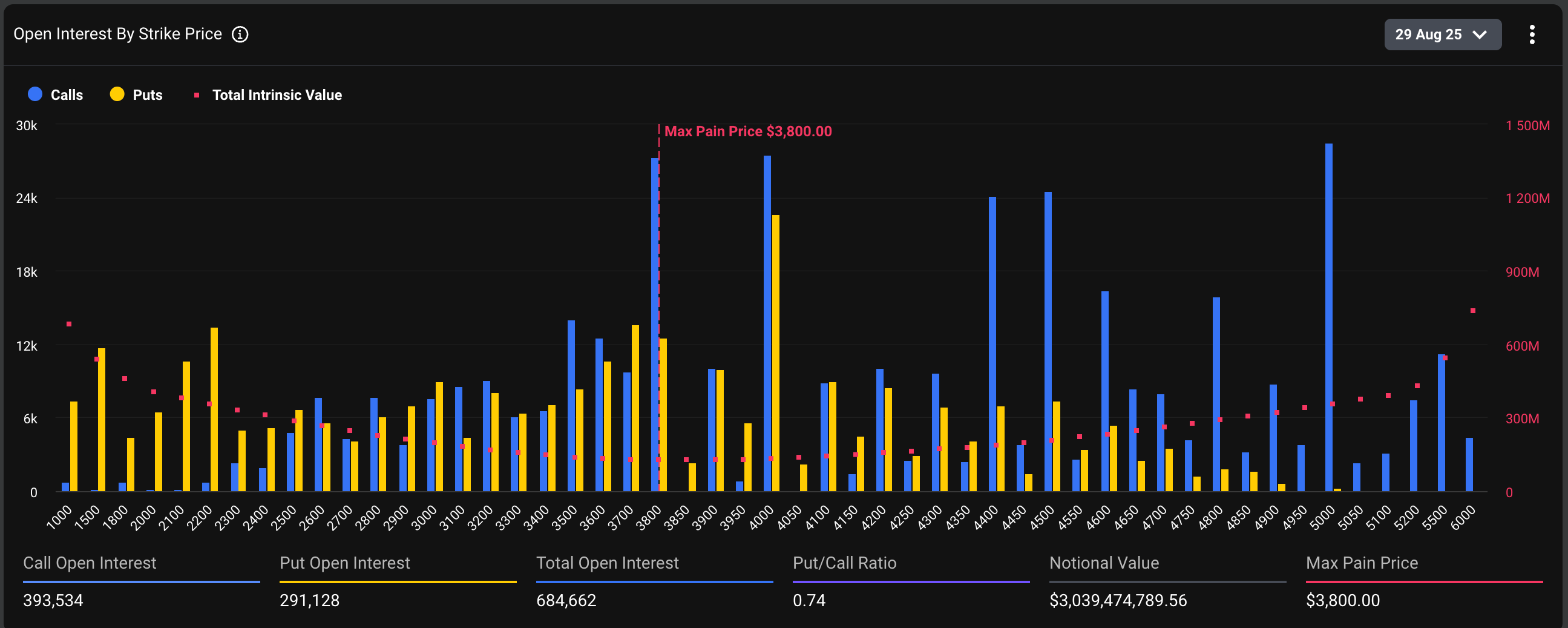

On the ethereum front, there are 393,534 call options and 291,128 put options due this week, totaling $3.03 billion in open interest. Call contracts are mainly focused on strike levels at $3,800, $4,000, and $5,000. Meanwhile, puts cluster around $4,000, $3,700, and $2,200—demonstrating a broad directional spread among traders.

Ethereum options open interest shows more balance between call and put positions.

Deribit commented on the skew between BTC and ETH, stating on X: “BTC expiry points to persistent demand for downside protection, while ETH looks more neutral. Combined with Powell’s Jackson Hole signal, this expiry may help set the market tone for September.”

Crash Course: Crypto Options and Derivative Trends

Options contracts give holders the ability to buy (call option) or sell (put option) an asset at a preset price before a specific date. Call options are commonly viewed as bullish, whereas puts offer a hedge against market dives—providing key insight into investor sentiment.

The use of crypto options has expanded significantly since 2020, especially regarding monthly and quarterly expiries. These events are known to sway market momentum on a short-term basis. By 2021, some analysts introduced the concept of a “max pain” zone—theoretical price levels causing maximal losses to options holders—as a potential pull factor for prices nearing expiry. However, the accuracy of this theory continues to be debated in the trading community.

Currently, the max pain thresholds are pegged at $116,000 for Bitcoin and $3,800 for Ethereum, aligning with the most active strike zones visible in the open interest data.

Related: XRP Price: $12M Max Pain for Bears

For added context around market movements, read more about recent liquidations impacting bullish positions across Ether, Dogecoin, and Bitcoin: Ether, Dogecoin, Bitcoin Plunge Sees $900M in Bullish Bets Liquidated.

Quick Summary

XRP options expiry is once again drawing investor attention due to rising demand for downside protection, mirroring behavior observed in larger markets like Bitcoin and Ethereum. High-Stakes Derivatives Event Centers on Bitcoin Over $14.6 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to expire this Friday on Deribit.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.