XRP experienced a notable price correction, influenced by broader market trends and profit-taking. Technical indicators like the TD Sequential flashed sell indicates, contributing to the downward pressure on XRP. Whale activity, specifically large sell-offs, may have amplified XRP’s price decline.

What to Know:

- XRP experienced a notable price correction, influenced by broader market trends and profit-taking.

- Technical indicators like the TD Sequential flashed sell signals, contributing to the downward pressure on XRP.

- Whale activity, specifically large sell-offs, may have amplified XRP’s price decline.

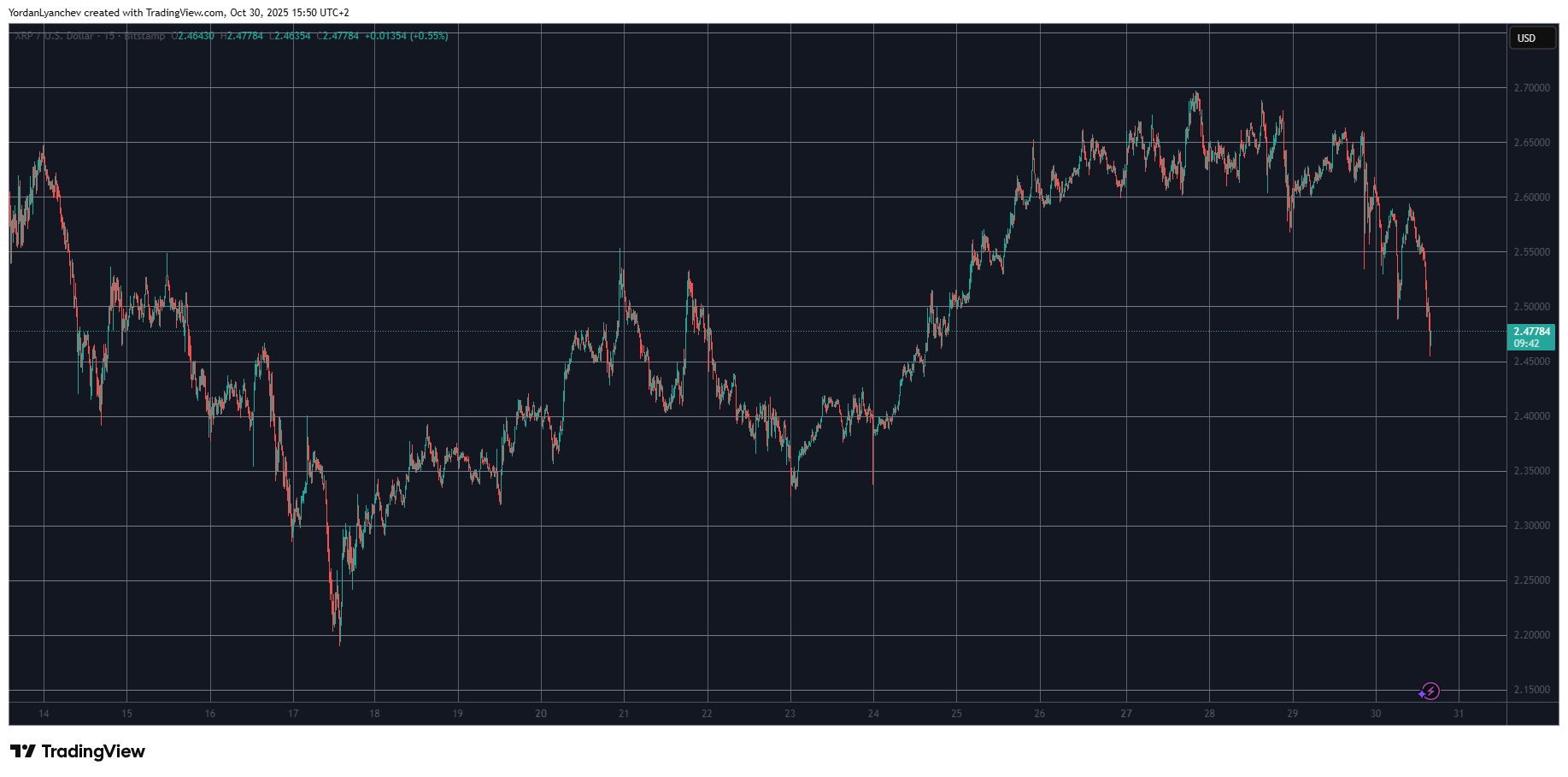

XRP has recently experienced a price correction, declining over 9% from its peak. Despite positive macroeconomic developments, including potential interest rate cuts and easing trade tensions, the cryptocurrency market is seeing mixed performance. This article explores the factors contributing to XRP’s recent downturn.

The most immediate cause appears to be a market-wide correction, with Bitcoin leading the decline and pulling down the prices of altcoins like XRP and Ethereum. XRP had previously enjoyed a strong rally, outperforming many other cryptocurrencies, so a pullback is not unexpected. Profit-taking after a significant price increase is a common market dynamic.

Technical analysis suggests that a sell signal from the TD Sequential indicator may have prompted some investors to reduce their XRP holdings. This indicator has historically been reliable in predicting XRP price movements. Moreover, data indicates that Ripple whales have been selling off their holdings, potentially exerting downward pressure on the token’s price.

The recent price drop triggered liquidations of leveraged XRP positions, but the figures are relatively small compared to Bitcoin and Ethereum. This suggests that while leverage played a role, it was not the primary driver of the correction. As the market matures, understanding these dynamics becomes crucial for investors and traders navigating the volatility of crypto assets.

While XRP’s recent performance may be concerning to some, corrections are a natural part of market cycles. The long-term prospects for XRP and Ripple will depend on the company’s ability to navigate regulatory landscapes and continue to develop innovative solutions for cross-border payments.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP experienced a notable price correction, influenced by broader market trends and profit-taking. Technical indicators like the TD Sequential flashed sell signals, contributing to the downward pressure on XRP. Whale activity, specifically large sell-offs, may have amplified XRP’s price decline.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.