XRP spot ETFs have rapidly accumulated nearly $1 billion in assets, showcasing initial investor interest. The true test for XRP lies in its utility for cross-border payments and on-chain activity, not just ETF demand.

What to Know:

- XRP spot ETFs have rapidly accumulated nearly $1 billion in assets, showcasing initial investor interest.

- The true test for XRP lies in its utility for cross-border payments and on-chain activity, not just ETF demand.

- Growth in ODL volume, active addresses, and RWA capitalization on XRPL will determine long-term adoption.

XRP has captured significant attention with the launch of several spot ETFs in the United States, collectively managing nearly $1 billion in assets. This surge in ETF holdings highlights the initial enthusiasm for XRP exposure through regulated investment vehicles. However, the long-term viability of XRP hinges on factors beyond ETF performance.

The growth of XRP ETFs has been remarkable, jumping from approximately $336 million at launch to almost $1 billion in just two months. This rapid accumulation indicates strong early interest, but it also raises questions about the sustainability of this demand. The key now is whether XRP can maintain and grow its utility beyond these investment products.

RippleNet has expanded to include over 300 financial institutions across more than 55 countries, with a significant portion actively using XRP for On-Demand Liquidity (ODL). ODL processed over $15 billion in cross-border payments in 2024, demonstrating a substantial increase in real-world usage. The expansion of ODL corridors and increased participation from RippleNet clients will be crucial for sustained growth.

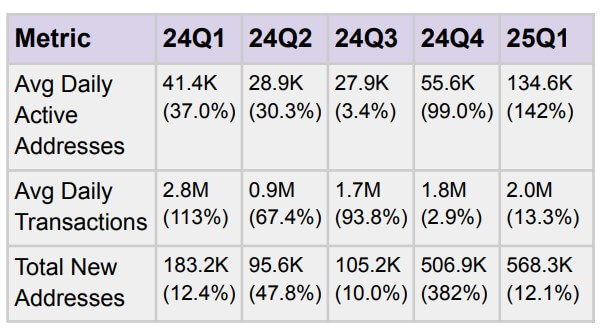

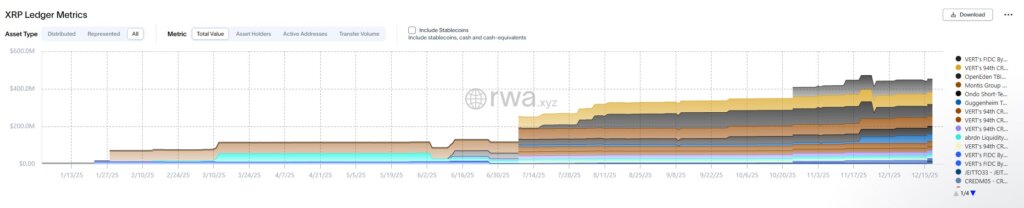

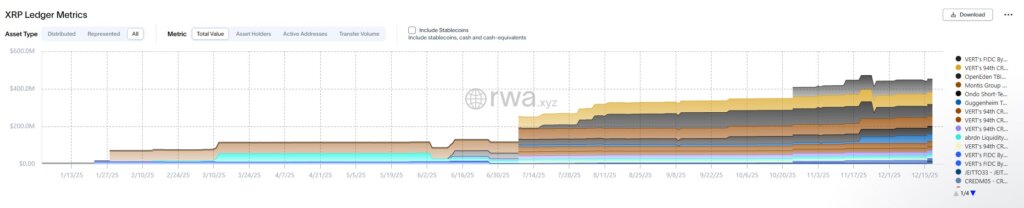

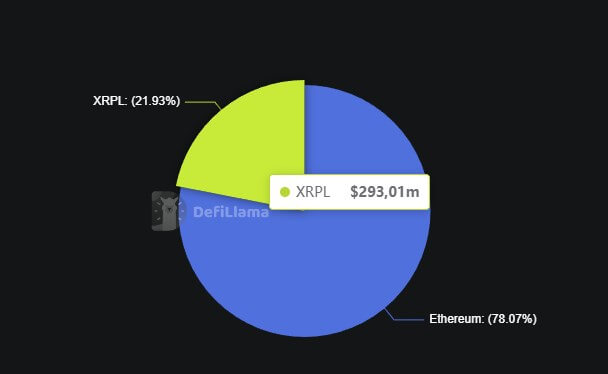

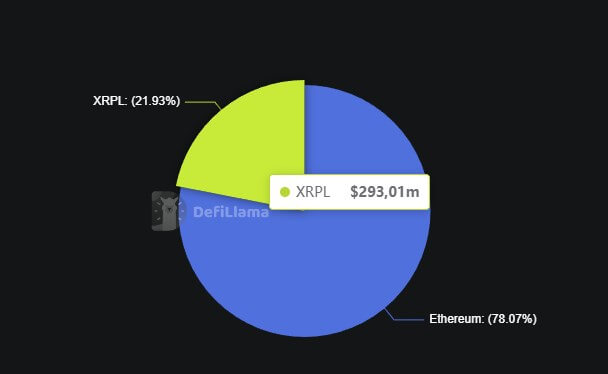

XRPL’s on-chain activity is another vital indicator of XRP’s adoption. In the third quarter of 2025, the network handled approximately 1.8 million transactions per day, with payments remaining the dominant use case. The growth of tokenized real-world assets (RWAs) on XRPL, along with the adoption of Ripple’s RLUSD stablecoin, further contributes to the network’s utility.

XRP’s liquidity structure and institutional plumbing are robust, with Kaiko ranking it alongside Ethereum in terms of liquidity, market depth, and institutional adoption. The average daily trading volume of XRP is substantial, reflecting its status as a top-tier crypto asset. Maintaining this liquidity, even if ETF inflows stabilize, will be essential for long-term viability.

Ultimately, the durability of XRP’s demand will be determined by the growth of ODL volumes, the expansion of on-chain payments and active addresses, and the increasing capitalization of RWAs and RLUSD on XRPL. If these metrics continue to rise, even with stable ETF assets under management, it will signal that XRP has achieved genuine, structural adoption.

In conclusion, while XRP ETFs have provided a significant boost and new access channel, the true measure of XRP’s success lies in its ability to establish itself as a core infrastructure for cross-border payments and on-chain finance. The focus should be on monitoring the growth and utilization of its underlying technology and network.

Related: XRP Destroyed Portfolios, Expert Reveals

Source: Original article

Quick Summary

XRP spot ETFs have rapidly accumulated nearly $1 billion in assets, showcasing initial investor interest. The true test for XRP lies in its utility for cross-border payments and on-chain activity, not just ETF demand. Growth in ODL volume, active addresses, and RWA capitalization on XRPL will determine long-term adoption.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.