XRP is exhibiting multiple bullish indicates, suggesting a potential rally toward $2.80 in the near term. Declining XRP supply on exchanges indicates strong holder conviction and reduced selling pressure. Consistent inflows into XRP ETFs underscore sustained institutional demand.

What to Know:

- XRP is exhibiting multiple bullish signals, suggesting a potential rally toward $2.80 in the near term.

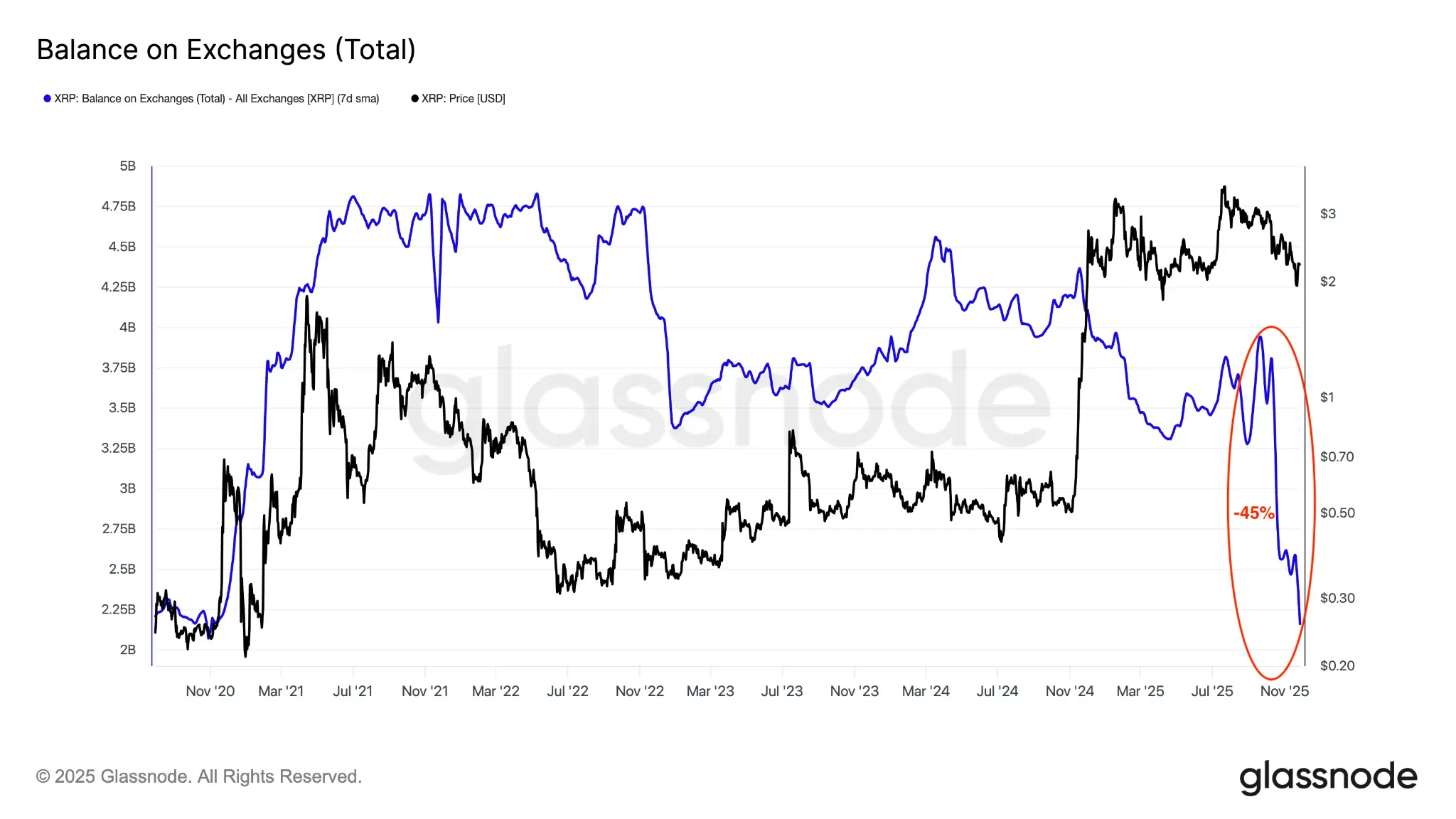

- Declining XRP supply on exchanges indicates strong holder conviction and reduced selling pressure.

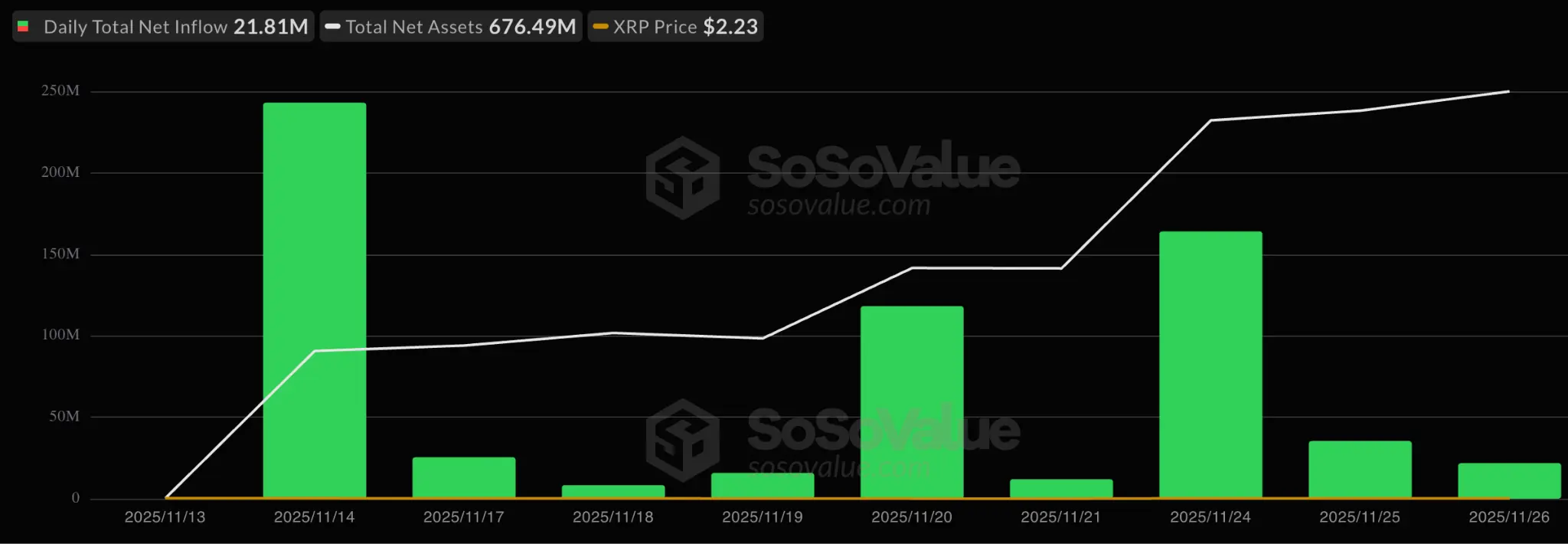

- Consistent inflows into XRP ETFs underscore sustained institutional demand.

XRP (XRP) has recently shown signs of life, bouncing nearly 21% from its recent lows. This resurgence has caught the attention of traders and analysts alike, with several technical and on-chain indicators pointing toward a potential price target of $2.80. As the digital asset landscape continues to mature, XRP’s performance offers a compelling case study for understanding market dynamics and investor sentiment.

From a technical analysis perspective, XRP’s four-hour chart reveals a bull pennant formation, a pattern often associated with strong upward continuation. A breakout above the pennant’s upper trendline, currently around $2.22, could trigger a swift move toward the $2.80 target. This pattern is reminiscent of similar formations seen in traditional equities, where a period of consolidation is followed by a sharp price increase.

“$XRP is looking really solid here,” said analyst Crypto Batman in an X post on Friday, adding:

“Not only has it reclaimed its previous support, but it’s also breaking out of a classic bullish pennant, a strong continuation pattern.”

The relative strength index (RSI) has also rebounded significantly, climbing from oversold territory to a more neutral level. This suggests that the recent price increase is not merely a dead cat bounce but rather a genuine shift in momentum. Furthermore, a V-shaped recovery pattern has emerged on the daily chart, with a potential neckline around $2.70. Overcoming the key supply zone between $2.30 and $2.63, where major simple moving averages (SMAs) converge, will be crucial for confirming this pattern.

On-chain data provides additional support for a bullish outlook. The balance of XRP on exchanges has decreased substantially, falling by over 45% in the past couple of months. This decline suggests that holders are less inclined to sell, reducing potential sell-side pressure and paving the way for further price appreciation. This dynamic mirrors historical instances in other asset classes, where decreasing supply on exchanges has often preceded significant price rallies.

ð¨ UPDATE: Binance’s XRP reserves have fallen to about 2.7B, one of the lowest ever, as steady outflows show investors pulling tokens off the exchange. pic.twitter.com/qm3yOQ2T6k

— Cointelegraph (@Cointelegraph) November 27, 2025

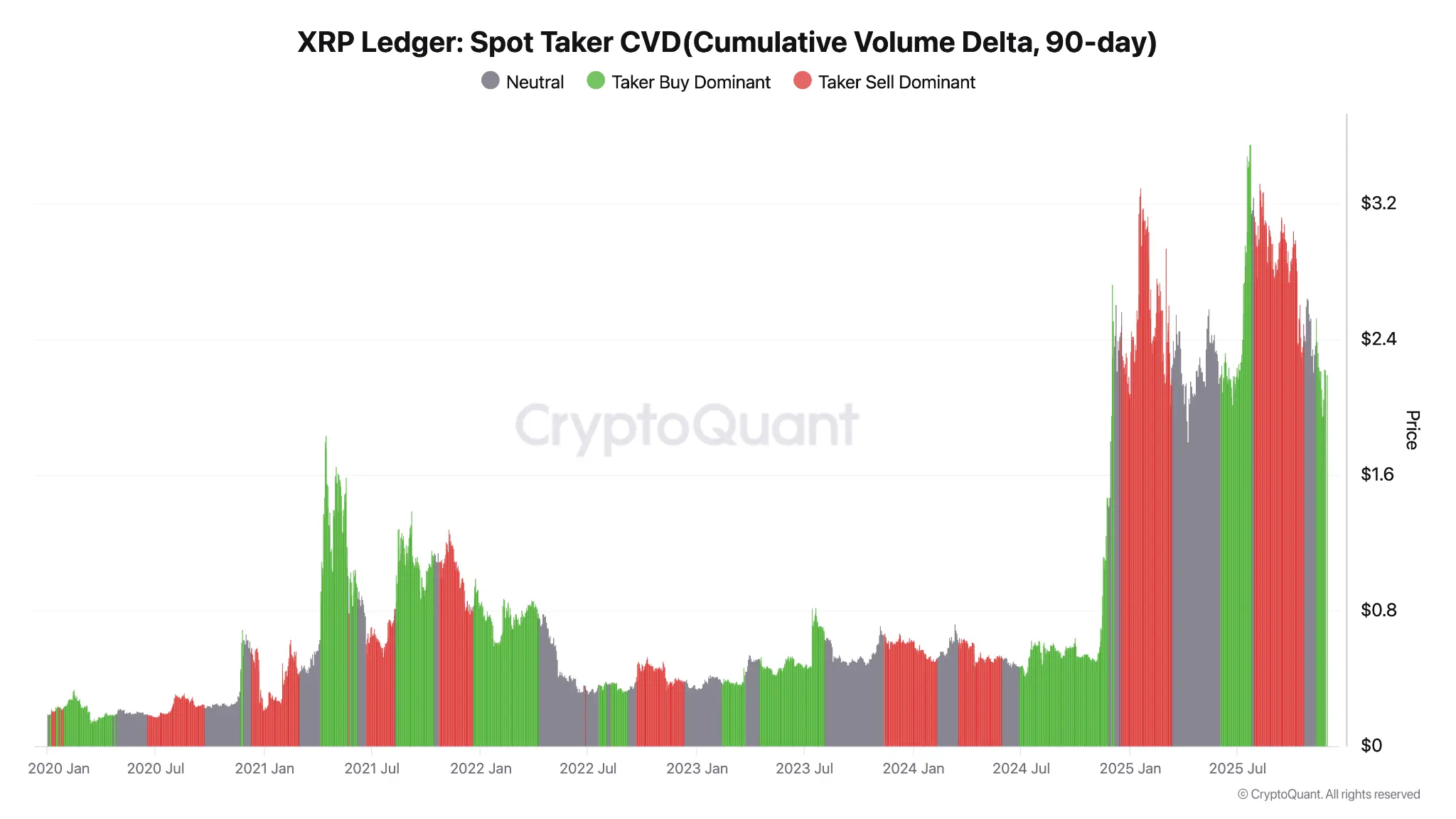

Moreover, the spot taker cumulative volume delta (CVD) indicates that buy orders have been consistently outpacing sell orders in recent weeks. This positive CVD suggests sustained demand and a willingness among buyers to aggressively accumulate XRP at current prices. The moving average convergence divergence (MACD) indicator is also signaling a bullish cross, further reinforcing the upward momentum.

The introduction and subsequent inflows into spot XRP ETFs have been a significant catalyst for price appreciation. These ETFs have experienced nine consecutive days of inflows, highlighting growing institutional interest in XRP. As more ETFs gain approval and launch, the demand for XRP is likely to increase further, potentially driving prices higher.

JUST IN: ðºð¸ 21Shares spot $XRP ETF will go live on Monday.

Bullish for XRP ð pic.twitter.com/ke7hH8VnRO

— Ash Crypto (@AshCrypto) November 28, 2025

In conclusion, XRP’s recent price action is supported by a confluence of technical, on-chain, and fundamental factors. The bull pennant formation, declining exchange supply, positive CVD, and sustained ETF inflows all point toward a potential rally toward $2.80. While the digital asset market remains inherently volatile, these indicators suggest that XRP may be poised for further gains in the near term, representing a notable opportunity for institutional and high-net-worth investors.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP is exhibiting multiple bullish signals, suggesting a potential rally toward $2.80 in the near term. Declining XRP supply on exchanges indicates strong holder conviction and reduced selling pressure. Consistent inflows into XRP ETFs underscore sustained institutional demand.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.