XRP price action has come under increased scrutiny as legal turbulence, speculation over a possible ETF, and fresh technical glitches spark market hesitation. Despite optimistic projections for Ripple’s future, short-term uncertainty is hitting XRP hard. Ripple’s legal feud with the U.S.

XRP price action has come under increased scrutiny as legal turbulence, speculation over a possible ETF, and fresh technical glitches spark market hesitation. Despite optimistic projections for Ripple’s future, short-term uncertainty is hitting XRP hard.

Ripple’s legal feud with the U.S. Securities and Exchange Commission (SEC) remains unresolved, stirring concern across the investor base. While Ripple’s CEO had previously alluded to progress in the case, the SEC has yet to formally withdraw its appeal. Traders are now keeping a close eye on the Commission’s upcoming private meeting on May 8, seen as a potential inflection point in the saga.

Over the weekend, XRP slipped 0.97%, settling at $2.1882 by the close of Saturday. This followed a minor 0.14% decline on Friday, reflecting broader negative sentiment in the digital asset sphere. The total cryptocurrency market cap dropped 1.07% to $2.94 trillion, underscoring the caution prevalent throughout the sector.

At press time, XRP hovered around $2.19, showing a 24-hour slide of 0.72% per data from the XRP Liquid Index. The market is treading water as participants await news from the SEC’s closed meeting, which could finally bring formal clarity to Ripple’s widely watched legal case.

Lingering Legal Ambiguity Dampens Confidence

Although Ripple CEO Brad Garlinghouse confirmed an agreement with SEC staff, the official vote to dismiss the case hasn’t yet occurred. In Garlinghouse’s words, “The Commission hasn’t yet voted. But what we’ve agreed is to dismiss and move on.” Journalistic voices echoed this sentiment, pointing to the May 8 meeting as likely the moment for decision-making.

This indecision has placed pressure on the XRP market as traders hesitate to make bold plays until clear regulatory signals emerge. Ripple’s ongoing dilemma continues to color the broader discussion about crypto regulation in the U.S. marketplace.

Technicals Paint a Mixed Picture for XRP

Despite encouraging long-term indicators, short-term technicals remain bearish. XRP has slipped below its 50-day Exponential Moving Average, while managing to stay above the 200-day average—a crucial support level. The 14-day RSI is currently sitting at 51.82, implying further upside potential before reaching overbought territory.

Analysts see $2.22 as a key resistance marker. Should XRP cross it, higher targets at $2.50 and $3.00 become viable. However, failure to stay above $2.05 may see it fall toward $1.93. Meanwhile, the likelihood of a U.S.-based spot ETF for XRP has risen to 79%, up from 68% in late April. Yet approval still likely hinges on the resolution of the legal matter, delaying institutional inflow potential.

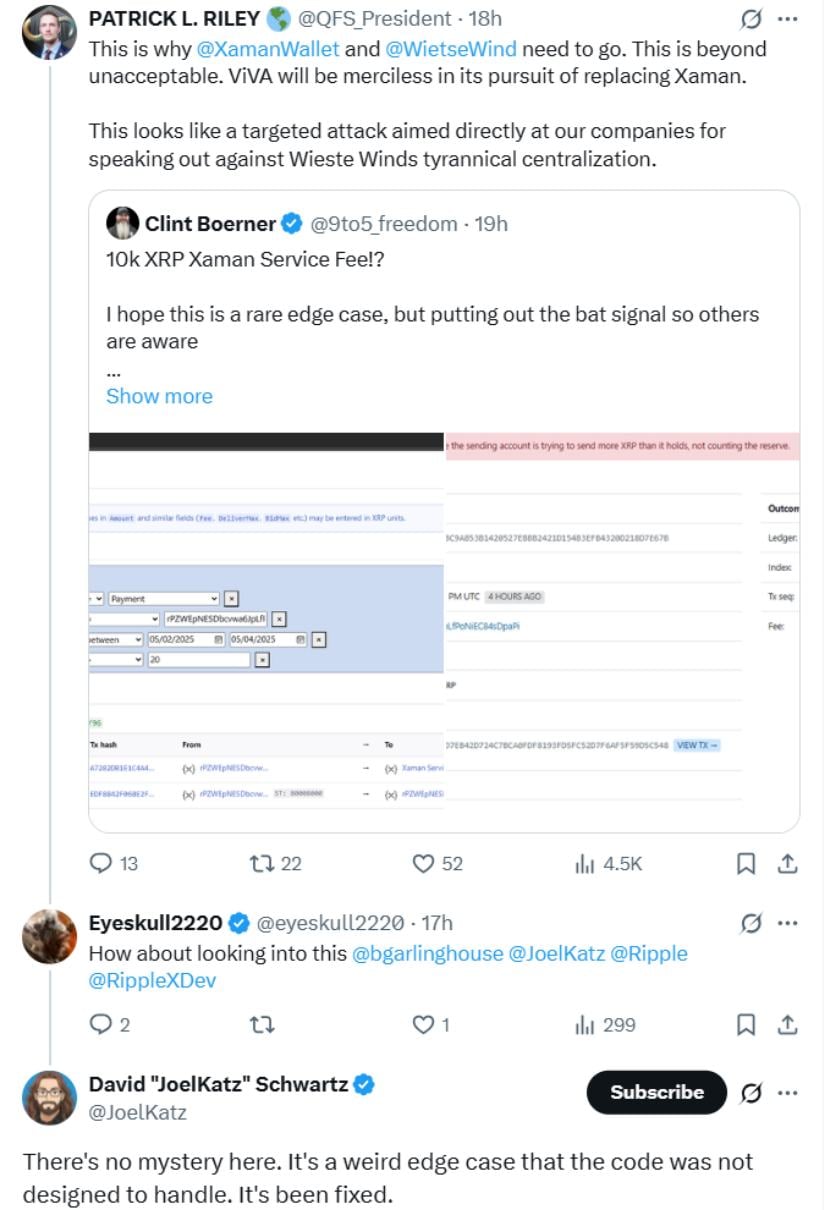

CTO Addresses XRP Ledger Bug

Adding to investor unease was a wallet issue spotlighted by a failed transaction that attempted to send 10,000 XRP using Xaman Wallet. The payment was stopped by the system due to insufficient funds, but the sheer amount raised alarms within the XRP ecosystem.

Ripple’s CTO, David Schwartz, quickly stepped in to control the narrative. He explained that the glitch was a rare and benign technical error, not indicative of a security threat or protocol flaw. The malfunction has since been corrected, and no funds were affected.

Mixed Market Outlook Clouds Forecasts

While critics warn of XRP’s struggle to break through long-standing resistance, many within the community maintain a bullish long-term perspective. High-profile supporters point to RippleNet’s expansion across over 55 countries and strategic alliances with institutions like SBI and Santander as firm grounds for optimism.

The trading community remains divided. Some analysts foresee modest gains, while others tout hyper-bullish predictions, including a possible leap to $24 by late 2025. More speculative forecasts, including figures beyond $10,000, are also making rounds—but are widely seen as overly optimistic by seasoned observers.

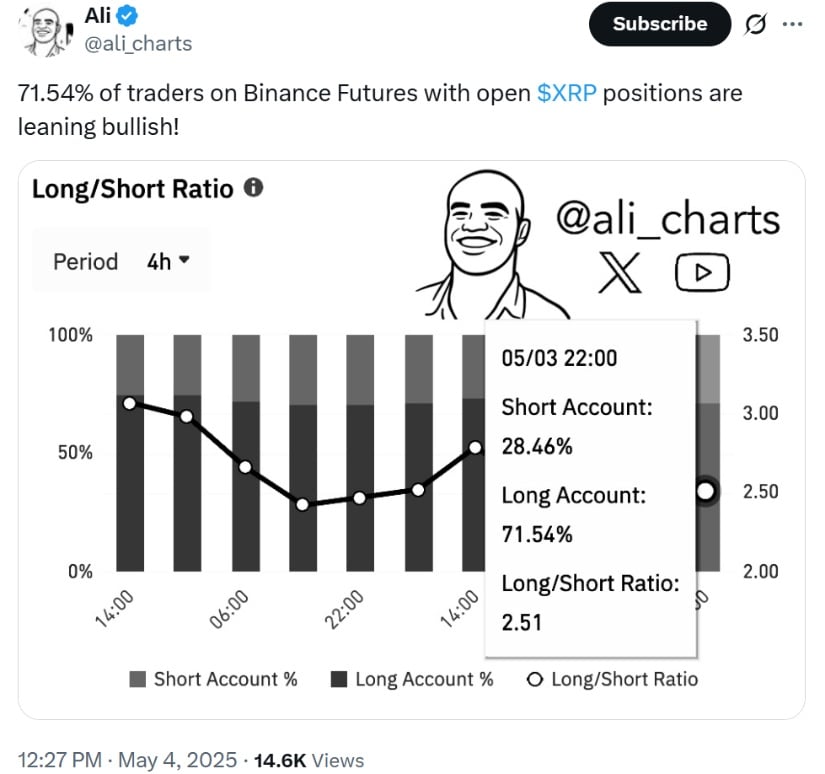

As of now, around 71.54% of open positions on Binance Futures favor a bullish breakout—hinting that traders are still banking on XRP’s recovery. Amidst these diverse projections, data shows that owning just 2,500 XRP places one in the global top 10% of XRP holders, reinforcing the idea of XRP as an asset for early adopters.

Outlook Hinges on Legal Milestones

In the days ahead, attention is locked on the SEC’s decision-making and whether it will finally allow Ripple’s cloud of litigation to lift. Until then, the ongoing mix of tech issues, regulatory anxiety, and ETF anticipation will likely keep XRP price activity unstable but full of potential.

Related: Expert Advice: Sell XRP If You’re Confused

If legal clouds disperse, XRP could be well-positioned not just for a rebound but for integration into the next phase of global digital finance. Despite short-term turbulence, long-time believers continue to see Ripple and XRP as sleeper agents for mass adoption.

Quick Summary

XRP price action has come under increased scrutiny as legal turbulence, speculation over a possible ETF, and fresh technical glitches spark market hesitation. Despite optimistic projections for Ripple’s future, short-term uncertainty is hitting XRP hard. Ripple’s legal feud with the U.S. Securities and Exchange Commission (SEC) remains unresolved, stirring concern across the investor base.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.