What to Know: Bitcoin’s short-term trajectory hinges on the Federal Reserve’s upcoming interest rate decision and forward guidance.

What to Know:

- Bitcoin’s short-term trajectory hinges on the Federal Reserve’s upcoming interest rate decision and forward guidance.

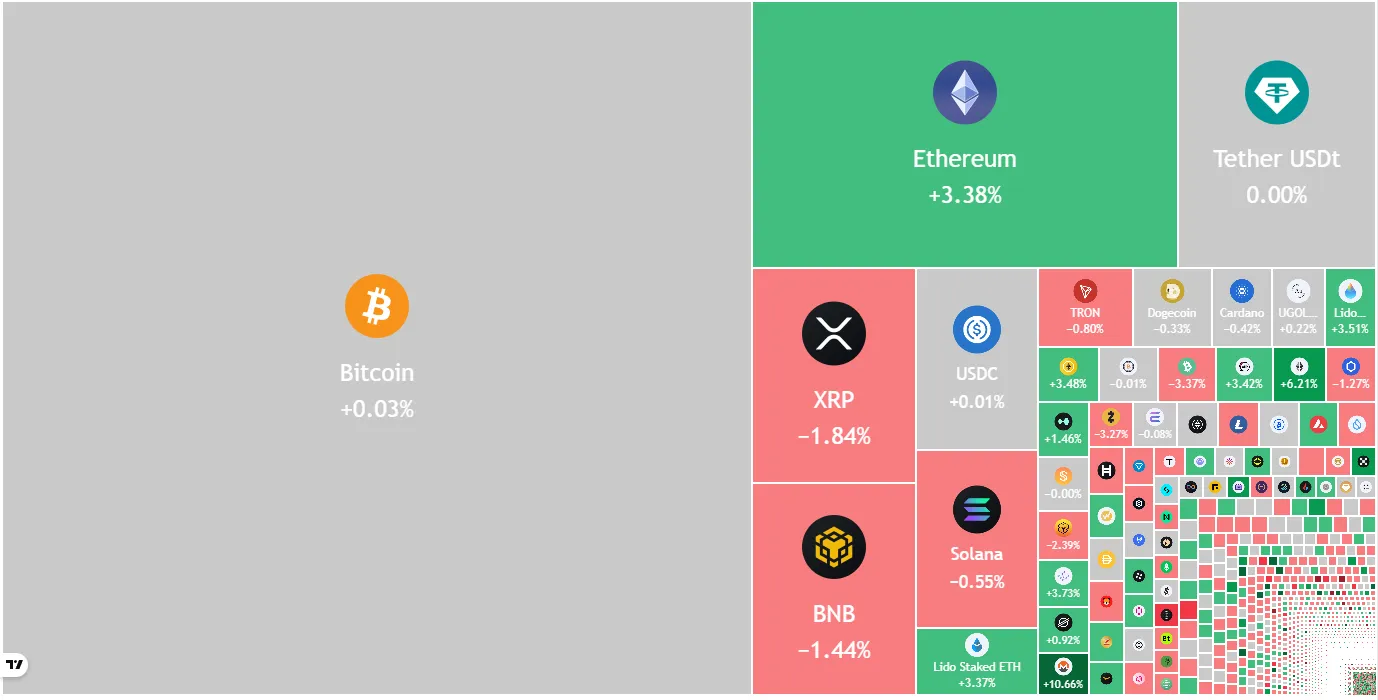

- Ether is demonstrating relative strength compared to other major altcoins, signaling a potential shift in market leadership.

- Key support and resistance levels have been identified for Bitcoin and a basket of leading altcoins, offering potential trade setups for active investors.

Bitcoin is attempting to stabilize after a period of volatility, with its immediate direction heavily influenced by the Federal Reserve’s monetary policy stance. Wednesday’s interest rate decision and subsequent commentary from Fed Chair Jerome Powell will be closely scrutinized by market participants seeking clarity on the path forward for inflation and economic growth. For institutional investors and active traders, this macro backdrop is crucial for calibrating risk exposure in digital asset portfolios.

The market’s reaction to the Fed’s announcement will likely set the tone for Bitcoin in the near term. A dovish signal, suggesting a slower pace of rate hikes or even a potential pause, could provide a tailwind for risk assets, including cryptocurrencies. Conversely, a hawkish stance, indicating a continued commitment to aggressive tightening, could trigger another leg down. This dynamic underscores the increasing correlation between digital assets and traditional financial markets, a trend that institutions must acknowledge.

Pseudonymous analyst Colin Talks Crypto suggests a potential BTC plunge to the $74,000-$77,000 zone.

Despite the near-term uncertainty, some long-term investors remain unfazed. MicroStrategy, led by Michael Saylor, recently added 10,624 BTC to its holdings, bringing its total to 660,624 BTC. This move reflects a conviction in Bitcoin’s long-term value proposition as a store of value and a hedge against inflation, despite the current macroeconomic headwinds. Such accumulation by institutional players can provide a floor for prices during periods of intense selling pressure.

Bitcoin’s immediate technical outlook hinges on its ability to overcome the $94,589 resistance level. A successful breach could pave the way for a retest of the psychological $100,000 mark, while failure to do so could lead to a pullback toward the $87,719 support. These levels represent key areas of supply and demand that traders will be watching closely for potential entry and exit points. The tug-of-war between bulls and bears at these levels will likely dictate the short-term trend.

Ether (ETH) is exhibiting signs of relative strength, outperforming many of its altcoin peers. Its recovery has reached the $3,350 level, suggesting robust buying interest at lower prices. A sustained move above this level could open the door for a rally toward $3,659 and potentially $3,918. This positive momentum in Ether could be attributed to anticipation surrounding upcoming network upgrades or growing adoption in decentralized finance (DeFi) applications.

XRP, on the other hand, has been struggling to break above its 20-day EMA, indicating continued selling pressure. A failure to overcome this resistance could lead to a retest of the $1.98 support level, potentially opening the door for a deeper correction toward $1.61.

BNB is currently range-bound between $791 and $1,020, reflecting a balance between buyers and sellers. A breakout above $1,020 could signal a resumption of the uptrend, while a breakdown below $791 could trigger a further decline toward $730.

Solana (SOL) is attempting to hold above its 20-day EMA, but faces resistance at the 50-day SMA. A successful break above this level could lead to a rally toward $172, while a failure to do so could result in a pullback toward $110 or even $95.

Dogecoin (DOGE) is struggling to maintain its price above the 20-day EMA. A break below $0.14 could trigger a sharp decline toward $0.10, while a move above the 50-day SMA could pave the way for a recovery toward $0.21.

Cardano (ADA) has broken above its 20-day EMA, signaling a potential reduction in selling pressure. A sustained move above the 50-day SMA could lead to a rally toward $0.60 or even $0.70.

Bitcoin Cash (BCH) is facing resistance at $607, indicating limited demand at higher levels. A break below the 20-day EMA could lead to a decline toward $528 or even $508.

Chainlink (LINK) is encountering selling pressure at its 50-day SMA. A break below the 20-day EMA could trigger a decline toward the $10.94 support level.

Hyperliquid (HYPE) closed below the $29.37 support, but is attracting buyers at lower levels. A move above the 20-day EMA could signal renewed upside momentum.

In conclusion, the cryptocurrency market remains sensitive to macroeconomic developments, particularly the Federal Reserve’s monetary policy decisions. While Bitcoin’s short-term direction is uncertain, Ether is showing signs of relative strength. Active traders should closely monitor key support and resistance levels for potential trading opportunities, while institutional investors should maintain a long-term perspective, focusing on the fundamental value proposition of digital assets.

Related: XRP Plumbing Narrative Signals Valuation Shift

Source: Original article

Quick Summary

What to Know: Bitcoin’s short-term trajectory hinges on the Federal Reserve’s upcoming interest rate decision and forward guidance.

Source

Information sourced from official Ripple publications, institutional market research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP, Ripple and digital asset adoption daily.

Editorial Note

Opinions are the author’s alone and for informational purposes only. This publication does not provide investment advice.