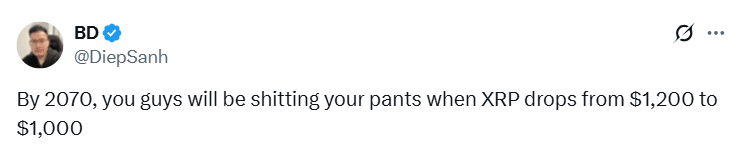

XRP community figure Diep Sanh predicts investor panic if XRP drops from $1,200 to $1,000 in the distant future. The analyst indicates a pattern of investors overreacting to price declines, even after substantial gains.

What to Know:

- XRP community figure Diep Sanh predicts investor panic if XRP drops from $1,200 to $1,000 in the distant future.

- The analyst highlights a pattern of investors overreacting to price declines, even after substantial gains.

- Despite XRP’s current price downturn, analysts suggest it may represent an accumulation opportunity for future growth.

Diep Sanh, a prominent voice in the XRP community, recently shared a long-term price prediction that includes a commentary on investor behavior. Sanh suggests that even if XRP reaches incredible heights, a future pullback could trigger undue panic among investors. This observation underscores the importance of maintaining a long-term perspective in the volatile crypto market.

Sanh’s prediction involves XRP reaching $1,200 and then declining to $1,000, which he believes would cause investors to panic despite the massive overall gains. This highlights a common psychological pitfall where investors focus on recent losses rather than the broader upward trajectory. Such reactions can lead to poor decision-making, especially in a market influenced by short-term volatility and news cycles.

The current market downturn reflects this pattern, as XRP has faced a challenging period. After reaching a market cap peak, XRP has seen a significant valuation decrease. However, it’s important to remember that XRP has shown resilience, maintaining a position significantly higher than its valuation just a year ago, indicating overall growth despite recent corrections.

Analysts suggest that the current downtrend could be an opportunity for investors to accumulate more XRP. The sentiment is that the market is presenting a chance to acquire XRP at levels not seen recently. This perspective encourages investors to view market corrections as potential entry points rather than reasons to panic, aligning with a long-term investment strategy.

In conclusion, while short-term price fluctuations are inevitable in the crypto market, maintaining a long-term perspective is crucial for XRP investors. Predictions like Diep Sanh’s serve as reminders to focus on the overall trajectory rather than reacting emotionally to temporary downturns, potentially turning market corrections into strategic opportunities.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP community figure Diep Sanh predicts investor panic if XRP drops from $1,200 to $1,000 in the distant future. The analyst highlights a pattern of investors overreacting to price declines, even after substantial gains. Despite XRP’s current price downturn, analysts suggest it may represent an accumulation opportunity for future growth.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.