XRP ETFs have rapidly accumulated over 500 million tokens, signaling strong early investor demand and a potential catalyst for future price appreciation. Technical analysis suggests a possible breakout scenario, with price targets in the $14-$15 range based on symmetrical triangle and bull flag patterns.

What to Know:

- XRP ETFs have rapidly accumulated over 500 million tokens, signaling strong early investor demand and a potential catalyst for future price appreciation.

- Technical analysis suggests a possible breakout scenario, with price targets in the $14-$15 range based on symmetrical triangle and bull flag patterns.

- Increased institutional exposure through ETFs could drive XRP toward a $10 price level by 2026, contingent on sustained inflows and overall market conditions.

The digital asset XRP is garnering attention as newly launched exchange-traded funds (ETFs) focused on the token show substantial early inflows. With the broader market still navigating a complex regulatory landscape, the performance of these XRP-backed investment vehicles is being closely watched by institutional investors and active traders alike. The initial demand could signal a shift in market sentiment and potentially unlock new price discovery mechanisms for XRP.

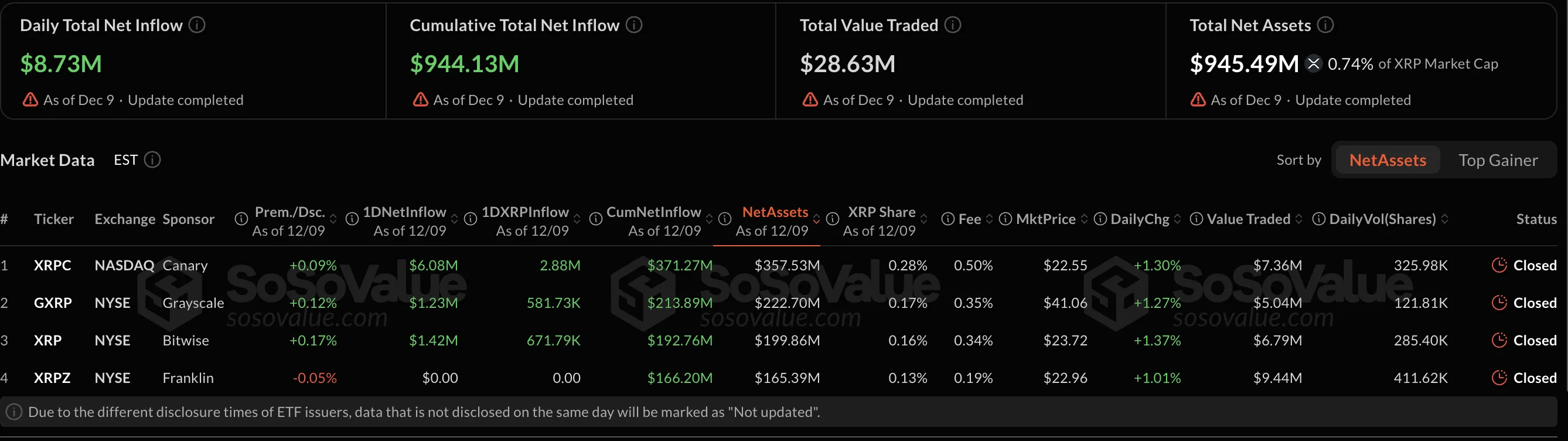

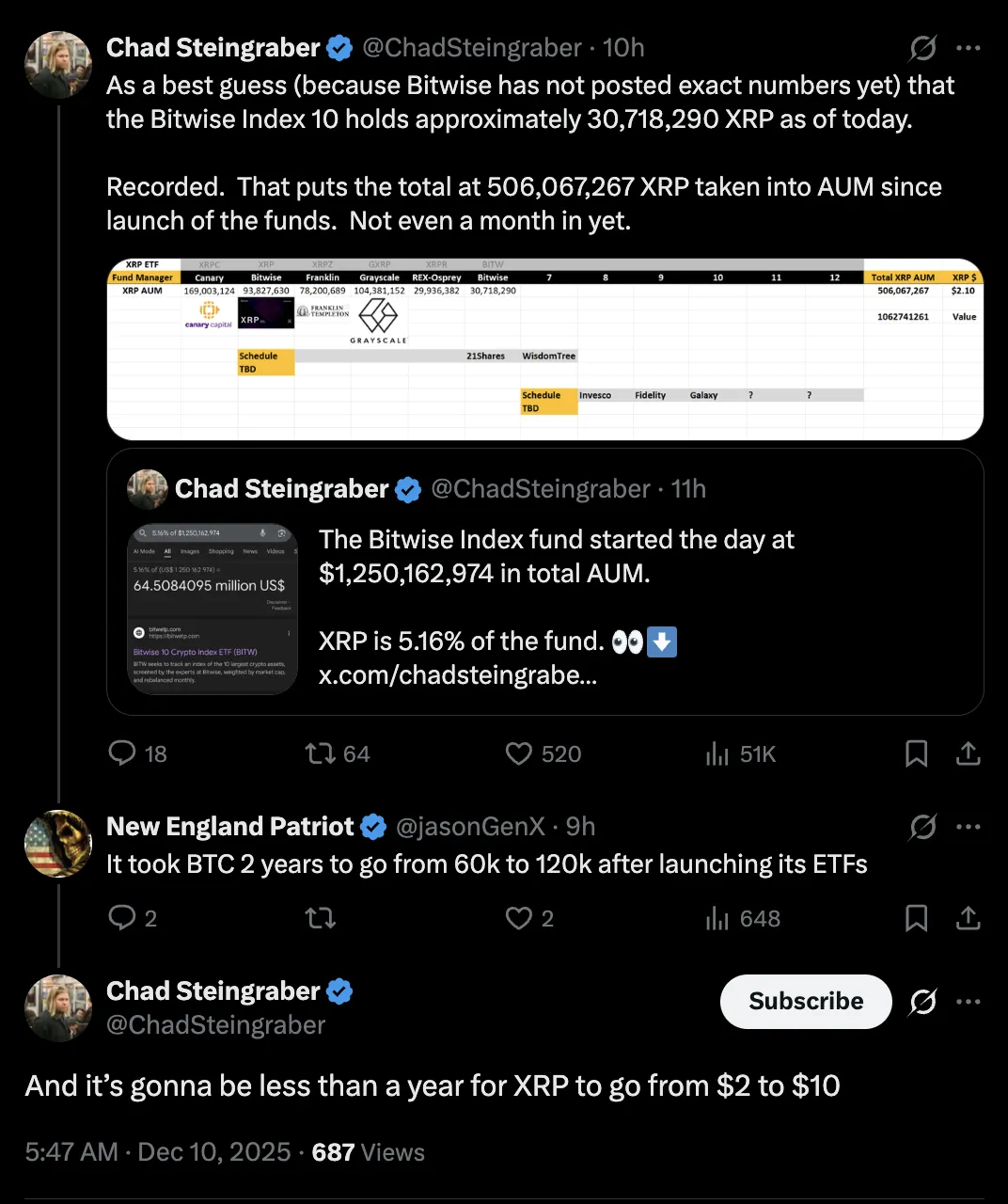

Analyst Chad Steingraber highlighted the rapid accumulation of XRP by these new ETFs, estimating that over 506 million XRP tokens have been absorbed in under a month. This figure represents approximately 0.74% of the total circulating supply of XRP, a significant amount considering the funds’ recent launch. The speed at which these ETFs are accumulating XRP suggests strong investor interest and could reduce the available supply on exchanges, potentially creating upward price pressure. We’ve seen similar dynamics play out in other asset classes, where ETF inflows have amplified price movements, both positively and negatively.

Steingraber also pointed to XRP’s inclusion in the Bitwise Crypto 10 Fund ETF (BITW), where it constitutes 5% of the portfolio. While Bitwise hasn’t released exact figures, Steingraber estimates the fund holds over 30 million XRP. This broader integration into diversified crypto funds further solidifies XRP’s presence in the institutional investment space. The diversification play is a common strategy among institutions looking for exposure to the crypto market without betting on a single asset.

Drawing parallels to Bitcoin’s post-ETF performance, Steingraber suggests that XRP could potentially reach $10 by 2026, a 400% increase from current levels, assuming ETF inflows continue. While such predictions should be taken with a grain of salt, the comparison to Bitcoin’s ETF-driven rally is noteworthy. The launch of Bitcoin ETFs marked a turning point for institutional adoption, and a similar dynamic could unfold for XRP, provided regulatory clarity and market confidence remain supportive.

From a technical analysis standpoint, XRP’s chart patterns also suggest potential upside. The token appears to be breaking out of a multi-month symmetrical triangle on the two-week chart, a pattern often associated with trend continuation after a period of consolidation. This breakout suggests renewed buying pressure, with the pattern’s measured move pointing towards a price target of $14-$15 in the coming months.

Adding further credence to this bullish outlook, XRP seems to have formed a bull flag pattern on higher time frames. This pattern, characterized by a strong initial rally followed by a downward-sloping consolidation channel, typically precedes another leg up. The projected move based on this pattern also aligns with the $14-$15 range, reinforcing the potential for a significant price increase if XRP confirms a breakout above the flag’s resistance. These technical formations are worth noting, but should not be considered in isolation. Macroeconomic conditions and regulatory developments can override technical signals in the short term.

In conclusion, the rapid accumulation of XRP by new ETFs, coupled with bullish technical indicators, suggests a potential for significant price appreciation in the coming months and years. While a $10 target by 2026 may seem ambitious, the increasing institutional exposure through ETFs could provide the necessary catalyst, drawing parallels to Bitcoin’s post-ETF rally. However, investors should remain mindful of the inherent risks in the cryptocurrency market and conduct thorough due diligence before making any investment decisions. The regulatory landscape, macroeconomic factors, and overall market sentiment will all play a crucial role in determining XRP’s future trajectory.

Related: Bitcoin Surge Adds $150 Billion to Crypto Market

Source: Original article

Quick Summary

XRP ETFs have rapidly accumulated over 500 million tokens, signaling strong early investor demand and a potential catalyst for future price appreciation. Technical analysis suggests a possible breakout scenario, with price targets in the $14-$15 range based on symmetrical triangle and bull flag patterns.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.