XRP continues to show strength in the cryptocurrency sector, emerging as the only top-tier digital asset that has remained profitable for holders over the past three to six months, according to recent data from Glassnode.

XRP continues to show strength in the cryptocurrency sector, emerging as the only top-tier digital asset that has remained profitable for holders over the past three to six months, according to recent data from Glassnode.

Despite general market uncertainty and a lackluster start to 2025 compared to the explosive finish of 2024, XRP has managed to maintain a slight upward trajectory. While most altcoins have either stagnated or declined significantly, XRP stands apart by delivering modest returns to recent investors.

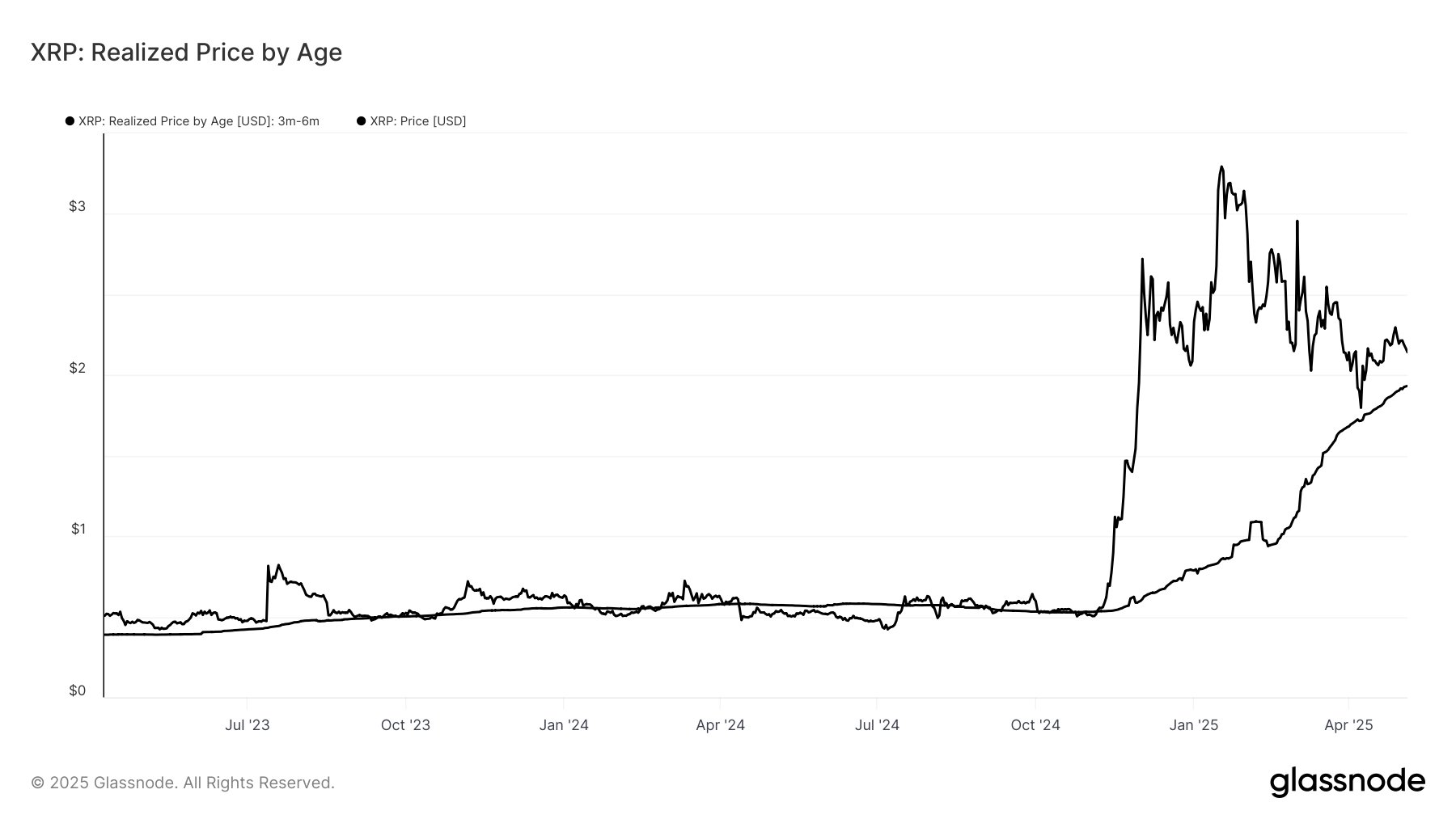

After a strong rally that pushed its price up by over 35% to $3.399 in January, XRP has cooled down but still holds a 2% gain year-to-date. This performance is relatively robust, considering major assets like Ethereum and Solana have failed to maintain such resilience. According to Glassnode’s report, holders who purchased XRP between December and January are currently sitting on at least an 11% unrealized profit, reinforcing XRP’s position as a stable choice amidst prevailing market volatility.

XRP’s Mid-Term Stability Amid Market Downturn

The insight from Glassnode emphasizes the mid-term sentiment in the crypto landscape. The study compared realized prices — essentially the average entry price — of key digital assets over a three to six-month window. In doing so, it revealed that most investors in this period are underwater. XRP, however, remains an exception.

Solana, now trading at $146, has dropped 28% below its average buy-in value among mid-term holders. Ethereum has also struggled, with its current price sitting 36% below its realized cost basis for investors within the same timeframe. Bitcoin, the market’s flagship, fares slightly better but still trends below the cost basis, hovering around $95,000. A recent rally to $96,000 offered temporary relief, though it wasn’t sufficient to guarantee profitability for holders from earlier this year.

Meanwhile, XRP has not only held ground but has also delivered positive returns. This suggests reduced sell-offs from mid-term investors and positions XRP as a preferable asset for newcomers seeking stability in an otherwise choppy market.

Broader Market Sentiment Remains Cautious

Glassnode warns that overall market sentiment remains fragile. Assets failing to exceed their three-to-six-month cost basis typically indicate ongoing weakness and lack of bullish momentum. Bitcoin, for instance, is currently battling to break past resistance at $97,000 despite rallying 12.7% from its April lows. This resistance zone continues to curb enthusiasm, reflecting broader caution among investors.

That said, there’s a glimmer of hope for Bitcoin and the wider crypto market. As reported by Santiment, large-scale investors have begun accumulating more Bitcoin again. Wallets holding between 10 and 10,000 BTC have collectively bought 81,338 BTC over the last six weeks. This notable accumulation suggests renewed confidence in a bullish outcome.

Additionally, macroeconomic dynamics are beginning to lean in favor of high-risk assets like cryptocurrencies. Developments in ongoing US-China trade negotiations and anticipated monetary easing have set the stage for a potential resurgence. These changes could fuel significant upward trends across the crypto market, including for XRP.

Why XRP Holds an Advantage

XRP’s ability to maintain profitability for mid-term holders not only sets it apart from its peers but also enhances its appeal in a turbulent market. Its consistent performance could be viewed as a sign of market maturity and investor confidence, even as external factors put pressure on other assets.

As macro and microeconomic indicators begin pointing towards recovery, assets like XRP that show resilience in tough conditions may become go-to choices for traders and long-term investors alike. With fewer holders compelled to sell at a loss, XRP enjoys reduced downward pressure—which could pave the way for a more sustained upward move if broader market conditions stabilize.

Related: Expert Advice: Sell XRP If You’re Confused

For now, XRP appears to be the rare beacon of consistency in a crypto market characterized by unpredictability.

Quick Summary

XRP continues to show strength in the cryptocurrency sector, emerging as the only top-tier digital asset that has remained profitable for holders over the past three to six months, according to recent data from Glassnode.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.