Alpha Lions Academy founder Edoardo Farina suggests only 1% of investors may be able to afford XRP in the future. Macroeconomic pressures, institutional accumulation, and technological shifts are reshaping crypto market structure.

What to Know:

- Alpha Lions Academy founder Edoardo Farina suggests only 1% of investors may be able to afford XRP in the future.

- Macroeconomic pressures, institutional accumulation, and technological shifts are reshaping crypto market structure.

- XRP’s concentration in fewer hands could lead to price appreciation for remaining holders, but also raises concerns about retail access.

A new analysis suggests that XRP ownership may become increasingly concentrated, with only a small percentage of investors able to afford the asset in the future. The prediction factors in macroeconomic trends, institutional investment, and the evolving landscape of digital assets. While such forecasts warrant skepticism, the underlying trends are worth examining for institutional investors.

Economic Pressures on Retail Investors

The analysis points to broad economic challenges that could limit retail participation in crypto markets. Rising inflation, stagnant wages, and global economic instability are squeezing individual investors. Many are forced to liquidate crypto holdings, including XRP, to cover essential expenses. This trend potentially accelerates the shift of assets from retail hands to larger institutional players with deeper pockets.

On-Chain Data Reflects Concentration

Recent on-chain data appears to support the idea of increasing concentration among XRP holders. As XRP’s price has risen, the number of tokens required to be in the top 10% of holders has decreased. However, the dollar value required to reach that threshold has significantly increased. This suggests that while fewer tokens are needed, the financial barrier to entry is rising, potentially pricing out smaller investors. The data indicates a substantial portion of XRP is held by a relatively small number of large wallets.

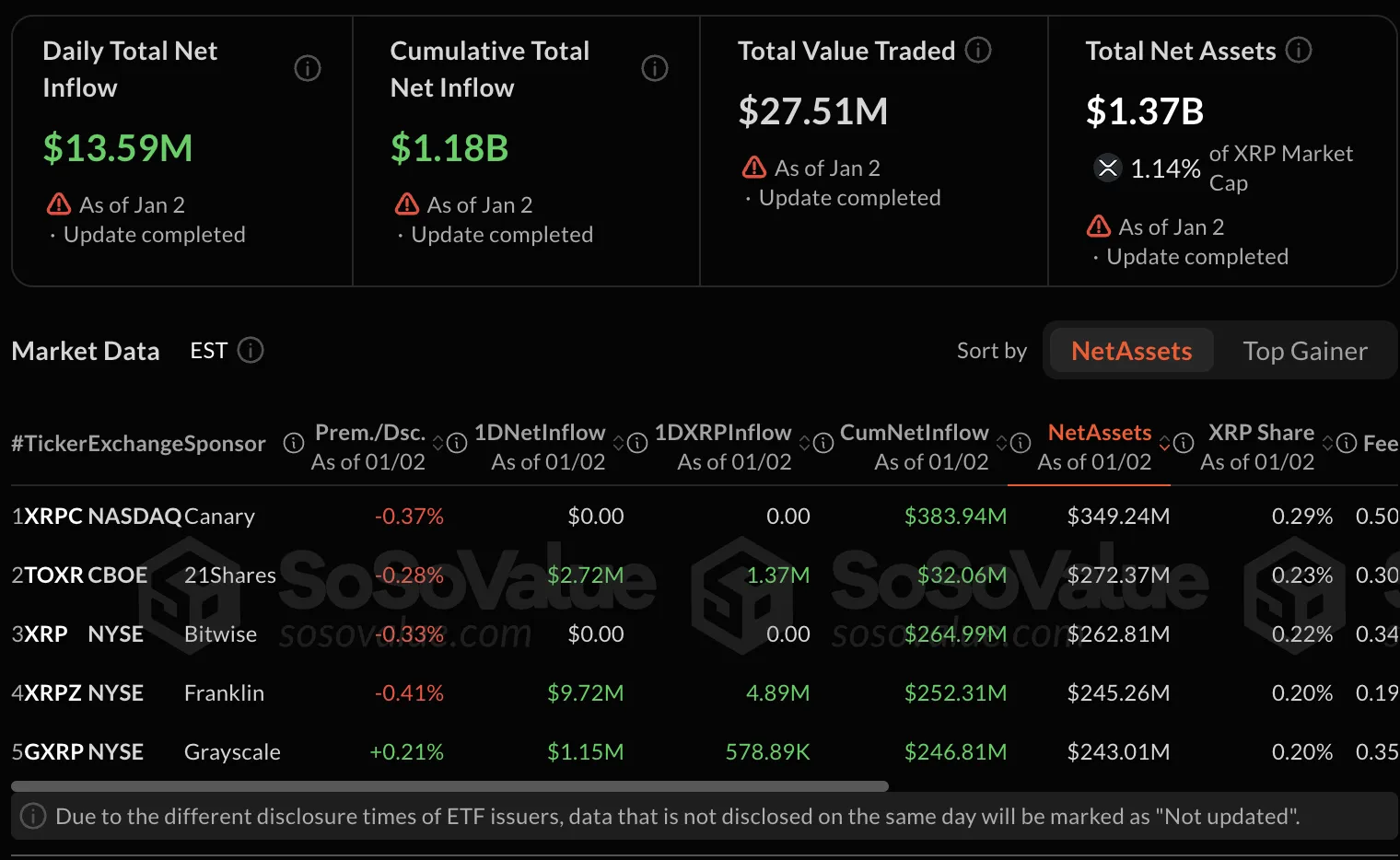

Institutional Inflows and ETF Dynamics

The analysis highlights growing institutional interest in XRP, with large financial institutions reportedly increasing their holdings. A key factor driving this trend is the launch of XRP-backed ETFs. These ETFs have accumulated a significant amount of XRP, further consolidating ownership. The ETF structure provides institutions with a regulated and familiar way to gain exposure to XRP, potentially reducing retail liquidity and influencing price dynamics.

Potential Price Scenarios

The confluence of reduced retail participation and increased institutional demand could lead to significant price appreciation for XRP. With fewer tokens available to the broader market, the remaining holders could see substantial gains if demand continues to rise. Some analysts have speculated about XRP reaching prices as high as $100 or even $1,000, though such projections should be viewed with caution. These figures are based on speculative future conditions, and the inherent volatility of crypto assets means that prices could move in either direction.

Regulatory and Technological Considerations

It’s important to consider the broader regulatory landscape and technological developments that could impact XRP’s future. Regulatory clarity, particularly in the United States, could significantly influence institutional adoption and market sentiment. Additionally, advancements in blockchain technology and the evolution of the digital asset ecosystem could create new opportunities or challenges for XRP. These factors, combined with macroeconomic forces, will ultimately determine the long-term trajectory of XRP and its accessibility to different investor segments.

While predictions of extreme price appreciation and limited accessibility should be taken with a grain of salt, the trends identified in the analysis—economic pressures on retail investors, increasing institutional interest, and the impact of ETF products—are relevant for those tracking the digital asset markets. The future distribution and price of XRP will depend on a complex interplay of economic, regulatory, and technological factors that are still unfolding.

Related: XRP: Franklin Templeton Paper Signals High Prices

Source: Original article

Quick Summary

Alpha Lions Academy founder Edoardo Farina suggests only 1% of investors may be able to afford XRP in the future. Macroeconomic pressures, institutional accumulation, and technological shifts are reshaping crypto market structure.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.