XRP is playing a pivotal role in the new chapter of Gemini Exchange as the crypto trading platform prepares for its long-anticipated IPO with financial backing from Ripple.

XRP is playing a pivotal role in the new chapter of Gemini Exchange as the crypto trading platform prepares for its long-anticipated IPO with financial backing from Ripple.

Gemini Prepares for IPO Backed by Ripple

Gemini Space Station, Inc., the parent company behind Gemini Exchange founded by the Winklevoss twins, has officially submitted an S-1 filing to the U.S. Securities and Exchange Commission (SEC), marking its intention to go public. This move adds Gemini to the growing list of crypto exchanges entering traditional financial markets.

In a key detail from the SEC submission, Gemini has secured a financing agreement with Ripple. Under the terms, Ripple has extended a revolving loan facility allowing Gemini to borrow at least $5 million per request, up to an initial limit of $75 million. The agreement potentially allows this cap to grow to $150 million, depending on collateral and other conditions.

Ripple may also provide funds beyond the initial commitment in RLUSD, its U.S. dollar-backed stablecoin. The agreed-upon interest rates are 6.5% or 8.5%, and all repayments must be made in USD, not in crypto assets.

Financial Challenges Amid Market Expansion

Financially, Gemini faces uphill challenges. According to the filing, the company experienced a dramatic rise in net losses, jumping more than 85% from $41.4 million to $282.5 million in the first half of 2025 compared to the same period in 2024. Revenues have also declined, slipping from $74.3 million to $68.6 million year-over-year for the same time frame.

Gemini plans to list on the NASDAQ under the ticker symbol “GEMI.” If the launch proceeds smoothly, it will become the third crypto exchange to debut on a major U.S. market. Coinbase made headlines with its NASDAQ debut in 2021, while Bullish recently celebrated its New York Stock Exchange listing with a $13.2 billion valuation.

Where Gemini Stands Among Exchanges

Despite its high-profile founders and Wall Street ambitions, Gemini is not among the upper echelon of crypto exchanges in terms of trading volume. Data from CoinMarketCap at the time of writing places Gemini 24th in spot trading and 16th in derivatives markets.

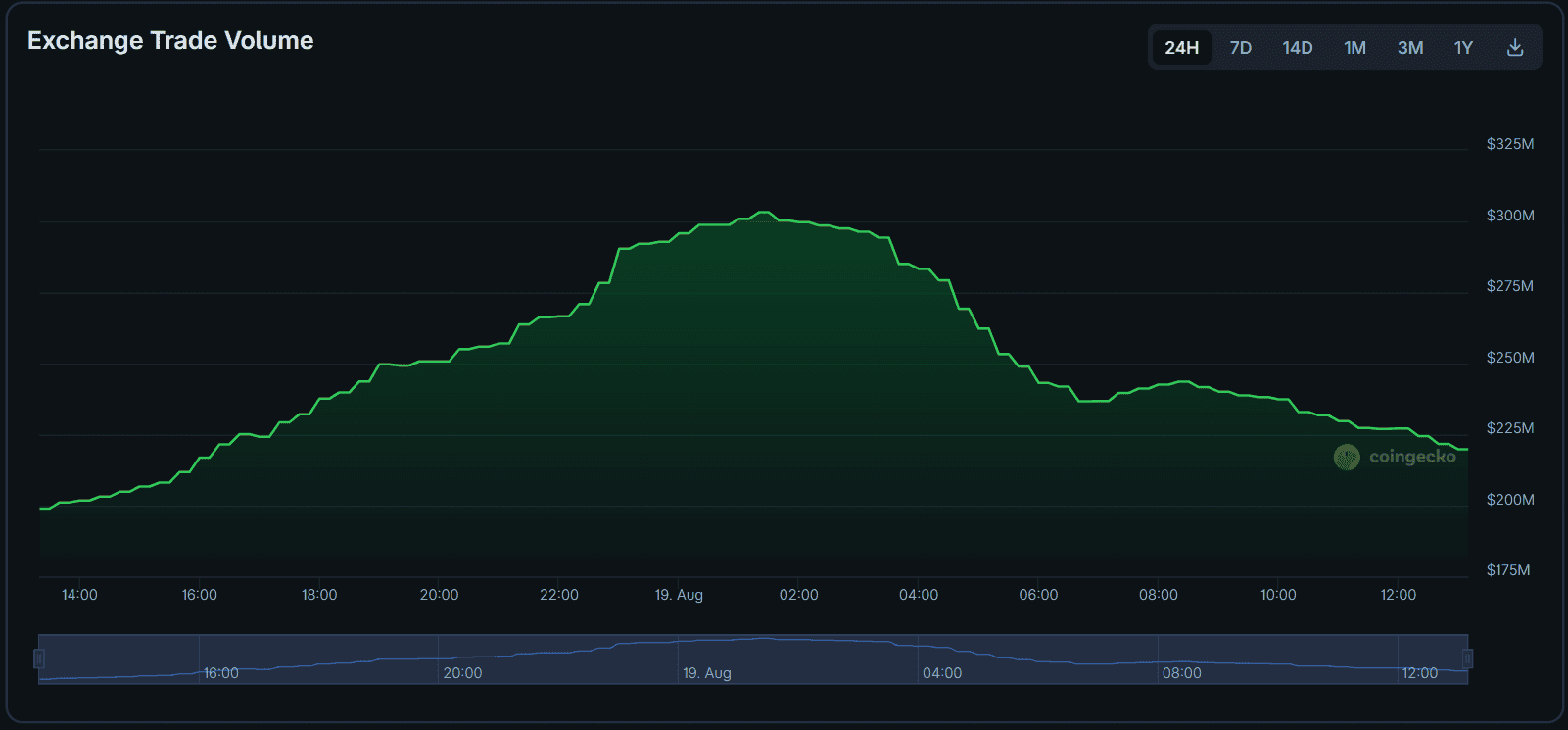

Still, the exchange maintains a strong reputation. CoinGecko has given Gemini a Trust Score of 9 out of 10, and it has facilitated over $220 million in trading volume in the past 24 hours, signaling solid market activity despite increased competition.

Gemini ranked strong by CoinGecko with notable trading volume.

Related: XRP Price: $12M Max Pain for Bears

As Gemini positions itself for public trading, Ripple’s credit support plays a crucial role in helping the exchange manage current financial stress while pursuing market expansion. This collaboration could mark a significant partnership model for fintech-driven IPOs moving forward.

Quick Summary

XRP is playing a pivotal role in the new chapter of Gemini Exchange as the crypto trading platform prepares for its long-anticipated IPO with financial backing from Ripple.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.